Schedule K 1 P Income Tax Business Tax Illinois Form

What is the Schedule K-1 P Income Tax Business Tax Illinois

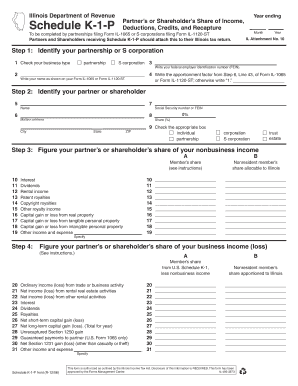

The Schedule K-1 P is a tax form used in Illinois for reporting income, deductions, and credits from partnerships. This form is specifically designed for partners in a partnership to report their share of the entity's income on their personal tax returns. Each partner receives a K-1 P, which details their allocated share of the partnership's profits or losses, allowing them to report this information accurately to the Illinois Department of Revenue.

This form is essential for ensuring compliance with state tax laws, as it helps partners understand their tax obligations based on the partnership's financial performance. It is important to note that the K-1 P is distinct from other K-1 forms used for different types of entities, such as S corporations or estates.

How to use the Schedule K-1 P Income Tax Business Tax Illinois

To use the Schedule K-1 P effectively, partners must first ensure they receive the completed form from the partnership. This document will include critical information such as the partner's share of income, deductions, and credits. Once received, partners should review the details carefully to ensure accuracy.

After confirming the information, partners will need to report the amounts listed on the K-1 P on their individual income tax returns. This typically involves transferring the figures to the appropriate sections of Form IL-1040, the Illinois individual income tax return. It is advisable to consult with a tax professional if there are any uncertainties regarding the reporting process or the implications of the reported amounts.

Steps to complete the Schedule K-1 P Income Tax Business Tax Illinois

Completing the Schedule K-1 P involves several key steps:

- Receive the K-1 P from the partnership, which outlines your share of income, deductions, and credits.

- Review the form for accuracy, ensuring that all amounts are correctly reported.

- Transfer the relevant figures from the K-1 P to your individual income tax return (Form IL-1040).

- Keep a copy of the K-1 P for your records, as it may be needed for future reference or audits.

- If necessary, consult a tax professional for guidance on any complex issues related to the K-1 P.

Legal use of the Schedule K-1 P Income Tax Business Tax Illinois

The Schedule K-1 P is legally required for partners in partnerships operating in Illinois. Partners must accurately report their allocated share of the partnership's income, deductions, and credits to comply with state tax regulations. Failure to file or inaccuracies in reporting can lead to penalties and interest charges from the Illinois Department of Revenue.

It is essential for partners to understand their legal obligations concerning the K-1 P to avoid potential legal issues. Keeping thorough records and ensuring the accuracy of the information reported can help mitigate risks associated with tax compliance.

Filing Deadlines / Important Dates

For partners in Illinois, the Schedule K-1 P must be issued by the partnership by the due date of the partnership's tax return. Typically, this is March 15 for partnerships operating on a calendar year. Partners should ensure they receive their K-1 P in a timely manner to accurately file their individual tax returns by the Illinois filing deadline, which is usually April 15.

It is crucial to stay informed about any changes to deadlines or filing requirements, as these can vary from year to year. Partners should also consider any extensions that may apply to their individual tax filings.

Who Issues the Form

The Schedule K-1 P is issued by the partnership itself. Each partnership is responsible for preparing and distributing the K-1 P to its partners. The form must be completed accurately, reflecting each partner's share of the partnership's income, deductions, and credits.

Partnerships should ensure that they maintain proper records and documentation to support the figures reported on the K-1 P. This not only aids in compliance but also helps partners understand their tax positions clearly.

Quick guide on how to complete schedule k 1 p income tax business tax illinois

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal sustainable alternative to conventional printed and signed paperwork, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without any delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign [SKS] without hassle

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to preserve your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Modify and eSign [SKS] and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule K 1 P Income Tax Business Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 p income tax business tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule K 1 P Income Tax Business Tax Illinois?

Schedule K 1 P Income Tax Business Tax Illinois is a tax form used by partnerships to report income, deductions, and credits to the IRS. It provides detailed information about each partner's share of the partnership's income, which is essential for accurate tax reporting. Understanding this form is crucial for businesses operating in Illinois to ensure compliance with state tax regulations.

-

How can airSlate SignNow help with Schedule K 1 P Income Tax Business Tax Illinois?

airSlate SignNow streamlines the process of preparing and signing Schedule K 1 P Income Tax Business Tax Illinois forms. With our easy-to-use platform, businesses can quickly send documents for eSignature, ensuring timely submission and compliance. This efficiency helps reduce the stress associated with tax season.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that simplify the management of documents, including those related to Schedule K 1 P Income Tax Business Tax Illinois. You can choose a plan that fits your budget while gaining access to essential tools for document management.

-

What features does airSlate SignNow provide for tax document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning, all of which are beneficial for managing Schedule K 1 P Income Tax Business Tax Illinois documents. These features enhance productivity and ensure that your tax documents are handled efficiently and securely. Additionally, our platform allows for easy tracking of document status.

-

Is airSlate SignNow compliant with Illinois tax regulations?

Yes, airSlate SignNow is designed to comply with various state and federal regulations, including those related to Schedule K 1 P Income Tax Business Tax Illinois. Our platform ensures that all documents are securely stored and managed, helping businesses maintain compliance with tax laws. This compliance is crucial for avoiding penalties and ensuring smooth tax filing.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with popular accounting and tax preparation software, making it easier to manage Schedule K 1 P Income Tax Business Tax Illinois forms. These integrations allow for seamless data transfer and enhance the overall efficiency of your tax preparation process. You can connect with tools you already use to streamline your workflow.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents, including Schedule K 1 P Income Tax Business Tax Illinois, provides numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick document turnaround and ensures that all signatures are legally binding. This means you can focus more on your business and less on administrative tasks.

Get more for Schedule K 1 P Income Tax Business Tax Illinois

- Non par provider contract request form molina healthcare

- Pastoral recommendation form international house of prayer

- Century insurance group owners amp contractors protective questionnaire form

- Loss of enjoymentduties under duress summary multi specialty form

- Modification agreement 2014 2019 form

- Wdva 2111 pre registration for cemetery inerment application form

- Skills proficiency form texas department of state health services dshs texas

Find out other Schedule K 1 P Income Tax Business Tax Illinois

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document