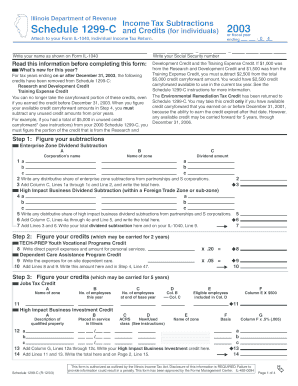

Schedule 1299 C Income Tax Individual Form

What is the Schedule 1299 C Income Tax Individual

The Schedule 1299 C Income Tax Individual is a tax form used by individuals in the United States to report certain types of income and claim specific deductions. This form is particularly relevant for those who have income that may not be reported on standard tax forms, such as self-employment income or income from certain investments. It is essential for accurately calculating tax liabilities and ensuring compliance with federal tax regulations.

How to Use the Schedule 1299 C Income Tax Individual

Using the Schedule 1299 C involves filling out the form with accurate financial information. Taxpayers must report all applicable income sources and deductions. The form allows individuals to detail their income, including wages, business earnings, and other taxable income. It is important to follow the instructions carefully to ensure that all information is reported correctly, as inaccuracies can lead to penalties or delays in processing.

Steps to Complete the Schedule 1299 C Income Tax Individual

Completing the Schedule 1299 C requires several steps:

- Gather all relevant financial documents, including W-2s, 1099s, and records of any other income sources.

- Fill in personal information, such as name, address, and Social Security number.

- Report income from various sources, ensuring that all amounts are accurate and supported by documentation.

- Calculate deductions and credits that apply to your situation, which may help reduce your overall tax liability.

- Review the completed form for accuracy before submission.

Legal Use of the Schedule 1299 C Income Tax Individual

The Schedule 1299 C is legally recognized by the Internal Revenue Service (IRS) as a valid means for reporting income and claiming deductions. It is essential for taxpayers to use this form in accordance with IRS guidelines to avoid legal issues. Filing the form correctly ensures compliance with tax laws and helps in the accurate assessment of tax obligations.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines when filing the Schedule 1299 C. Typically, the deadline for submitting this form aligns with the standard tax filing deadline, which is April 15 for most individuals. However, extensions may be available under certain circumstances. It is crucial to stay informed about any changes to deadlines, especially in light of recent tax law adjustments.

Required Documents

To complete the Schedule 1299 C, individuals need to gather several documents:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Bank statements and investment income records

- Receipts for deductible expenses, such as business-related costs

- Any other documentation that supports income or deductions claimed on the form

Quick guide on how to complete schedule 1299 c income tax individual

Effortlessly prepare [SKS] on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Manage [SKS] across any platform with the airSlate SignNow apps for Android or iOS and simplify your document-related tasks today.

How to modify and electronically sign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule 1299 c income tax individual

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule 1299 C Income Tax Individual?

Schedule 1299 C Income Tax Individual is a tax form used by individuals to report certain types of income and claim deductions. It is essential for ensuring compliance with tax regulations and maximizing potential refunds. Understanding this form can help you navigate your tax obligations more effectively.

-

How can airSlate SignNow help with Schedule 1299 C Income Tax Individual?

airSlate SignNow provides a streamlined solution for signing and sending documents related to Schedule 1299 C Income Tax Individual. With its user-friendly interface, you can easily manage your tax documents, ensuring they are signed and submitted on time. This can save you valuable time and reduce stress during tax season.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. Each plan provides access to features that can assist with managing Schedule 1299 C Income Tax Individual documents. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as eSignature capabilities, document templates, and secure cloud storage. These tools are particularly useful for managing Schedule 1299 C Income Tax Individual forms, allowing you to prepare and sign documents efficiently. The platform also supports collaboration, making it easier to work with tax professionals.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Schedule 1299 C Income Tax Individual documents are protected. The platform uses encryption and secure access controls to safeguard your information. You can trust that your sensitive tax data is handled with the utmost care.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax preparation software. This allows you to seamlessly manage your Schedule 1299 C Income Tax Individual documents alongside your other financial tools. Integration enhances efficiency and helps streamline your overall tax preparation process.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your Schedule 1299 C Income Tax Individual documents offers numerous benefits, including time savings, improved accuracy, and enhanced organization. The platform simplifies the signing process and reduces the likelihood of errors. Additionally, you can access your documents anytime, anywhere, making tax season less stressful.

Get more for Schedule 1299 C Income Tax Individual

- Brother authorized partner program application form

- Power of one fccla project sheets form

- Fccla planning process formpdffillercom

- Ccht recertification 2014 2019 form

- Apha immunization certificate reprint form

- Provider data form gateway health plan

- New process server application state of arkansas form

- Ywca studio apartment application cidny form

Find out other Schedule 1299 C Income Tax Individual

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation