Illinois Department of Revenue or Fiscal Year Ending Schedule NR 0 5 Nonresident and Part Year Resident Computation of Illinois Form

Understanding the Illinois Department of Revenue Schedule NR

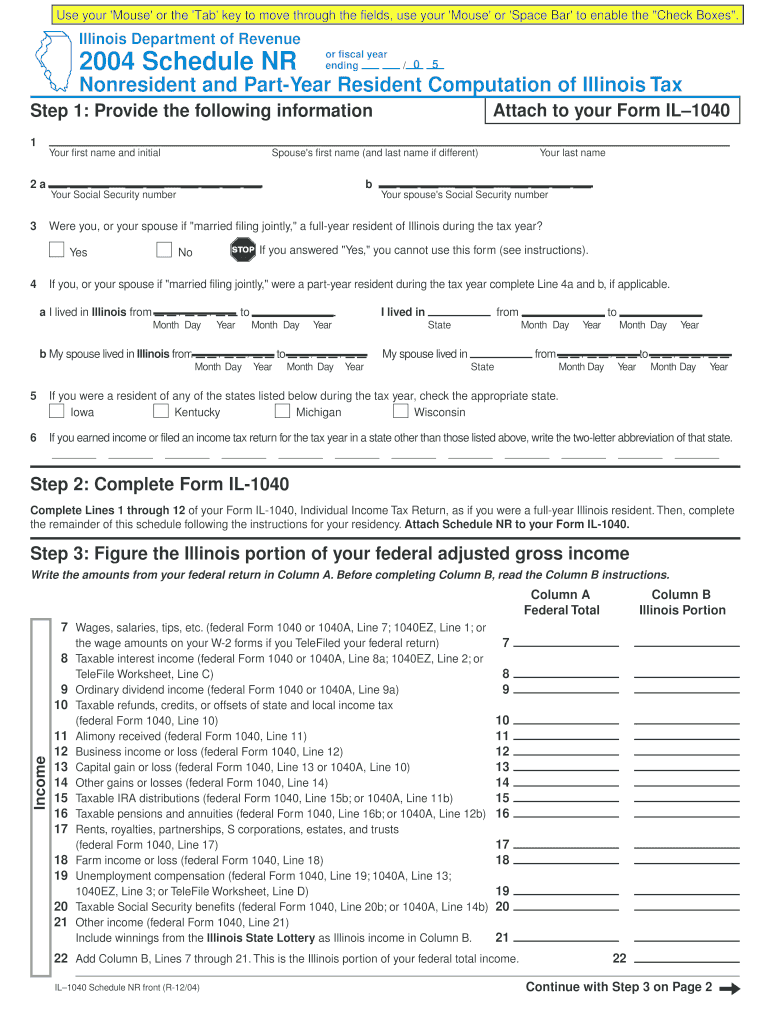

The Illinois Department of Revenue Schedule NR is designed for nonresidents and part-year residents to compute their Illinois tax obligations. This form is essential for individuals who earn income in Illinois but do not reside there for the entire year. By completing this schedule, taxpayers can accurately report their income and determine their tax liability based on their residency status during the fiscal year.

Steps to Complete the Schedule NR

To complete the Schedule NR, follow these steps:

- Begin by providing your personal information, including your first name and initial.

- Indicate your residency status for the year in question.

- List all sources of income earned in Illinois during the fiscal year.

- Calculate your total Illinois tax based on the income reported.

- Attach the completed Schedule NR to your Form IL-1040 when filing your taxes.

Obtaining the Schedule NR

The Schedule NR can be obtained directly from the Illinois Department of Revenue's website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, many tax preparation software programs include this form, allowing for easier completion and submission.

Key Elements of the Schedule NR

Several key elements must be included when completing the Schedule NR:

- Your full name and initial.

- Your Social Security number.

- Details of income earned in Illinois.

- Applicable deductions and credits.

- Your total Illinois tax due.

Legal Use of the Schedule NR

The Schedule NR is a legal document that must be filled out accurately to comply with Illinois tax laws. Failing to provide correct information can result in penalties or audits. It is crucial to retain copies of the completed form and any supporting documents for your records.

Filing Deadlines for the Schedule NR

Taxpayers must file the Schedule NR by the same deadline as their Form IL-1040. Typically, this is April 15 for most individuals. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Always check for any updates or changes to filing deadlines each tax year.

Quick guide on how to complete illinois department of revenue or fiscal year ending schedule nr 0 5 nonresident and part year resident computation of illinois

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle [SKS] on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

Easily Alter and Electronically Sign [SKS]

- Obtain [SKS] and select Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Update and electronically sign [SKS] to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Or Fiscal Year Ending Schedule NR 0 5 Nonresident And Part Year Resident Computation Of Illinois

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue or fiscal year ending schedule nr 0 5 nonresident and part year resident computation of illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Or Fiscal Year Ending Schedule NR 0 5?

The Illinois Department Of Revenue Or Fiscal Year Ending Schedule NR 0 5 is a form used by nonresident and part-year resident taxpayers to compute their Illinois tax obligations. It is essential for accurately reporting income earned in Illinois and ensuring compliance with state tax laws. Completing this schedule is a critical step when filing your Form IL 1040.

-

How do I complete the Schedule NR 0 5 for my Illinois tax return?

To complete the Schedule NR 0 5, you need to provide specific information, including your first name and initial, as well as details about your income and residency status. This information is crucial for the Illinois Department Of Revenue to assess your tax liability correctly. Make sure to follow the instructions carefully to avoid any errors.

-

What are the benefits of using airSlate SignNow for tax document management?

airSlate SignNow offers a user-friendly platform that simplifies the process of sending and eSigning tax documents, including the Illinois Department Of Revenue Or Fiscal Year Ending Schedule NR 0 5. With its cost-effective solution, you can streamline your tax filing process, ensuring that all necessary forms are completed and submitted on time.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow provides various pricing plans to accommodate different business needs. The cost is competitive and reflects the value of the features offered, such as secure eSigning and document management. Investing in airSlate SignNow can save you time and reduce the hassle of tax document handling, including the Illinois Department Of Revenue Or Fiscal Year Ending Schedule NR 0 5.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software and business applications. This integration allows you to manage your documents more efficiently, including the Illinois Department Of Revenue Or Fiscal Year Ending Schedule NR 0 5, ensuring that all your tax-related tasks are streamlined and organized.

-

What features does airSlate SignNow offer for document security?

airSlate SignNow prioritizes document security with features such as encryption, secure cloud storage, and audit trails. These features ensure that your sensitive information, including the Illinois Department Of Revenue Or Fiscal Year Ending Schedule NR 0 5, is protected throughout the signing process. You can trust that your documents are safe and compliant with industry standards.

-

How can airSlate SignNow help me track my tax documents?

With airSlate SignNow, you can easily track the status of your tax documents, including the Illinois Department Of Revenue Or Fiscal Year Ending Schedule NR 0 5. The platform provides real-time updates and notifications, allowing you to stay informed about when documents are sent, viewed, and signed. This feature enhances your ability to manage your tax filings effectively.

Get more for Illinois Department Of Revenue Or Fiscal Year Ending Schedule NR 0 5 Nonresident And Part Year Resident Computation Of Illinois

- Lifeview financial goal analysis and financial morgan stanley form

- Patient implant passport straumann form

- Form a 1 request and agreement to arbitrate

- Samples form

- Snhu student program modification forms

- Social skills data sheet professionals autism speaks autismspeaks form

- Click here for notice about address change tax ny form

- Maryland health connection affidavit form

Find out other Illinois Department Of Revenue Or Fiscal Year Ending Schedule NR 0 5 Nonresident And Part Year Resident Computation Of Illinois

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online