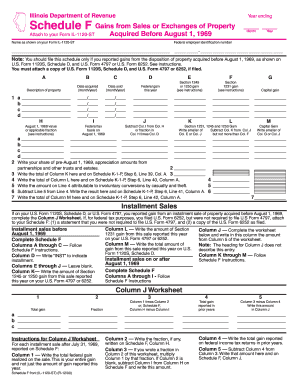

Schedule F Income Tax Business Tax Illinois Form

What is the Schedule F Income Tax Business Tax Illinois

The Schedule F is a tax form used by farmers to report income and expenses related to farming activities. In Illinois, this form is essential for individuals who earn income from farming operations. It allows taxpayers to detail their earnings from agricultural activities, including sales of livestock, produce, and other farm products. The Schedule F also enables the deduction of various expenses incurred in the farming business, such as operating costs, depreciation, and other related expenditures.

How to use the Schedule F Income Tax Business Tax Illinois

Using the Schedule F involves accurately reporting your farming income and expenses. Start by gathering all relevant financial records, including receipts and invoices related to your farming activities. On the form, list your total income from farming on the designated lines. Next, detail your expenses in the appropriate sections, ensuring you categorize them correctly. This process allows you to calculate your net profit or loss from farming, which will ultimately affect your overall tax liability.

Steps to complete the Schedule F Income Tax Business Tax Illinois

Completing the Schedule F requires a systematic approach:

- Gather all financial documents related to your farming income and expenses.

- Fill out the income section, reporting all earnings from farming activities.

- Detail your expenses, categorizing them into sections such as operating costs and depreciation.

- Calculate your net profit or loss by subtracting total expenses from total income.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

In Illinois, the deadline for filing the Schedule F typically aligns with the federal tax deadline, which is usually April fifteenth. However, if you are unable to meet this deadline, you may file for an extension, allowing you additional time to complete your tax return. It is important to stay informed about any changes to filing dates or requirements that may arise each tax year.

Required Documents

To complete the Schedule F accurately, you will need several documents, including:

- Receipts for all farming income.

- Invoices for expenses related to farming operations.

- Records of asset purchases and sales, including livestock and equipment.

- Bank statements and financial records related to your farming business.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule F, including instructions on what qualifies as farming income and deductible expenses. It is essential to refer to the IRS instructions for the Schedule F to ensure compliance with federal tax laws. Understanding these guidelines will help you accurately report your income and maximize your deductions, ultimately benefiting your tax situation.

Quick guide on how to complete schedule f income tax business tax illinois

Effortlessly Manage [SKS] on Any Device

Digital document management has gained traction among companies and individuals. It serves as an excellent environmentally-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, adjust, and electronically sign your documents swiftly without any hold-ups. Process [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Adjust and Electronically Sign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes seconds and carries the same legal authority as a traditional ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] to ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule F Income Tax Business Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the schedule f income tax business tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule F Income Tax Business Tax Illinois?

Schedule F Income Tax Business Tax Illinois is a tax form used by farmers to report income and expenses related to farming activities. It allows business owners to detail their earnings and deductions, ensuring compliance with state tax regulations. Understanding this form is crucial for accurate tax reporting and maximizing potential deductions.

-

How can airSlate SignNow help with Schedule F Income Tax Business Tax Illinois?

airSlate SignNow streamlines the process of preparing and signing documents related to Schedule F Income Tax Business Tax Illinois. Our platform allows users to easily create, send, and eSign necessary tax documents, reducing the time spent on paperwork. This efficiency can help business owners focus more on their farming operations.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing Schedule F Income Tax Business Tax Illinois. These tools simplify the documentation process, ensuring that all necessary forms are completed accurately and efficiently. Additionally, our platform provides a user-friendly interface for easy navigation.

-

Is airSlate SignNow cost-effective for small businesses dealing with Schedule F Income Tax Business Tax Illinois?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing Schedule F Income Tax Business Tax Illinois. Our pricing plans are competitive and cater to various business sizes, ensuring that even small farmers can access essential document management tools without breaking the bank. This affordability helps businesses save money while staying compliant with tax regulations.

-

Can I integrate airSlate SignNow with other accounting software for Schedule F Income Tax Business Tax Illinois?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage Schedule F Income Tax Business Tax Illinois. This integration allows users to sync their financial data, ensuring that all information is up-to-date and accurate. By connecting your tools, you can streamline your tax preparation process.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including Schedule F Income Tax Business Tax Illinois, offers numerous benefits. Users can enjoy enhanced security, faster turnaround times, and reduced paperwork. Our platform ensures that all documents are stored securely and can be accessed anytime, making tax season less stressful.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your tax documents, including those related to Schedule F Income Tax Business Tax Illinois. We utilize advanced encryption methods and secure cloud storage to protect sensitive information. Additionally, our platform complies with industry standards to ensure that your data remains confidential and secure.

Get more for Schedule F Income Tax Business Tax Illinois

- Final cast list information sheet

- Taft hartley report for principals new media sag aftra form

- Sag new media performer contract

- Blank fct data collection sheet csesa form

- En109 reading writing and research in the workplace cms montgomerycollege form

- Saq dpdf pci security standards council pcisecuritystandards form

- Sky zone van nuys form

- Chemistry worksheet matter 1 form

Find out other Schedule F Income Tax Business Tax Illinois

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast