IL 1118B RE Illinois Department of Revenue Tax Illinois Form

Understanding the IL 1118B RE

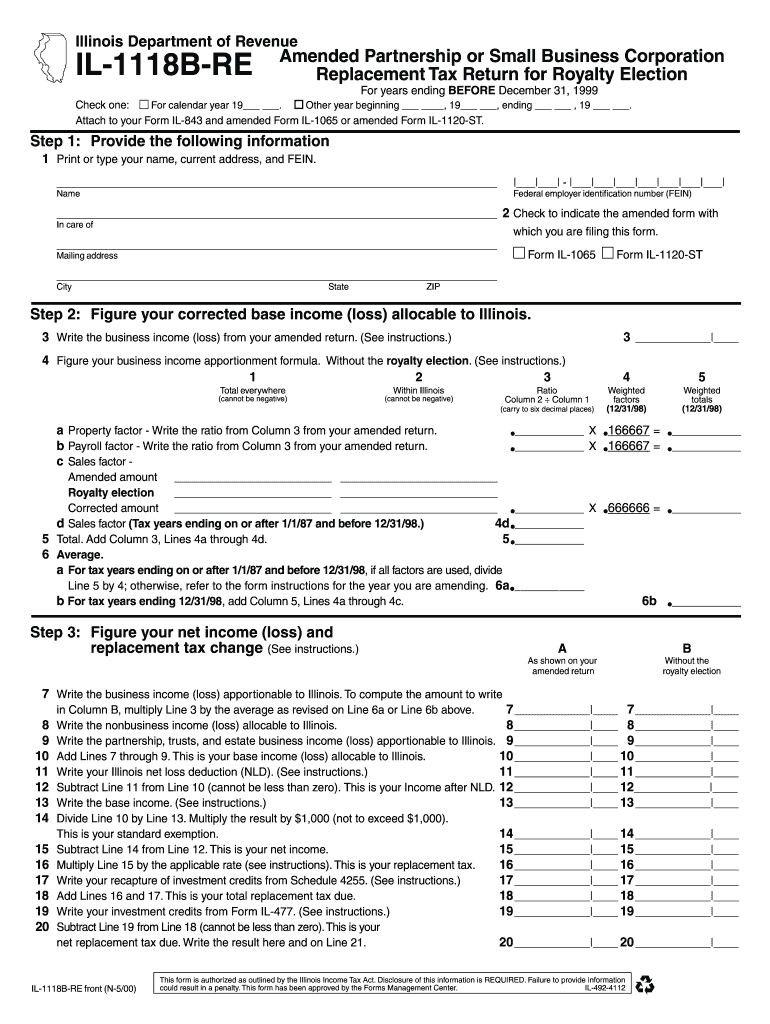

The IL 1118B RE is a tax form issued by the Illinois Department of Revenue. This form is primarily used for reporting income and calculating tax liabilities for individuals and businesses operating within Illinois. It is essential for ensuring compliance with state tax regulations and for accurately determining tax obligations. The form must be filled out correctly to avoid penalties and ensure that taxpayers meet their legal responsibilities.

Steps to Complete the IL 1118B RE

Completing the IL 1118B RE involves several key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Fill out the form with accurate personal and financial information, ensuring all sections are completed.

- Calculate your total income and applicable deductions to determine your taxable income.

- Review the form for accuracy before submission to avoid errors that could lead to penalties.

- Submit the completed form by the specified deadline, either online, by mail, or in person.

Required Documents for the IL 1118B RE

To successfully complete the IL 1118B RE, certain documents are necessary:

- W-2 forms from employers for reported wages.

- 1099 forms for any freelance or contract work.

- Records of business expenses, if applicable.

- Any other documentation that supports income claims or deductions.

Filing Deadlines for the IL 1118B RE

It is crucial to be aware of filing deadlines for the IL 1118B RE to avoid late fees:

- The standard deadline for filing is typically April 15 of each year.

- If the deadline falls on a weekend or holiday, it may be extended to the next business day.

- Extensions may be available, but it is important to check specific guidelines to ensure compliance.

Legal Use of the IL 1118B RE

The IL 1118B RE must be used in accordance with Illinois state tax laws. This includes:

- Accurate reporting of income to avoid legal repercussions.

- Understanding the implications of misreporting or failing to file.

- Being aware of the rights and responsibilities as a taxpayer under Illinois law.

Examples of Using the IL 1118B RE

Practical examples help illustrate the application of the IL 1118B RE:

- A sole proprietor reporting income from a small business.

- An individual with multiple income sources, such as wages and freelance work.

- A partnership that needs to report combined income and expenses.

Quick guide on how to complete il 1118b re illinois department of revenue tax illinois

Accomplish [SKS] effortlessly on any gadget

Digital document management has gained traction among enterprises and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage [SKS] on any gadget using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest method to alter and eSign [SKS] without hassle

- Find [SKS] and click on Acquire Form to get started.

- Utilize the tools we offer to fill out your form.

- Highlight essential sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review all the details and click on the Finish button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IL 1118B RE Illinois Department Of Revenue Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the il 1118b re illinois department of revenue tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 1118B RE Illinois Department Of Revenue Tax Illinois form?

The IL 1118B RE Illinois Department Of Revenue Tax Illinois form is used by businesses to report their income and calculate their tax liability in the state of Illinois. This form is essential for ensuring compliance with state tax regulations and can be easily managed using airSlate SignNow's eSigning solutions.

-

How can airSlate SignNow help with the IL 1118B RE Illinois Department Of Revenue Tax Illinois form?

airSlate SignNow streamlines the process of completing and submitting the IL 1118B RE Illinois Department Of Revenue Tax Illinois form by allowing users to eSign documents securely and efficiently. Our platform simplifies document management, ensuring that your tax forms are completed accurately and on time.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solutions ensure that you can manage your IL 1118B RE Illinois Department Of Revenue Tax Illinois forms without breaking the bank, providing excellent value for your eSigning needs.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, such as customizable templates, secure storage, and automated reminders. These features make it easier to handle the IL 1118B RE Illinois Department Of Revenue Tax Illinois form and other tax-related documents efficiently.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, enhancing your workflow. This integration allows you to manage the IL 1118B RE Illinois Department Of Revenue Tax Illinois form alongside your other financial documents, ensuring a smooth process.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the IL 1118B RE Illinois Department Of Revenue Tax Illinois form, offers numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, making tax season less stressful.

-

Is airSlate SignNow compliant with Illinois tax regulations?

Yes, airSlate SignNow is designed to comply with all relevant Illinois tax regulations, including those pertaining to the IL 1118B RE Illinois Department Of Revenue Tax Illinois form. Our commitment to compliance ensures that your eSigned documents are legally valid and accepted by state authorities.

Get more for IL 1118B RE Illinois Department Of Revenue Tax Illinois

- Letter landlord notice 497428075 form

- Letter from landlord to tenant as notice to remove unauthorized pets from premises virginia form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497428077 form

- Virginia tenant notice form

- Letter from tenant to landlord containing notice that doors are broken and demand repair virginia form

- Letter from tenant to landlord with demand that landlord repair broken windows virginia form

- Virginia letter demand form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497428082 form

Find out other IL 1118B RE Illinois Department Of Revenue Tax Illinois

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed