A Non Resident Disposing of Taxable Canadian Property Form

Understanding the Non-Resident Disposing of Taxable Canadian Property

The Non-Resident Disposing of Taxable Canadian Property refers to the tax obligations for non-residents who sell or dispose of certain types of Canadian property. This includes real estate, shares of Canadian corporations, and other specified assets. When a non-resident disposes of such property, they may be subject to Canadian taxes on any capital gains realized from the sale. It is essential for non-residents to understand these obligations to ensure compliance with Canadian tax laws.

Steps to Complete the Non-Resident Disposing of Taxable Canadian Property

Completing the process involves several important steps:

- Determine the type of property being disposed of and whether it falls under the taxable category.

- Calculate the capital gains or losses incurred from the sale of the property.

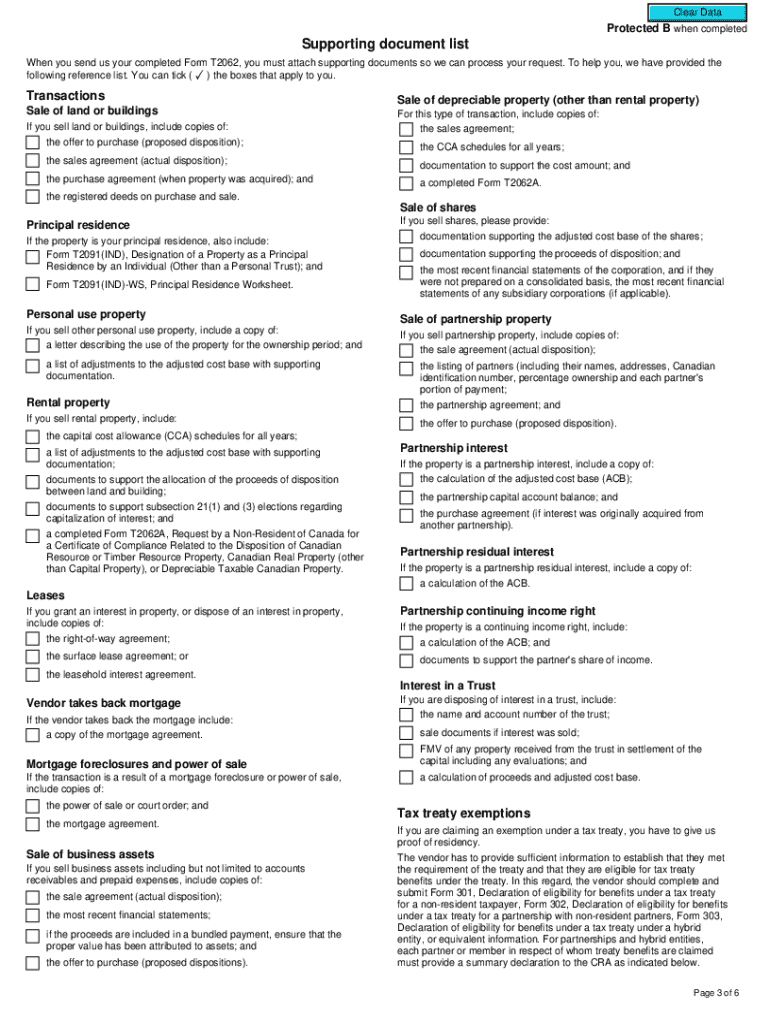

- Complete the appropriate forms, including the T2062 form, which reports the disposition of the property.

- Submit the completed forms and any required documentation to the Canada Revenue Agency (CRA).

- Pay any taxes owed based on the calculated capital gains.

Required Documents for the Non-Resident Disposing of Taxable Canadian Property

When filing the T2062 form, several documents are necessary:

- Proof of ownership of the property, such as a title deed or purchase agreement.

- Documentation showing the sale price and any associated costs, such as real estate commissions.

- Records of any improvements made to the property that could affect the capital gains calculation.

- Identification documents to verify the non-resident status, such as a passport or residency certificate.

Filing Deadlines and Important Dates

Filing deadlines are crucial for compliance. Non-residents must submit the T2062 form within a specified timeframe after the disposition of the property. Typically, the form should be filed within thirty days of the sale. It is essential to be aware of these deadlines to avoid penalties and interest on unpaid taxes.

Legal Use of the Non-Resident Disposing of Taxable Canadian Property

The legal framework governing the disposal of taxable Canadian property by non-residents is outlined in Canadian tax legislation. Non-residents must adhere to these laws to ensure that they are meeting their tax obligations. Understanding the legal implications of property disposal is vital for compliance and to avoid potential legal issues.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding the disposal of taxable Canadian property can result in significant penalties. Non-residents who do not file the T2062 form or pay the required taxes may face fines, interest on unpaid amounts, and potential legal action from the CRA. It is important to understand these risks and ensure timely compliance to avoid financial repercussions.

Quick guide on how to complete a non resident disposing of taxable canadian property

Complete A Non resident Disposing Of Taxable Canadian Property effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage A Non resident Disposing Of Taxable Canadian Property on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign A Non resident Disposing Of Taxable Canadian Property seamlessly

- Obtain A Non resident Disposing Of Taxable Canadian Property and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device of your liking. Modify and eSign A Non resident Disposing Of Taxable Canadian Property to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the a non resident disposing of taxable canadian property

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Canada Revenue Agency forms T2062?

Canada Revenue Agency forms T2062 are used to report the disposition of certain types of property, particularly when a non-resident sells Canadian real estate. These forms help ensure compliance with Canadian tax regulations. Understanding these forms is crucial for non-residents to avoid penalties.

-

How can airSlate SignNow help with Canada Revenue Agency forms T2062?

airSlate SignNow simplifies the process of completing and submitting Canada Revenue Agency forms T2062 by providing an intuitive eSigning platform. Users can easily fill out the forms, sign them electronically, and send them securely. This streamlines the entire process, making it more efficient.

-

What features does airSlate SignNow offer for managing Canada Revenue Agency forms T2062?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and real-time tracking for Canada Revenue Agency forms T2062. These features enhance user experience by ensuring that documents are easily accessible and manageable. Additionally, users can collaborate with others seamlessly.

-

Is airSlate SignNow cost-effective for handling Canada Revenue Agency forms T2062?

Yes, airSlate SignNow is a cost-effective solution for managing Canada Revenue Agency forms T2062. With various pricing plans available, businesses can choose one that fits their budget while still accessing powerful eSigning features. This affordability makes it an attractive option for both small and large businesses.

-

Can I integrate airSlate SignNow with other tools for Canada Revenue Agency forms T2062?

Absolutely! airSlate SignNow offers integrations with various applications, allowing users to streamline their workflow when dealing with Canada Revenue Agency forms T2062. Whether you use CRM systems or document management tools, integration ensures a seamless experience across platforms.

-

What are the benefits of using airSlate SignNow for Canada Revenue Agency forms T2062?

Using airSlate SignNow for Canada Revenue Agency forms T2062 provides numerous benefits, including enhanced security, faster processing times, and improved accuracy. The platform reduces the risk of errors and ensures that documents are signed and submitted promptly. This efficiency can save businesses time and resources.

-

How secure is airSlate SignNow when handling Canada Revenue Agency forms T2062?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect Canada Revenue Agency forms T2062. Users can trust that their sensitive information is safeguarded throughout the signing process. This commitment to security helps maintain confidentiality and integrity.

Get more for A Non resident Disposing Of Taxable Canadian Property

Find out other A Non resident Disposing Of Taxable Canadian Property

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe