Schedule F Business Income Tax Fiduciary Tax Illinois Form

What is the Schedule F Business Income Tax Fiduciary Tax Illinois

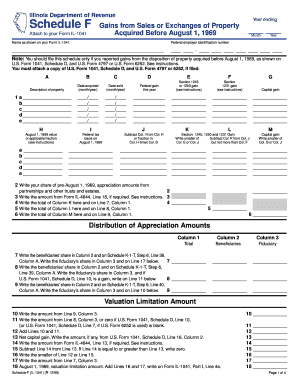

The Schedule F Business Income Tax Fiduciary Tax in Illinois is a specific tax form used by fiduciaries to report income generated from farming activities. This form is essential for estates and trusts that have income derived from farming operations. The Schedule F allows fiduciaries to detail their farming income and expenses, ensuring compliance with state tax regulations. Understanding this form is crucial for accurate tax reporting and to avoid potential penalties.

How to use the Schedule F Business Income Tax Fiduciary Tax Illinois

Using the Schedule F involves several steps to ensure accurate reporting of farming income. First, fiduciaries must gather all relevant financial information related to farming activities, including income from sales and any associated expenses. Next, the form should be filled out carefully, detailing income and expenditures in the designated sections. It is important to maintain thorough records to support the information reported on the form. Finally, the completed Schedule F must be submitted along with the fiduciary's tax return to the Illinois Department of Revenue.

Steps to complete the Schedule F Business Income Tax Fiduciary Tax Illinois

Completing the Schedule F requires a systematic approach:

- Gather all relevant financial documents related to farming income and expenses.

- Fill out the income section, listing all sources of income from farming activities.

- Document all allowable expenses related to farming, such as equipment costs, maintenance, and labor.

- Calculate the net profit or loss from farming activities by subtracting total expenses from total income.

- Review the form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule F Business Income Tax Fiduciary Tax in Illinois typically align with the general tax return deadlines. Fiduciaries must file the form by the due date of the fiduciary tax return, which is generally April 15 for calendar year filers. It is essential to stay informed about any changes in deadlines or extensions that may apply to specific tax years.

Key elements of the Schedule F Business Income Tax Fiduciary Tax Illinois

The Schedule F includes several key elements that are crucial for accurate reporting:

- Income Reporting: Detailed sections for reporting all income from farming activities.

- Expense Deduction: Areas to document all allowable expenses related to farming.

- Net Profit Calculation: A section for calculating the net profit or loss from farming operations.

- Signature and Verification: A requirement for the fiduciary to sign and date the form, confirming its accuracy.

Legal use of the Schedule F Business Income Tax Fiduciary Tax Illinois

The Schedule F is legally required for fiduciaries managing estates or trusts with farming income. Proper use of this form ensures compliance with Illinois tax laws and helps avoid legal issues related to tax reporting. Fiduciaries must ensure that all information reported is accurate and substantiated by appropriate documentation to meet legal obligations.

Quick guide on how to complete schedule f business income tax fiduciary tax illinois

Effortlessly Complete [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents quickly and without delays. Manage [SKS] on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we have available to complete your form.

- Select important sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced papers, tedious document searches, or errors that necessitate reprinting new copies. airSlate SignNow satisfies your document management requirements with just a few clicks from your preferred device. Modify and electronically sign [SKS] to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule F Business Income Tax Fiduciary Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the schedule f business income tax fiduciary tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule F Business Income Tax Fiduciary Tax Illinois?

Schedule F Business Income Tax Fiduciary Tax Illinois is a tax form used by fiduciaries to report income from farming operations. It is essential for accurately reporting agricultural income and expenses, ensuring compliance with state tax regulations. Understanding this form can help you manage your tax obligations effectively.

-

How can airSlate SignNow help with Schedule F Business Income Tax Fiduciary Tax Illinois?

airSlate SignNow provides a streamlined solution for managing and signing documents related to Schedule F Business Income Tax Fiduciary Tax Illinois. With our platform, you can easily prepare, send, and eSign necessary tax documents, saving you time and reducing the risk of errors. Our user-friendly interface makes it simple to stay organized during tax season.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing Schedule F Business Income Tax Fiduciary Tax Illinois. These tools help ensure that your documents are completed accurately and on time. Additionally, our platform allows for easy collaboration with tax professionals.

-

Is airSlate SignNow cost-effective for small businesses handling Schedule F Business Income Tax Fiduciary Tax Illinois?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing Schedule F Business Income Tax Fiduciary Tax Illinois. Our pricing plans are flexible and cater to various business sizes, ensuring that you only pay for what you need. This affordability allows you to allocate resources more efficiently while staying compliant with tax regulations.

-

Can I integrate airSlate SignNow with other accounting software for tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your Schedule F Business Income Tax Fiduciary Tax Illinois. This integration allows for automatic data transfer, reducing manual entry and minimizing errors. You can streamline your workflow and enhance productivity by connecting your tools.

-

What are the benefits of using airSlate SignNow for tax document eSigning?

Using airSlate SignNow for tax document eSigning offers numerous benefits, especially for Schedule F Business Income Tax Fiduciary Tax Illinois. It enhances security, ensures compliance, and speeds up the signing process. With our platform, you can sign documents from anywhere, making it convenient for busy professionals.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your tax documents, including those related to Schedule F Business Income Tax Fiduciary Tax Illinois. We utilize advanced encryption and secure cloud storage to protect your sensitive information. Additionally, our platform complies with industry standards to ensure your data remains safe and confidential.

Get more for Schedule F Business Income Tax Fiduciary Tax Illinois

Find out other Schedule F Business Income Tax Fiduciary Tax Illinois

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template