Schedule 1299 C Income Tax Individual Form

What is the Schedule 1299 C Income Tax Individual

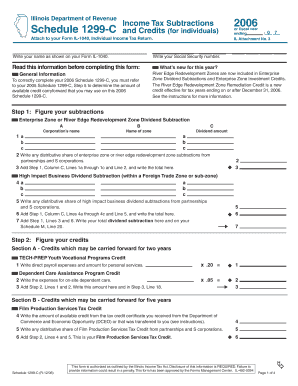

The Schedule 1299 C Income Tax Individual is a tax form used by individuals in the United States to report certain types of income that may not be captured on the standard IRS Form 1040. This form is particularly relevant for taxpayers who have income from sources such as self-employment, rental properties, or other non-traditional income streams. It allows individuals to detail their income and claim any applicable deductions or credits associated with that income.

How to use the Schedule 1299 C Income Tax Individual

To effectively use the Schedule 1299 C Income Tax Individual, taxpayers must first gather all necessary documentation related to their income sources. This includes records of earnings, expenses, and any relevant financial statements. Once the documentation is in order, individuals can fill out the form, ensuring that all income is accurately reported and that any deductions are appropriately claimed. After completing the form, it should be submitted along with the individual’s main tax return.

Steps to complete the Schedule 1299 C Income Tax Individual

Completing the Schedule 1299 C Income Tax Individual involves several key steps:

- Gather all income documentation, including W-2s, 1099s, and receipts for expenses.

- Fill out personal information at the top of the form, including name, address, and Social Security number.

- Report all sources of income in the designated sections, ensuring accuracy.

- Claim any allowable deductions related to the reported income.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the Schedule 1299 C Income Tax Individual. Typically, individual tax returns, including this schedule, are due on April fifteenth of each year. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions they may wish to file, which can provide additional time to complete their returns.

Required Documents

When preparing to file the Schedule 1299 C Income Tax Individual, individuals should have the following documents ready:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Bank statements related to income

- Any other relevant financial documentation

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule 1299 C Income Tax Individual. Taxpayers should refer to the official IRS instructions for detailed information on how to fill out each section of the form. These guidelines include definitions of various income types, allowable deductions, and any recent changes to tax laws that may affect the reporting process. Staying informed about IRS guidelines is essential for accurate and compliant tax filing.

Quick guide on how to complete schedule 1299 c income tax individual 10998440

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly and without interruptions. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to Modify and eSign [SKS] with Ease

- Locate [SKS] and click Get Form to initiate the process.

- Utilize the available tools to complete your form.

- Mark important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate the stress of lost or misfiled documents, tedious form searching, and mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to maintain outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule 1299 C Income Tax Individual

Create this form in 5 minutes!

How to create an eSignature for the schedule 1299 c income tax individual 10998440

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule 1299 C Income Tax Individual?

Schedule 1299 C Income Tax Individual is a form used by individuals to report their income tax obligations. It is essential for ensuring compliance with tax regulations and helps in calculating the correct amount of tax owed. Understanding this form is crucial for effective tax planning and filing.

-

How can airSlate SignNow help with Schedule 1299 C Income Tax Individual?

airSlate SignNow provides a streamlined solution for signing and sending documents related to Schedule 1299 C Income Tax Individual. With its user-friendly interface, you can easily manage your tax documents, ensuring they are signed and submitted on time. This efficiency can save you time and reduce stress during tax season.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals handling Schedule 1299 C Income Tax Individual. Each plan provides access to essential features that simplify document management and eSigning. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow when dealing with Schedule 1299 C Income Tax Individual. These integrations allow you to connect with popular tools like Google Drive, Dropbox, and more, making document management even easier. This flexibility helps streamline your tax preparation process.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are particularly beneficial for managing Schedule 1299 C Income Tax Individual. These tools help ensure that your documents are completed accurately and efficiently. Additionally, you can store and organize your tax documents in one secure location.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security, making it a safe choice for handling sensitive documents like Schedule 1299 C Income Tax Individual. The platform employs advanced encryption and security protocols to protect your data. You can confidently manage your tax documents knowing they are secure.

-

Can I access airSlate SignNow on mobile devices?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to manage your Schedule 1299 C Income Tax Individual documents on the go. The mobile app provides the same features as the desktop version, ensuring you can eSign and send documents anytime, anywhere. This flexibility is ideal for busy professionals.

Get more for Schedule 1299 C Income Tax Individual

- Nc lien waiver form 86534280

- Family membermilitary spouse supplement cnic cnic navy form

- Architect contract administratorampamp39s instruction riba contracts form

- Topgrading career history form

- Certificate of home resale inspection village of brookfield form

- Biomolecule review worksheet cloudfrontnet form

- How to fill schedule z eversource form

- Boulder area rental housing association lease bb form

Find out other Schedule 1299 C Income Tax Individual

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast