Schedule UBNLD Income Tax Corporate Form

What is the Schedule UBNLD Income Tax Corporate

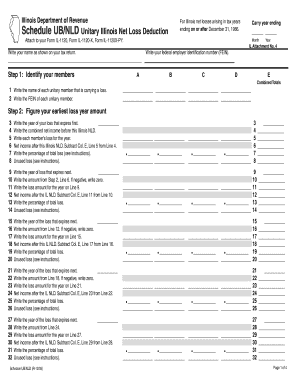

The Schedule UBNLD Income Tax Corporate is a specific tax form used by corporations to report their income, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for corporate tax compliance, allowing entities to accurately calculate their tax obligations based on their financial activities during the tax year. The UBNLD designation refers to unincorporated business net loss deductions, which can affect the overall taxable income of the corporation.

How to use the Schedule UBNLD Income Tax Corporate

Using the Schedule UBNLD Income Tax Corporate involves a series of steps to ensure accurate reporting. Corporations must first gather all relevant financial information, including income statements, balance sheets, and records of deductions. After compiling this data, the corporation fills out the form, detailing income sources and applicable deductions. It's crucial to follow IRS guidelines closely to ensure compliance and avoid penalties.

Steps to complete the Schedule UBNLD Income Tax Corporate

Completing the Schedule UBNLD Income Tax Corporate requires careful attention to detail. The following steps outline the process:

- Gather all financial documents, including income statements and expense records.

- Identify all sources of income and allowable deductions.

- Fill out the form accurately, ensuring all figures are correct.

- Review the completed form for any errors or omissions.

- Submit the form by the appropriate deadline, either electronically or via mail.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Schedule UBNLD Income Tax Corporate. Generally, the deadline for filing corporate tax returns is the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically falls on April fifteenth. It is important to check for any extensions or changes to these dates annually, as they can vary based on IRS regulations.

Required Documents

To complete the Schedule UBNLD Income Tax Corporate, several documents are necessary. These include:

- Income statements detailing revenue and expenses.

- Balance sheets that reflect the corporation's financial position.

- Records of prior year losses that may be applicable for deductions.

- Any additional documentation supporting deductions claimed on the form.

Penalties for Non-Compliance

Failure to comply with the requirements of the Schedule UBNLD Income Tax Corporate can result in significant penalties. These may include fines for late filing, interest on unpaid taxes, and potential audits by the IRS. It is essential for corporations to file accurately and on time to avoid these consequences and maintain good standing with tax authorities.

Quick guide on how to complete schedule ubnld income tax corporate 10998385

Complete [SKS] seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Identify important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule UBNLD Income Tax Corporate

Create this form in 5 minutes!

How to create an eSignature for the schedule ubnld income tax corporate 10998385

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to Schedule UBNLD Income Tax Corporate?

To Schedule UBNLD Income Tax Corporate, you need to gather all necessary financial documents and use our platform to fill out the required forms. airSlate SignNow simplifies this process by allowing you to eSign and send documents securely. Our user-friendly interface ensures that you can complete your tax scheduling efficiently.

-

How much does it cost to Schedule UBNLD Income Tax Corporate using airSlate SignNow?

The pricing for scheduling UBNLD Income Tax Corporate with airSlate SignNow is competitive and designed to fit various business needs. We offer flexible subscription plans that cater to different volumes of document management. You can choose a plan that best suits your budget and requirements.

-

What features does airSlate SignNow offer for scheduling UBNLD Income Tax Corporate?

airSlate SignNow provides a range of features for scheduling UBNLD Income Tax Corporate, including customizable templates, secure eSigning, and document tracking. These features streamline the tax scheduling process, making it easier for businesses to manage their corporate tax obligations efficiently.

-

Can I integrate airSlate SignNow with other software for scheduling UBNLD Income Tax Corporate?

Yes, airSlate SignNow offers seamless integrations with various accounting and financial software. This allows you to easily import and export data needed to Schedule UBNLD Income Tax Corporate. Our integrations enhance your workflow and ensure that all your documents are synchronized.

-

What are the benefits of using airSlate SignNow for Schedule UBNLD Income Tax Corporate?

Using airSlate SignNow to Schedule UBNLD Income Tax Corporate provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform reduces the risk of errors in your tax documents and ensures that you meet deadlines efficiently. Additionally, the eSigning feature allows for quick approvals.

-

Is airSlate SignNow secure for scheduling UBNLD Income Tax Corporate?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive tax information. When you Schedule UBNLD Income Tax Corporate with us, you can trust that your data is safe and secure throughout the entire process.

-

How can I get support while scheduling UBNLD Income Tax Corporate with airSlate SignNow?

Our dedicated support team is available to assist you while scheduling UBNLD Income Tax Corporate. You can signNow out via live chat, email, or phone for any questions or issues you may encounter. We are committed to ensuring that your experience with our platform is smooth and successful.

Get more for Schedule UBNLD Income Tax Corporate

- Contributions section form

- P45 part 1a details of employee leaving work zpayplus form

- Potawatomi area council boy scouts of america doubleknot form

- Lguda 103 pa department of community amp economic bb form

- Nicop cancellation form

- Workcover medical certificate qld form

- American mathematical society cover sheet download form

- Jdf 601 colorado state judicial branch courts state co form

Find out other Schedule UBNLD Income Tax Corporate

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free