Schedule M Income Tax Business Form

What is the Schedule M Income Tax Business

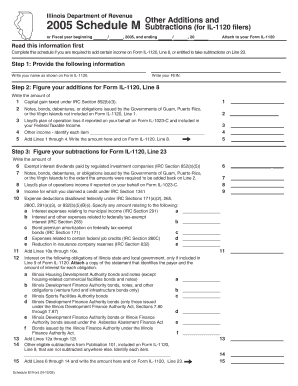

The Schedule M Income Tax Business is a tax form used by certain businesses to report income and deductions. This form is specifically designed for partnerships and S corporations to provide detailed information about their income, expenses, and other relevant financial data. It helps the IRS ensure that businesses are accurately reporting their earnings and paying the appropriate amount of taxes. Understanding this form is essential for business owners to comply with tax regulations and to maximize their deductions.

How to use the Schedule M Income Tax Business

Using the Schedule M Income Tax Business involves several steps. First, gather all necessary financial records, including income statements and expense reports. Next, fill out the form accurately, ensuring that all income and deductions are reported. It is important to follow the IRS guidelines closely to avoid errors. Once completed, the form must be submitted along with the business's tax return. Digital tools can simplify this process, allowing for easy e-signing and submission.

Steps to complete the Schedule M Income Tax Business

Completing the Schedule M Income Tax Business requires a systematic approach:

- Collect all financial documents related to your business operations.

- Review the instructions provided by the IRS for the Schedule M form.

- Accurately enter your business income, including gross receipts and other earnings.

- Detail all allowable deductions, ensuring you have documentation for each.

- Double-check all calculations to prevent mistakes.

- Sign and date the form before submission.

Key elements of the Schedule M Income Tax Business

Several key elements are crucial when filling out the Schedule M Income Tax Business:

- Income Reporting: Clearly state all sources of income.

- Deductions: List all eligible business expenses, including operating costs.

- Tax Credits: Identify any applicable tax credits that can reduce your overall tax liability.

- Signature: Ensure that the form is signed by an authorized person within the business.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule M Income Tax Business are typically aligned with the overall business tax return deadlines. For most partnerships and S corporations, the due date is March 15. However, if additional time is needed, businesses can file for an extension, which generally allows for an additional six months. It's important to keep track of these dates to avoid penalties and ensure compliance with IRS regulations.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule M Income Tax Business. These guidelines outline the necessary information required, how to report income and deductions, and any special considerations for different business types. Familiarizing yourself with these guidelines is essential for accurate reporting and compliance. The IRS website offers comprehensive resources and instructions that can assist in the completion of this form.

Quick guide on how to complete schedule m income tax business

Easily Prepare [SKS] on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents promptly without any delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The Simplest Way to Modify and eSign [SKS] Effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule M Income Tax Business

Create this form in 5 minutes!

How to create an eSignature for the schedule m income tax business

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule M Income Tax Business?

Schedule M Income Tax Business is a form used by businesses to report income and expenses. It helps in determining the taxable income for the business, ensuring compliance with tax regulations. Understanding this form is crucial for accurate tax filing and maximizing deductions.

-

How can airSlate SignNow assist with Schedule M Income Tax Business?

airSlate SignNow provides a streamlined solution for sending and eSigning documents related to Schedule M Income Tax Business. With its user-friendly interface, businesses can easily manage their tax documents, ensuring they are signed and submitted on time. This efficiency can help reduce errors and improve compliance.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, including options for small businesses and larger enterprises. Each plan includes features that support the management of documents related to Schedule M Income Tax Business. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning, all of which are beneficial for managing Schedule M Income Tax Business documents. These features help streamline the process, making it easier to prepare and submit tax forms accurately and efficiently.

-

Can airSlate SignNow integrate with accounting software for Schedule M Income Tax Business?

Yes, airSlate SignNow integrates seamlessly with various accounting software, enhancing the management of Schedule M Income Tax Business documents. This integration allows for easy data transfer and ensures that all financial information is up-to-date, simplifying the tax filing process.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including Schedule M Income Tax Business, offers numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. The platform ensures that all documents are stored securely and can be accessed anytime, which is crucial during tax season.

-

Is airSlate SignNow suitable for all business sizes when dealing with Schedule M Income Tax Business?

Absolutely! airSlate SignNow is designed to accommodate businesses of all sizes, making it an ideal solution for managing Schedule M Income Tax Business documents. Whether you are a small startup or a large corporation, the platform can scale to meet your specific needs.

Get more for Schedule M Income Tax Business

- Proof of surviving legal heirs sample how to fill up form

- D20 modern character sheet form

- Daas 6223 interim or quarterly client review adult services interim or quarterly client review info dhhs state nc form

- Vintners wine report kentucky department of revenue ky form

- Disclaimer form

- Table 6 template for cspap implementation plan table 6 template for cspap implementation plan cdc form

- Goat registration form american dairy goat association

- Declaration of conformity outboard tmc jun 11

Find out other Schedule M Income Tax Business

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed