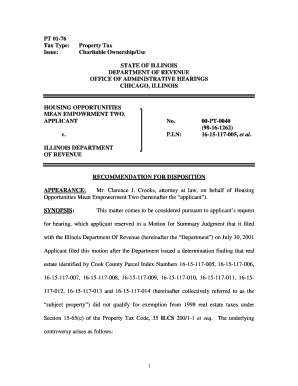

PT 01 76 Charitable OwnershipUse Property Tax Administrative Hearing Tax Illinois Form

What is the PT 01 76 Charitable Ownership Use Property Tax Administrative Hearing Tax Illinois

The PT 01 76 form is a specific document used in Illinois for property tax administrative hearings related to charitable ownership. This form is essential for organizations seeking to claim property tax exemptions due to their charitable status. It outlines the necessary information and justifications required for the Illinois Department of Revenue to assess eligibility for such exemptions. Understanding this form is crucial for non-profit organizations and charities aiming to navigate the property tax landscape effectively.

How to use the PT 01 76 Charitable Ownership Use Property Tax Administrative Hearing Tax Illinois

To utilize the PT 01 76 form, organizations must first ensure they meet the eligibility criteria for charitable property tax exemptions. The form requires detailed information about the organization, including its mission, activities, and how it meets the requirements set by the state. Once completed, the form should be submitted to the appropriate local tax authority for review. It is advisable to keep copies of all submitted documents for future reference and follow up to ensure the hearing is scheduled.

Steps to complete the PT 01 76 Charitable Ownership Use Property Tax Administrative Hearing Tax Illinois

Completing the PT 01 76 form involves several key steps:

- Gather necessary documentation, including proof of the organization’s charitable status and financial records.

- Fill out the form accurately, ensuring all sections are completed with relevant details.

- Review the form for completeness and accuracy before submission.

- Submit the form to the local tax authority, either in person or by mail, depending on local regulations.

- Prepare for the administrative hearing by organizing supporting documents and evidence that demonstrate the organization’s eligibility for the exemption.

Required Documents

When submitting the PT 01 76 form, several documents are typically required to support the application. These may include:

- Proof of the organization’s tax-exempt status, such as a 501(c)(3) determination letter from the IRS.

- Financial statements that reflect the organization’s income and expenses.

- Bylaws and articles of incorporation that outline the organization’s purpose and operations.

- Any additional documentation requested by the local tax authority to substantiate the claim for exemption.

Eligibility Criteria

To qualify for the property tax exemption under the PT 01 76 form, an organization must meet specific eligibility criteria established by Illinois law. Generally, these criteria include:

- The organization must be recognized as a charitable entity under IRS regulations.

- The property in question must be used exclusively for charitable purposes.

- The organization must not operate for profit and should not distribute earnings to private individuals.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the PT 01 76 form can result in significant penalties. These may include:

- Loss of property tax exemption, leading to increased tax liabilities.

- Fines imposed by the local tax authority for late or incomplete submissions.

- Potential legal action if the organization is found to be misrepresenting its charitable status.

Quick guide on how to complete pt 01 76 charitable ownershipuse property tax administrative hearing tax illinois

Prepare [SKS] seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a great eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without interruptions. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The easiest way to alter and eSign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pt 01 76 charitable ownershipuse property tax administrative hearing tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is PT 01 76 Charitable OwnershipUse Property Tax Administrative Hearing Tax Illinois?

PT 01 76 Charitable OwnershipUse Property Tax Administrative Hearing Tax Illinois refers to a specific tax regulation that allows charitable organizations to appeal property tax assessments. Understanding this process is crucial for nonprofits looking to manage their tax liabilities effectively.

-

How can airSlate SignNow assist with PT 01 76 Charitable OwnershipUse Property Tax Administrative Hearing Tax Illinois?

airSlate SignNow provides a streamlined platform for eSigning and managing documents related to PT 01 76 Charitable OwnershipUse Property Tax Administrative Hearing Tax Illinois. This ensures that all necessary paperwork is completed efficiently, helping organizations focus on their charitable missions.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet the needs of different organizations, including those dealing with PT 01 76 Charitable OwnershipUse Property Tax Administrative Hearing Tax Illinois. Each plan provides access to essential features that facilitate document management and eSigning.

-

What features does airSlate SignNow offer for managing property tax documents?

Key features of airSlate SignNow include customizable templates, secure eSigning, and document tracking, all of which are beneficial for handling PT 01 76 Charitable OwnershipUse Property Tax Administrative Hearing Tax Illinois. These tools help ensure compliance and streamline the appeal process.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow integrates seamlessly with various software solutions, enhancing your ability to manage PT 01 76 Charitable OwnershipUse Property Tax Administrative Hearing Tax Illinois. This integration allows for a more cohesive workflow, making it easier to handle all aspects of property tax documentation.

-

What are the benefits of using airSlate SignNow for charitable organizations?

Using airSlate SignNow provides charitable organizations with a cost-effective solution for managing documents related to PT 01 76 Charitable OwnershipUse Property Tax Administrative Hearing Tax Illinois. The platform enhances efficiency, reduces paperwork, and ensures that all necessary documents are signed and stored securely.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Absolutely! airSlate SignNow is designed to be user-friendly, making it accessible for individuals unfamiliar with eSigning processes. This ease of use is particularly beneficial for organizations navigating PT 01 76 Charitable OwnershipUse Property Tax Administrative Hearing Tax Illinois.

Get more for PT 01 76 Charitable OwnershipUse Property Tax Administrative Hearing Tax Illinois

- Eis1 pdf 2014 2019 form

- Preferred customer enrollment form lifevantage

- Planned parenthood pregnancy confirmation form

- Cvpm recommendation form vhma

- Decreeconsent decree of dissolution with children pinal county form

- Bureau of state office buildings form b mass

- F 4 permit application ohio department of commerce state com ohio form

- 59250 03 12 consent to use business namexft nd form

Find out other PT 01 76 Charitable OwnershipUse Property Tax Administrative Hearing Tax Illinois

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free