IL 1120 Instructions Income Tax Business Corporate Form

What is the IL 1120 Instructions Income Tax Business Corporate

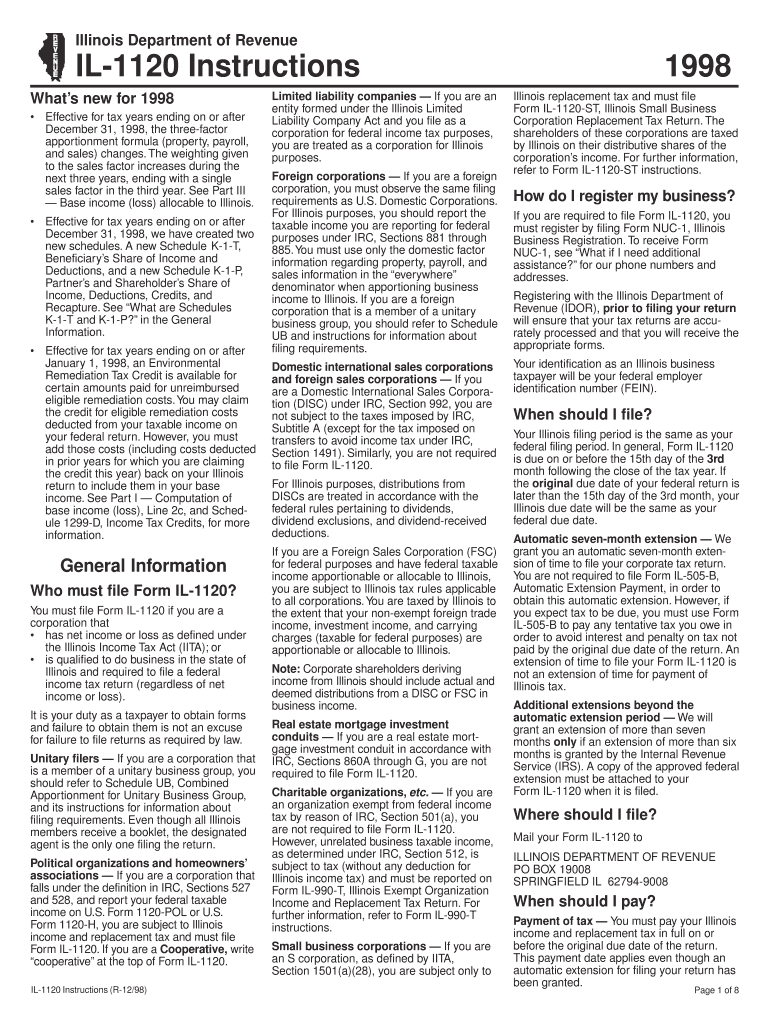

The IL 1120 Instructions Income Tax Business Corporate form is a crucial document for corporations operating in Illinois. It provides detailed guidelines on how to report income, deductions, and credits for state income tax purposes. This form is specifically designed for corporations, including C corporations and S corporations, ensuring compliance with state tax laws. Understanding these instructions is essential for accurate reporting and to avoid potential penalties.

Steps to complete the IL 1120 Instructions Income Tax Business Corporate

Completing the IL 1120 form involves several key steps:

- Gather Financial Information: Collect all necessary financial records, including income statements, balance sheets, and any relevant tax documents.

- Follow the Instructions: Carefully read through the IL 1120 instructions to understand each section of the form.

- Fill Out the Form: Complete the form by entering the required information accurately. Ensure that all calculations are correct.

- Review for Accuracy: Double-check all entries for accuracy and completeness before submission.

- Submit the Form: Choose your preferred submission method—online, by mail, or in person—and ensure it is sent by the deadline.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines when filing the IL 1120 form. Typically, the form is due on the fifteenth day of the third month following the end of the corporation's fiscal year. For corporations operating on a calendar year, the deadline is March 15. Extensions may be available, but they must be requested in advance. It is important to stay informed about any changes to these deadlines to ensure timely compliance.

Required Documents

To successfully complete the IL 1120 form, several documents are necessary:

- Financial statements, including profit and loss statements.

- Balance sheets that reflect the corporation's financial position.

- Previous year's tax returns, if applicable.

- Documentation for any deductions or credits claimed.

- Records of any estimated tax payments made during the year.

Who Issues the Form

The IL 1120 form is issued by the Illinois Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating within Illinois. It is advisable for corporations to refer to the official guidelines provided by this department when completing the form to ensure adherence to all regulations and requirements.

Penalties for Non-Compliance

Failure to comply with the IL 1120 filing requirements can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal consequences for the corporation. Understanding the importance of timely and accurate submissions can help mitigate these risks and ensure that the corporation remains in good standing with state tax authorities.

Quick guide on how to complete il 1120 instructions income tax business corporate

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular with companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive details using tools specifically designed for this purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IL 1120 Instructions Income Tax Business Corporate

Create this form in 5 minutes!

How to create an eSignature for the il 1120 instructions income tax business corporate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the IL 1120 Instructions Income Tax Business Corporate?

The IL 1120 Instructions Income Tax Business Corporate provide detailed guidelines for corporations filing their income tax returns in Illinois. These instructions cover eligibility, required forms, and deadlines, ensuring compliance with state tax laws. Understanding these instructions is crucial for businesses to avoid penalties and ensure accurate filings.

-

How can airSlate SignNow help with IL 1120 Instructions Income Tax Business Corporate filings?

airSlate SignNow simplifies the process of preparing and submitting documents related to IL 1120 Instructions Income Tax Business Corporate. With our eSignature solution, businesses can easily sign and send necessary forms securely and efficiently. This streamlines the filing process, allowing you to focus on your business operations.

-

What features does airSlate SignNow offer for corporate tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing corporate tax documents. These features ensure that your IL 1120 Instructions Income Tax Business Corporate documents are handled efficiently and securely. Additionally, our platform allows for easy collaboration among team members.

-

Is airSlate SignNow cost-effective for businesses handling IL 1120 Instructions Income Tax Business Corporate?

Yes, airSlate SignNow is a cost-effective solution for businesses managing IL 1120 Instructions Income Tax Business Corporate. Our pricing plans are designed to fit various business sizes and needs, ensuring you get the best value for your investment. By reducing paperwork and streamlining processes, you can save both time and money.

-

Can airSlate SignNow integrate with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, enhancing your workflow for IL 1120 Instructions Income Tax Business Corporate. This integration allows for easy import and export of documents, ensuring that all your tax-related information is organized and accessible. You can manage your tax filings more effectively with our platform.

-

What are the benefits of using airSlate SignNow for corporate tax filings?

Using airSlate SignNow for corporate tax filings offers numerous benefits, including increased efficiency, enhanced security, and improved compliance with IL 1120 Instructions Income Tax Business Corporate. Our platform allows for quick document turnaround and reduces the risk of errors associated with manual processes. This ensures that your business remains compliant and can focus on growth.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents, including those related to IL 1120 Instructions Income Tax Business Corporate. Our platform is designed to safeguard your information, ensuring that only authorized users have access. You can trust us to keep your corporate tax filings secure.

Get more for IL 1120 Instructions Income Tax Business Corporate

- Org 18009222770 troopgroup trip application all trip applications must be submitted to the service unit manager or designee form

- Backflow preventer inspection form bellbrook cityofbellbrook

- Attorney disclosure form

- Substitution of trustee and full reconveyance first american title form

- Natca pac form

- Full surrender form phoenix life

- Nmcourts form

- Inspection word mining form

Find out other IL 1120 Instructions Income Tax Business Corporate

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement