IL 2210 Computation of Penalties for Individuals Form

What is the IL 2210 Computation Of Penalties For Individuals

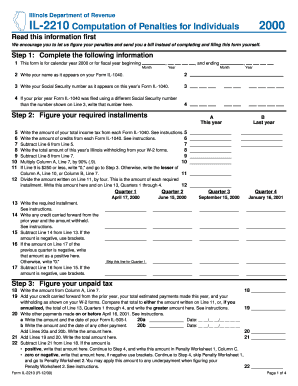

The IL 2210 Computation Of Penalties For Individuals is a form used by taxpayers in Illinois to calculate penalties for underpayment of estimated taxes. This form is essential for individuals who did not pay enough tax throughout the year, either through withholding or estimated payments. The penalties may apply if the total tax owed exceeds a certain threshold and if payments made do not meet the required amounts at specified intervals. Understanding this form helps individuals ensure compliance with state tax regulations and avoid unnecessary penalties.

How to use the IL 2210 Computation Of Penalties For Individuals

Using the IL 2210 Computation Of Penalties For Individuals involves several steps. First, gather all relevant financial documents, including income statements and previous tax returns. Next, determine your total tax liability for the year and compare it to the amount you have paid through withholding and estimated payments. If there is a shortfall, you can then use the form to calculate the penalty based on the underpayment amount and the duration of the underpayment. It is important to follow the instructions carefully to ensure accurate calculations.

Steps to complete the IL 2210 Computation Of Penalties For Individuals

Completing the IL 2210 involves a systematic approach:

- Begin by entering your total tax due for the year.

- List the amounts you have already paid through withholding and estimated payments.

- Calculate the difference to determine the underpayment amount.

- Refer to the provided tables in the form to find the applicable penalty rates based on the duration of the underpayment.

- Complete the form by filling in all required fields and double-checking your calculations.

Key elements of the IL 2210 Computation Of Penalties For Individuals

Key elements of the IL 2210 include the total tax liability, total payments made, and the calculated underpayment. Additionally, the form provides penalty rates that vary depending on how long the underpayment has persisted. It is crucial to accurately report all figures to avoid discrepancies that could lead to further penalties. Understanding these elements ensures that taxpayers can effectively manage their tax obligations and minimize penalties.

Filing Deadlines / Important Dates

Filing deadlines for the IL 2210 are typically aligned with the annual tax return deadlines. For most individuals, this means the form is due on April 15 of the following year. However, if you have filed for an extension, the deadline may be adjusted accordingly. It is essential to be aware of these dates to avoid late penalties and ensure timely compliance with state tax obligations.

Penalties for Non-Compliance

Failure to comply with the requirements of the IL 2210 can result in significant penalties. These penalties are typically calculated based on the amount of underpayment and the duration for which the amount remained unpaid. The state may impose interest on the unpaid taxes, increasing the overall financial burden. Understanding the implications of non-compliance can motivate individuals to accurately complete and submit the IL 2210, thereby avoiding unnecessary costs.

Quick guide on how to complete il 2210 computation of penalties for individuals

Complete [SKS] easily on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to edit and eSign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or a link invitation, or download it to your computer.

Stop worrying about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IL 2210 Computation Of Penalties For Individuals

Create this form in 5 minutes!

How to create an eSignature for the il 2210 computation of penalties for individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 2210 Computation Of Penalties For Individuals?

The IL 2210 Computation Of Penalties For Individuals is a form used to calculate penalties for underpayment of estimated tax in Illinois. It helps individuals determine if they owe any penalties and how much they might be. Understanding this computation is crucial for accurate tax filing and avoiding unnecessary penalties.

-

How can airSlate SignNow assist with the IL 2210 Computation Of Penalties For Individuals?

airSlate SignNow provides a streamlined process for signing and sending tax documents, including those related to the IL 2210 Computation Of Penalties For Individuals. Our platform ensures that your documents are securely signed and delivered, making tax compliance easier and more efficient.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the IL 2210 Computation Of Penalties For Individuals. These features enhance productivity and ensure that all necessary documents are handled promptly and securely.

-

Is airSlate SignNow cost-effective for individuals handling tax documents?

Yes, airSlate SignNow is a cost-effective solution for individuals managing tax documents, including the IL 2210 Computation Of Penalties For Individuals. Our pricing plans are designed to fit various budgets, ensuring that you can access essential eSigning features without breaking the bank.

-

Can I integrate airSlate SignNow with other tax software?

Absolutely! airSlate SignNow integrates seamlessly with various tax software, allowing you to manage the IL 2210 Computation Of Penalties For Individuals alongside your other tax-related tasks. This integration simplifies your workflow and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the IL 2210 Computation Of Penalties For Individuals, offers numerous benefits such as enhanced security, faster processing times, and improved organization. These advantages help you stay compliant and reduce the stress associated with tax season.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents like the IL 2210 Computation Of Penalties For Individuals. You can trust that your information is safe while using our platform for eSigning and document management.

Get more for IL 2210 Computation Of Penalties For Individuals

- Zone donation request form

- Uspc stall card form

- Strata title body corporate tax return and australian taxation office ato gov form

- Wm community benefits form city of riviera beach

- Incident report n0262284doc1 nycscaorg nycsca form

- Gulfstream 400 user manual spectra watermakers form

- Internettelecom floor grid 10x20 pennsylvania convention center form

- Us script prior authorization form pdf

Find out other IL 2210 Computation Of Penalties For Individuals

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe