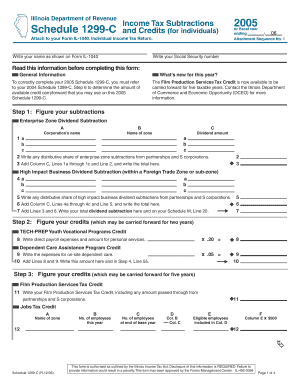

Schedule 1299 C Income Tax Individual Form

What is the Schedule 1299 C Income Tax Individual

The Schedule 1299 C Income Tax Individual is a specific tax form used by individuals in the United States to report certain types of income and claim applicable deductions. This form is particularly relevant for taxpayers who have income that may not be reported through traditional means, such as wages or salaries. It allows individuals to provide detailed information about their income sources, which may include self-employment earnings, rental income, or other miscellaneous income. Understanding this form is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Schedule 1299 C Income Tax Individual

Using the Schedule 1299 C Income Tax Individual involves several steps to ensure accurate completion. Taxpayers should first gather all relevant financial documents, including income statements and receipts for deductions. Next, individuals fill out the form by providing their personal information, detailing their income sources, and claiming any deductions or credits they may qualify for. It is essential to review the completed form for accuracy before submission, as errors can lead to delays or penalties. The form can be submitted electronically or by mail, depending on the taxpayer's preference.

Steps to complete the Schedule 1299 C Income Tax Individual

Completing the Schedule 1299 C Income Tax Individual requires a systematic approach:

- Gather necessary documents, including income records and deduction receipts.

- Fill in personal details, such as name, address, and Social Security number.

- Report all income sources accurately, ensuring to include self-employment and miscellaneous income.

- Claim deductions by providing the required details and supporting documentation.

- Review the form for any errors or omissions before submission.

After ensuring accuracy, the form can be submitted electronically or mailed to the appropriate IRS office.

Key elements of the Schedule 1299 C Income Tax Individual

The Schedule 1299 C Income Tax Individual includes several key elements that are vital for proper tax reporting:

- Personal Information: This section captures the taxpayer's identity, including name and Social Security number.

- Income Reporting: Detailed sections for reporting various income types, including self-employment income and other sources.

- Deductions and Credits: Areas to claim deductions that can reduce taxable income, such as business expenses.

- Signature and Date: A declaration section where the taxpayer must sign and date the form, affirming its accuracy.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule 1299 C Income Tax Individual align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file their returns. It is important to stay informed about these dates to avoid late filing penalties.

Eligibility Criteria

To use the Schedule 1299 C Income Tax Individual, taxpayers must meet specific eligibility criteria. Generally, individuals who have income from self-employment or other sources that are not reported on standard W-2 forms are eligible. This includes freelancers, independent contractors, and those with rental income. Additionally, taxpayers must ensure they comply with IRS guidelines regarding income thresholds and reporting requirements. Understanding these criteria helps ensure that individuals are correctly using the form and accurately reporting their income.

Quick guide on how to complete schedule 1299 c income tax individual 10998403

Prepare [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The easiest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to start.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or mask sensitive information using features that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method of submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule 1299 C Income Tax Individual

Create this form in 5 minutes!

How to create an eSignature for the schedule 1299 c income tax individual 10998403

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule 1299 C Income Tax Individual?

Schedule 1299 C Income Tax Individual is a form used by individuals to report certain types of income and claim deductions on their tax returns. It is essential for ensuring compliance with tax regulations and maximizing potential refunds. Understanding this form can help you navigate your tax obligations more effectively.

-

How can airSlate SignNow help with Schedule 1299 C Income Tax Individual?

airSlate SignNow provides a seamless way to eSign and send documents related to Schedule 1299 C Income Tax Individual. With its user-friendly interface, you can easily manage your tax documents, ensuring they are signed and submitted on time. This streamlines the process and reduces the risk of errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals handling Schedule 1299 C Income Tax Individual. Each plan provides access to essential features for document management and eSigning. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are beneficial for managing Schedule 1299 C Income Tax Individual. These tools help ensure that your documents are organized and easily accessible. Additionally, you can collaborate with others in real-time.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your Schedule 1299 C Income Tax Individual documents. This ensures that your sensitive information remains confidential and secure throughout the signing process. You can trust airSlate SignNow with your important tax documents.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various tax preparation software, making it easier to manage your Schedule 1299 C Income Tax Individual documents. This connectivity allows for a more streamlined workflow, enabling you to import and export documents seamlessly between platforms.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for your Schedule 1299 C Income Tax Individual documents offers numerous benefits, including time savings, improved accuracy, and enhanced collaboration. The platform simplifies the signing process, allowing you to focus on your tax strategy rather than paperwork. This efficiency can lead to better financial outcomes.

Get more for Schedule 1299 C Income Tax Individual

- Installment agreement to pay accident damages ernestoromero ernestoromero form

- 150824 experience standardsdocx form

- Chm 130ll molecular models gcc web gccaz form

- State of california public utilities commission cpuc form of intent state of california public utilities commission cpuc form

- Government entity diesel fuel tax return boe 501 dg board of boe ca form

- Mark downey rentals form

- Bryan yancey 8th grade history form

- Special program supplemental form

Find out other Schedule 1299 C Income Tax Individual

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast