Schedule NLD Business Income Tax Corporate Tax Illinois Form

What is the Schedule NLD Business Income Tax Corporate Tax Illinois

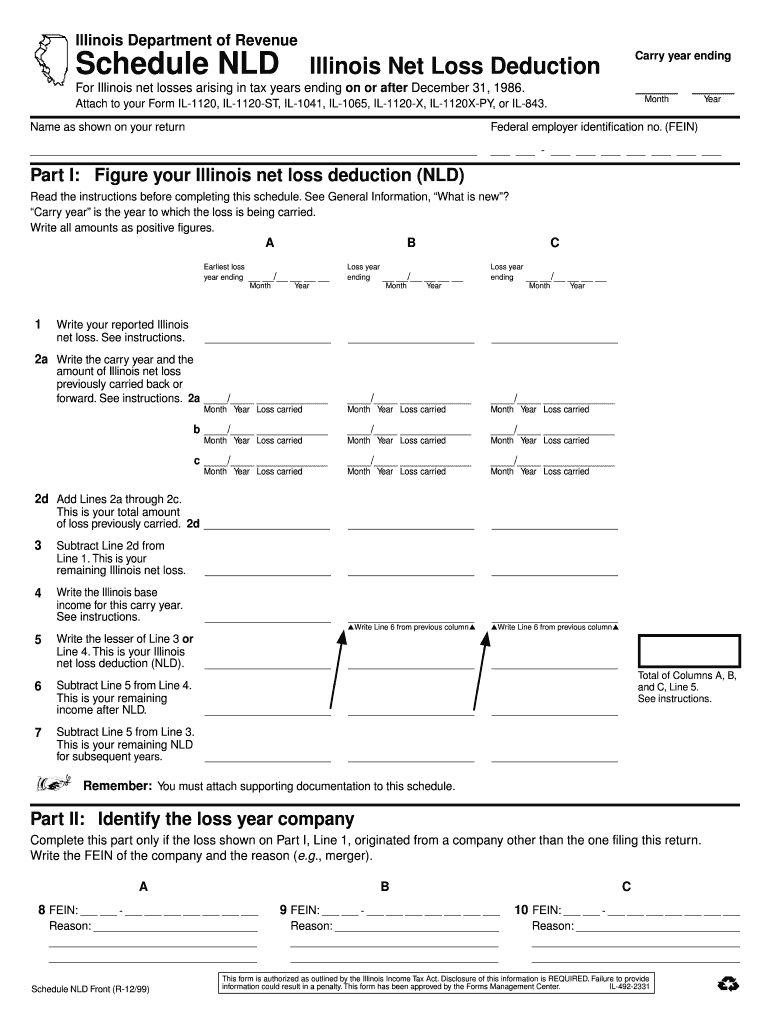

The Schedule NLD is a specific form used in Illinois for reporting business income tax for corporations. This form is essential for corporations that have non-business income or losses, allowing them to accurately report their financial activities to the state. The NLD stands for "Non-Business Loss Deduction," which is crucial for determining the tax liability of a corporation. Understanding this form is vital for compliance with Illinois tax laws and ensures that businesses can effectively manage their tax obligations.

How to use the Schedule NLD Business Income Tax Corporate Tax Illinois

Using the Schedule NLD involves several steps to ensure accurate reporting of non-business income or losses. First, gather all necessary financial documents, including income statements and expense records. Next, complete the form by providing information about the corporation's income, deductions, and any non-business losses. It is important to follow the instructions carefully to avoid errors that could lead to penalties. Once completed, the form should be submitted along with the corporation's main tax return to the Illinois Department of Revenue.

Steps to complete the Schedule NLD Business Income Tax Corporate Tax Illinois

Completing the Schedule NLD requires a systematic approach:

- Collect all relevant financial documents, including income and expense records.

- Fill out the corporation's identification information at the top of the form.

- Report all business income and any non-business income or losses in the designated sections.

- Calculate the total non-business loss deduction, ensuring accuracy in calculations.

- Review the completed form for any errors or omissions before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule NLD are aligned with the corporation's tax return due date. Generally, corporations must file their tax returns by the fifteenth day of the fourth month following the end of their fiscal year. For corporations operating on a calendar year, this means the deadline is April 15. It is crucial to be aware of these dates to avoid late filing penalties and ensure timely compliance with state tax regulations.

Required Documents

To complete the Schedule NLD, several documents are required:

- Income statements detailing all sources of revenue.

- Expense records that support deductions claimed on the form.

- Previous tax returns, if applicable, to verify any carryover losses.

- Any additional documentation that substantiates non-business income or losses.

Penalties for Non-Compliance

Failure to file the Schedule NLD or inaccuracies in reporting can lead to significant penalties. The Illinois Department of Revenue imposes fines for late submissions, which can accumulate over time. Additionally, incorrect information may result in audits or further scrutiny, potentially leading to additional taxes owed. It is essential for corporations to adhere to filing requirements and ensure the accuracy of their tax submissions to avoid these penalties.

Quick guide on how to complete schedule nld business income tax corporate tax illinois

Effortlessly prepare [SKS] on any device

Digital document management has gained traction among both businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and electronically sign your documents without delays. Handle [SKS] on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related processes today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule NLD Business Income Tax Corporate Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the schedule nld business income tax corporate tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule NLD Business Income Tax Corporate Tax Illinois?

Schedule NLD Business Income Tax Corporate Tax Illinois is a form used by businesses to report their income and calculate their tax obligations in Illinois. It is essential for ensuring compliance with state tax laws and can help businesses avoid penalties. Understanding this form is crucial for effective tax planning and management.

-

How can airSlate SignNow help with Schedule NLD Business Income Tax Corporate Tax Illinois?

airSlate SignNow provides an efficient platform for businesses to prepare, sign, and send documents related to Schedule NLD Business Income Tax Corporate Tax Illinois. With its user-friendly interface, businesses can streamline their tax documentation process, ensuring accuracy and compliance. This saves time and reduces the risk of errors in tax submissions.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, including options for small businesses and larger enterprises. Each plan includes features that support the preparation and signing of documents like Schedule NLD Business Income Tax Corporate Tax Illinois. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage, all of which are beneficial for managing tax documents like Schedule NLD Business Income Tax Corporate Tax Illinois. These features enhance collaboration and ensure that all necessary documents are easily accessible and securely stored.

-

Is airSlate SignNow compliant with Illinois tax regulations?

Yes, airSlate SignNow is designed to comply with various state regulations, including those related to Schedule NLD Business Income Tax Corporate Tax Illinois. The platform ensures that all documents are prepared and signed in accordance with legal standards, providing peace of mind for businesses during tax season.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easier to manage your Schedule NLD Business Income Tax Corporate Tax Illinois documents alongside your financial records. This integration streamlines workflows and enhances efficiency in tax preparation and filing.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation, including Schedule NLD Business Income Tax Corporate Tax Illinois, provides numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick document turnaround and ensures that all signatures are legally binding, simplifying the tax filing process.

Get more for Schedule NLD Business Income Tax Corporate Tax Illinois

Find out other Schedule NLD Business Income Tax Corporate Tax Illinois

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy

- Sign Maine Alternative Work Offer Letter Later

- Sign Wisconsin Resignation Letter Free

- Help Me With Sign Wyoming Resignation Letter

- How To Sign Hawaii Military Leave Policy

- How Do I Sign Alaska Paid-Time-Off Policy

- Sign Virginia Drug and Alcohol Policy Easy