Request for Taxpayer ReliefCancel or Waive Penalties and Form

Understanding the Request for Taxpayer Relief

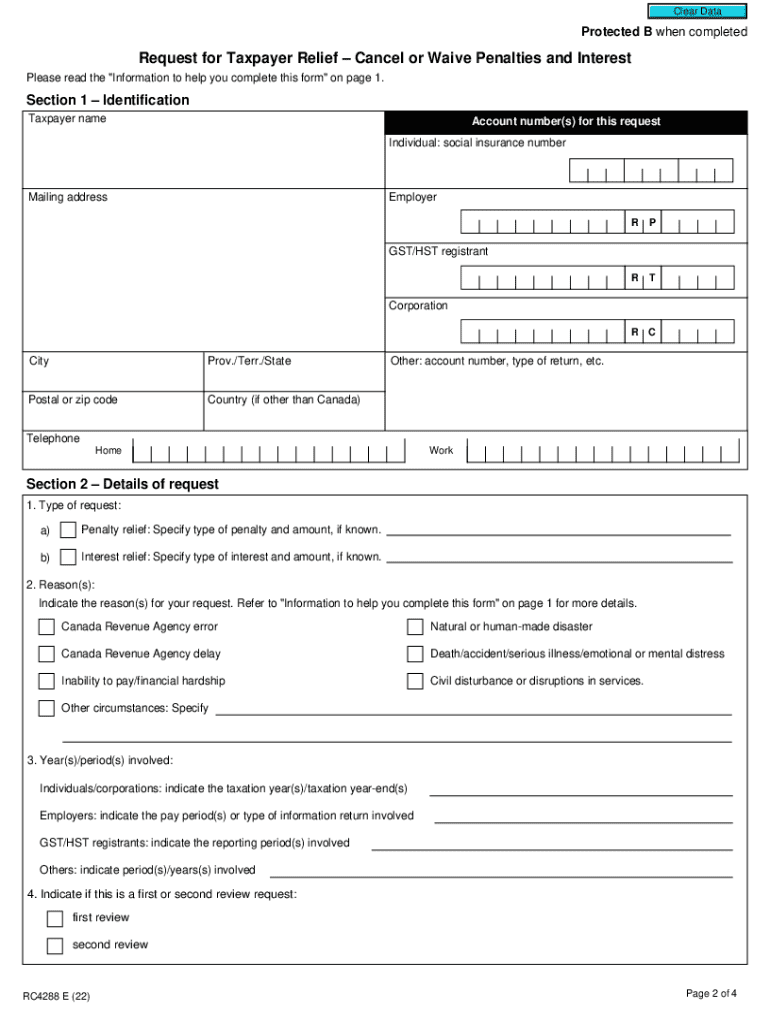

The Canada RC4288 form, also known as the Request for Taxpayer Relief, allows taxpayers to request the cancellation or waiver of penalties and interest charged by the Canada Revenue Agency (CRA). This form is particularly useful for individuals who have experienced circumstances beyond their control that have impacted their ability to meet tax obligations. Such circumstances may include serious illness, natural disasters, or other significant life events that hinder timely tax payments.

Steps to Complete the RC4288 Form

Completing the RC4288 form requires careful attention to detail. Here are the essential steps:

- Gather all relevant documentation that supports your request, such as medical records or evidence of financial hardship.

- Clearly state the reasons for your request in the designated sections of the form, ensuring you provide a detailed explanation of your circumstances.

- Include any supporting documents that validate your claims, as this will strengthen your application.

- Review the form for accuracy and completeness before submission.

- Submit the completed form to the CRA through the appropriate method, whether online, by mail, or in person.

Eligibility Criteria for Taxpayer Relief

To qualify for relief using the RC4288 form, taxpayers must meet specific eligibility criteria. Generally, the CRA considers requests based on the following factors:

- The taxpayer must demonstrate that they faced extraordinary circumstances that affected their ability to comply with tax obligations.

- The request must be made within a reasonable time frame following the event that caused the hardship.

- Taxpayers should have a history of compliance with tax laws, as prior non-compliance may negatively impact the request.

Required Documents for Submission

When submitting the RC4288 form, it is essential to include all required documentation to support your request. This may include:

- Medical records or letters from healthcare providers if health issues contributed to the inability to pay taxes.

- Financial statements or documentation showing a significant loss of income.

- Any other relevant documents that substantiate your claims, such as notices from the CRA or evidence of natural disasters.

Form Submission Methods

Taxpayers can submit the RC4288 form through various methods, depending on their preference and convenience:

- Online: If eligible, taxpayers may submit the form electronically through the CRA's online services.

- By Mail: Completed forms can be sent to the CRA by postal service. Ensure that you keep a copy for your records.

- In-Person: Taxpayers may also visit a local CRA office to submit the form directly.

Important Filing Deadlines

Awareness of filing deadlines is crucial when submitting the RC4288 form. Generally, requests should be made as soon as possible after the event that caused the hardship. The CRA encourages taxpayers to file their requests within one year of the date they were notified of the penalties or interest. Missing these deadlines may result in the denial of the request for relief.

Quick guide on how to complete request for taxpayer reliefcancel or waive penalties and

Complete Request For Taxpayer ReliefCancel Or Waive Penalties And effortlessly on any device

Digital document management has gained immense popularity among organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents quickly without interruptions. Manage Request For Taxpayer ReliefCancel Or Waive Penalties And using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign Request For Taxpayer ReliefCancel Or Waive Penalties And with ease

- Locate Request For Taxpayer ReliefCancel Or Waive Penalties And and click Get Form to begin.

- Use the tools we offer to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that function.

- Create your signature using the Sign tool, which takes just moments and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or save it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document versions. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Update and eSign Request For Taxpayer ReliefCancel Or Waive Penalties And and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the request for taxpayer reliefcancel or waive penalties and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Canada RC4288 form?

The Canada RC4288 form is a document used by businesses to request a refund of the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST) paid on eligible expenses. Understanding this form is crucial for businesses looking to optimize their tax returns and ensure compliance with Canadian tax regulations.

-

How can airSlate SignNow help with the Canada RC4288 form?

airSlate SignNow simplifies the process of completing and submitting the Canada RC4288 form by allowing users to eSign documents securely and efficiently. Our platform ensures that all necessary fields are filled out correctly, reducing the risk of errors and speeding up the submission process.

-

Is there a cost associated with using airSlate SignNow for the Canada RC4288 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions provide access to features that streamline the completion of the Canada RC4288 form, making it a valuable investment for businesses looking to manage their documentation efficiently.

-

What features does airSlate SignNow offer for the Canada RC4288 form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically designed for forms like the Canada RC4288. These features enhance user experience and ensure that your documents are processed quickly and securely.

-

Can I integrate airSlate SignNow with other software for the Canada RC4288 form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to manage your Canada RC4288 form alongside your existing tools. This integration capability enhances workflow efficiency and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for the Canada RC4288 form?

Using airSlate SignNow for the Canada RC4288 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows businesses to focus on their core operations while ensuring that their tax documentation is handled accurately and promptly.

-

Is airSlate SignNow user-friendly for completing the Canada RC4288 form?

Yes, airSlate SignNow is designed with user-friendliness in mind. Our intuitive interface makes it easy for anyone to navigate and complete the Canada RC4288 form without extensive training or technical knowledge, ensuring a smooth experience for all users.

Get more for Request For Taxpayer ReliefCancel Or Waive Penalties And

Find out other Request For Taxpayer ReliefCancel Or Waive Penalties And

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement