Illinois Department of Revenue Schedule UBNLD Unitary Illinois Net Loss Deduction Carry Year Ending for Illinois Net Losses Aris Form

Understanding the Illinois Department Of Revenue Schedule UBNLD

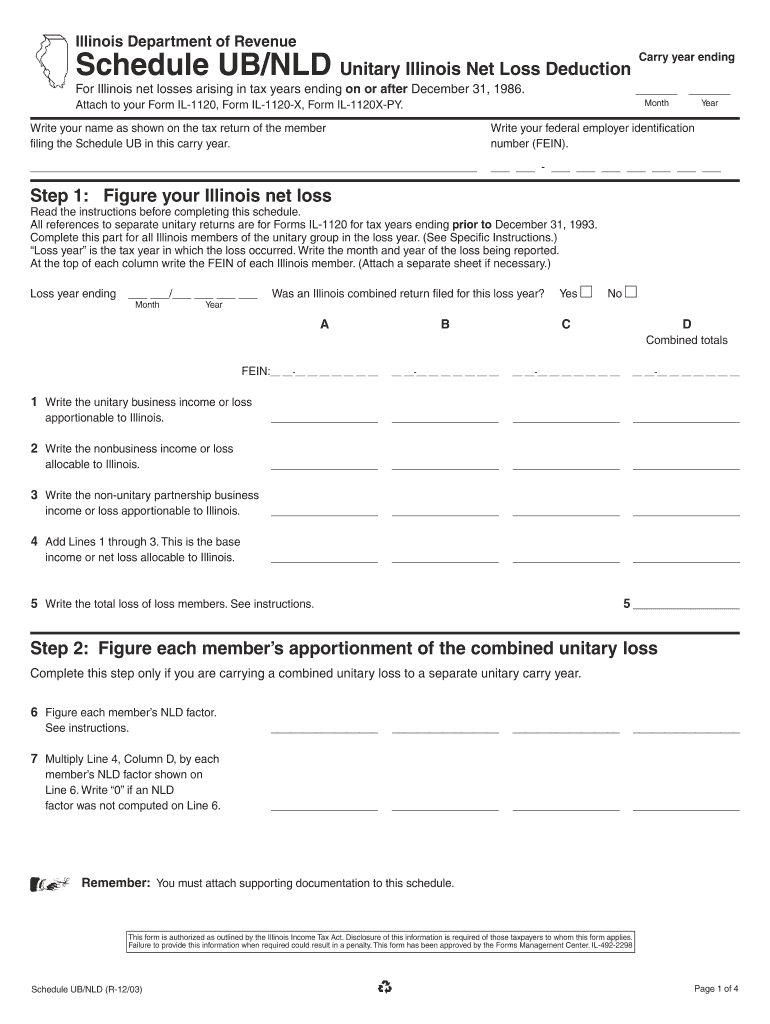

The Illinois Department Of Revenue Schedule UBNLD, or Unitary Illinois Net Loss Deduction Carry, is a crucial form for businesses that have incurred net losses in tax years ending on or after December 31, 1986. This schedule allows eligible entities to carry forward their net losses to offset future taxable income, thereby reducing their overall tax liability. The form is particularly relevant for corporations operating in a unitary business group, as it facilitates the deduction of losses across different entities within the group.

Steps to Complete the Illinois Department Of Revenue Schedule UBNLD

Completing the Schedule UBNLD involves several key steps:

- Gather all necessary financial records, including income statements and previous tax returns.

- Calculate the total net loss for the applicable tax year, ensuring that all allowable deductions are included.

- Determine the amount of net loss to be carried forward, adhering to the limits set by Illinois tax law.

- Fill out the Schedule UBNLD accurately, providing details about the loss and the entities involved.

- Review the completed form for accuracy before submission.

Eligibility Criteria for Using the Schedule UBNLD

To utilize the Illinois Department Of Revenue Schedule UBNLD, businesses must meet specific eligibility criteria. Generally, only corporations that are part of a unitary business group and have incurred net losses in tax years ending on or after December 31, 1986, qualify for this deduction. Additionally, the losses must be properly documented and reported in accordance with Illinois tax regulations.

Required Documents for Filing Schedule UBNLD

When filing the Schedule UBNLD, businesses should prepare and submit several supporting documents:

- Financial statements detailing the net loss for the relevant tax year.

- Previous tax returns that reflect the business’s income and losses.

- Any additional documentation that substantiates the loss, such as audit reports or financial analyses.

Filing Deadlines for the Schedule UBNLD

It is essential to adhere to filing deadlines to avoid penalties. The Schedule UBNLD must be submitted along with the corporation's Illinois income tax return. Typically, the deadline aligns with the federal tax return due date, which is usually the fifteenth day of the third month following the end of the tax year. Businesses should verify specific dates each year, as they may vary.

Form Submission Methods for Schedule UBNLD

Businesses can submit the Schedule UBNLD through various methods:

- Online filing via the Illinois Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the appropriate address provided by the Illinois Department of Revenue.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete illinois department of revenue schedule ubnld unitary illinois net loss deduction carry year ending for illinois net losses

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained popularity among organizations and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage [SKS] on any device through airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The Simplest Method to Modify and Electronically Sign [SKS]

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Identify important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate the reprinting of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and electronically sign [SKS] to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule UBNLD Unitary Illinois Net Loss Deduction Carry Year Ending For Illinois Net Losses Aris

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule ubnld unitary illinois net loss deduction carry year ending for illinois net losses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule UBNLD Unitary Illinois Net Loss Deduction Carry Year Ending?

The Illinois Department Of Revenue Schedule UBNLD Unitary Illinois Net Loss Deduction Carry Year Ending is a form used to report and claim deductions for net losses incurred in Illinois. This schedule is specifically for losses arising in tax years ending on or after December 31, 1986, allowing businesses to carry forward these losses to offset future taxable income.

-

How can airSlate SignNow assist with the Illinois Department Of Revenue Schedule UBNLD?

airSlate SignNow provides a streamlined platform for businesses to prepare, send, and eSign the Illinois Department Of Revenue Schedule UBNLD Unitary Illinois Net Loss Deduction Carry Year Ending documents. Our user-friendly interface simplifies the process, ensuring that all necessary information is accurately captured and submitted on time.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solutions ensure that you can efficiently manage your Illinois Department Of Revenue Schedule UBNLD Unitary Illinois Net Loss Deduction Carry Year Ending documents without breaking the bank.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features specifically designed for tax document management, such as customizable templates, automated workflows, and secure eSigning. These features help ensure that your Illinois Department Of Revenue Schedule UBNLD Unitary Illinois Net Loss Deduction Carry Year Ending forms are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, allowing you to manage your Illinois Department Of Revenue Schedule UBNLD Unitary Illinois Net Loss Deduction Carry Year Ending documents alongside your existing tools. This integration enhances productivity and ensures that all your financial data is synchronized.

-

What benefits does airSlate SignNow provide for businesses handling tax documents?

Using airSlate SignNow for your tax documents, including the Illinois Department Of Revenue Schedule UBNLD Unitary Illinois Net Loss Deduction Carry Year Ending, offers numerous benefits. These include increased efficiency, reduced errors, and enhanced security, ensuring that your sensitive information is protected throughout the signing process.

-

Is airSlate SignNow compliant with Illinois tax regulations?

Yes, airSlate SignNow is designed to comply with Illinois tax regulations, including those related to the Illinois Department Of Revenue Schedule UBNLD Unitary Illinois Net Loss Deduction Carry Year Ending. Our platform is regularly updated to reflect any changes in tax laws, ensuring that your documents remain compliant.

Get more for Illinois Department Of Revenue Schedule UBNLD Unitary Illinois Net Loss Deduction Carry Year Ending For Illinois Net Losses Aris

Find out other Illinois Department Of Revenue Schedule UBNLD Unitary Illinois Net Loss Deduction Carry Year Ending For Illinois Net Losses Aris

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online