Schedule K 1 T2 Income Tax Business Tax Illinois Form

What is the Schedule K-1 T2 Income Tax Business Tax Illinois

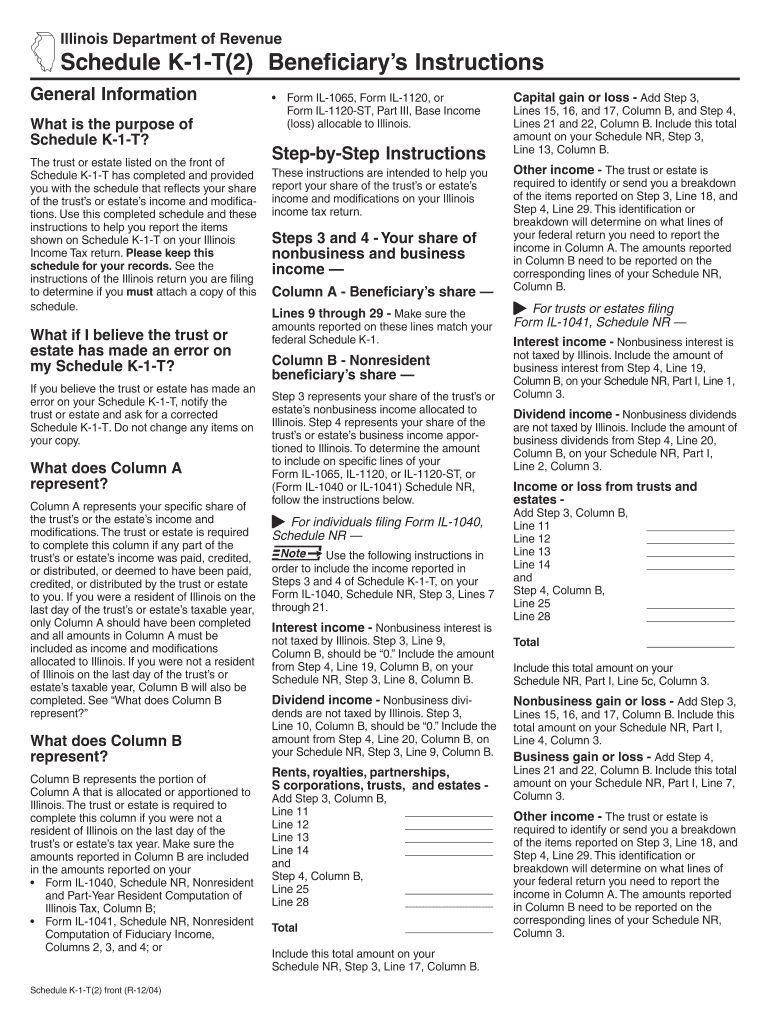

The Schedule K-1 T2 is a tax form used in Illinois for reporting income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form is essential for individuals who are partners or shareholders in these entities, as it provides detailed information about their share of the entity's income and expenses. Each partner or shareholder receives a K-1 that outlines their specific financial stake and tax obligations, which they must report on their personal tax returns.

How to Use the Schedule K-1 T2 Income Tax Business Tax Illinois

To effectively use the Schedule K-1 T2, individuals must first ensure they receive the form from the partnership or S corporation they are involved with. Once obtained, it is crucial to review the information for accuracy, including income, deductions, and credits. The details provided on the K-1 must then be transferred to the individual's personal tax return, specifically on Form 1040. It is important to follow IRS guidelines when reporting this income to avoid potential penalties.

Steps to Complete the Schedule K-1 T2 Income Tax Business Tax Illinois

Completing the Schedule K-1 T2 involves several steps:

- Obtain the Schedule K-1 from the partnership or S corporation.

- Review the form for accuracy, ensuring all income and deductions are correctly reported.

- Transfer the relevant information from the K-1 to your personal tax return, typically on Form 1040.

- Consult IRS guidelines for any specific instructions related to your tax situation.

- Keep a copy of the K-1 for your records in case of future audits.

Legal Use of the Schedule K-1 T2 Income Tax Business Tax Illinois

The Schedule K-1 T2 is legally required for reporting income from partnerships and S corporations in Illinois. Failure to report this income can lead to penalties and interest on unpaid taxes. It is important for individuals to understand their legal obligations regarding the K-1, ensuring that all information is accurately reported on their tax returns. Consulting with a tax professional can help clarify any legal complexities associated with the use of this form.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K-1 T2 align with the tax return deadlines for partnerships and S corporations. Typically, partnerships must file their tax returns by March 15, while S corporations have the same deadline. Individuals receiving a K-1 should ensure they file their personal tax returns by April 15. It is crucial to be aware of these dates to avoid late fees and penalties.

Who Issues the Form

The Schedule K-1 T2 is issued by partnerships and S corporations to their partners and shareholders. Each entity is responsible for preparing and distributing the K-1 forms, which must be done by the tax filing deadline. It is important for recipients to ensure they receive their K-1 in a timely manner to accurately report their income on their personal tax returns.

Quick guide on how to complete schedule k 1 t2 income tax business tax illinois 10998352

Complete [SKS] seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents promptly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Alter and electronically sign [SKS] and ensure efficient communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule K 1 T2 Income Tax Business Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 t2 income tax business tax illinois 10998352

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule K 1 T2 Income Tax Business Tax Illinois?

Schedule K 1 T2 Income Tax Business Tax Illinois is a tax form used by partnerships and S corporations to report income, deductions, and credits to their partners or shareholders. Understanding this form is crucial for accurate tax reporting and compliance in Illinois. It ensures that all income is properly accounted for and that partners receive the necessary information for their personal tax returns.

-

How can airSlate SignNow help with Schedule K 1 T2 Income Tax Business Tax Illinois?

airSlate SignNow provides a streamlined solution for sending and eSigning documents related to Schedule K 1 T2 Income Tax Business Tax Illinois. With our platform, businesses can easily manage their tax documents, ensuring they are signed and submitted on time. This efficiency helps reduce errors and enhances compliance with tax regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling Schedule K 1 T2 Income Tax Business Tax Illinois. Our plans range from basic to advanced features, allowing you to choose the one that best fits your budget and requirements. We also provide a free trial, so you can explore our features before committing.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning, all of which are essential for managing Schedule K 1 T2 Income Tax Business Tax Illinois. These tools help streamline the document preparation process, ensuring that all necessary forms are completed accurately and efficiently. Additionally, our platform offers real-time tracking of document status.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security, making it a safe choice for handling sensitive documents like Schedule K 1 T2 Income Tax Business Tax Illinois. We utilize advanced encryption and comply with industry standards to protect your data. This ensures that your tax information remains confidential and secure throughout the signing process.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, making it easier to manage Schedule K 1 T2 Income Tax Business Tax Illinois alongside your financial records. This integration allows for efficient data transfer and reduces the risk of errors when preparing tax documents. You can connect with popular platforms to enhance your workflow.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including Schedule K 1 T2 Income Tax Business Tax Illinois, offers numerous benefits such as increased efficiency, reduced paperwork, and enhanced compliance. Our platform simplifies the signing process, allowing you to focus on your business rather than administrative tasks. Additionally, the ability to track document status in real-time helps ensure timely submissions.

Get more for Schedule K 1 T2 Income Tax Business Tax Illinois

- Dch 0838 2015 form

- 14 15 qualified income trust the state of new jersey state nj form

- Nuisance abatement manual texas attorney general texasatt nextmp form

- Nova hunting the elements form

- Blumberg 185 form

- Pa change form

- Affidavit of legal interest city of star staridaho form

- Temporary event notice form lichfield district council lichfielddc gov

Find out other Schedule K 1 T2 Income Tax Business Tax Illinois

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free