Schedule CR Income Tax Individual Form

What is the Schedule CR Income Tax Individual

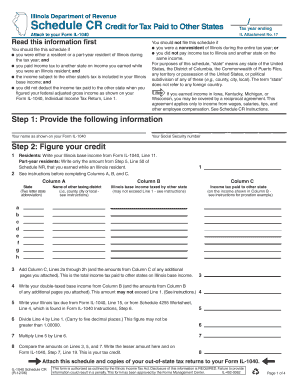

The Schedule CR Income Tax Individual is a form used by residents of certain states to claim a credit for taxes paid to other jurisdictions. This form is particularly relevant for individuals who earn income in multiple states, allowing them to avoid double taxation. By filing this schedule, taxpayers can report their eligible credits and ensure they receive the appropriate tax relief based on their income sources.

How to use the Schedule CR Income Tax Individual

To effectively use the Schedule CR Income Tax Individual, taxpayers should gather all necessary documentation regarding income earned in other states. This includes W-2 forms, 1099 forms, and any state tax returns filed. Once all information is compiled, taxpayers can fill out the schedule, detailing the amount of tax paid to other states and calculating the credit to be claimed. It is essential to follow the instructions carefully to ensure accurate reporting and compliance with state tax laws.

Steps to complete the Schedule CR Income Tax Individual

Completing the Schedule CR Income Tax Individual involves several steps:

- Gather all relevant income documentation from other states.

- Obtain the Schedule CR form from the appropriate state tax authority.

- Fill in personal information, including name, address, and Social Security number.

- Report the income earned in other states and the taxes paid.

- Calculate the credit based on the instructions provided on the form.

- Review the completed form for accuracy before submission.

Required Documents

When filing the Schedule CR Income Tax Individual, taxpayers must provide specific documents to support their claims. These documents typically include:

- W-2 forms from employers for income earned in other states.

- 1099 forms for any freelance or contract work.

- State tax returns filed for the jurisdictions where income was earned.

- Proof of taxes paid, such as canceled checks or receipts.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the Schedule CR Income Tax Individual. Generally, the deadline aligns with the federal tax return due date, which is typically April fifteenth. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is important to check with the state tax authority for any specific deadlines or extensions that may apply.

Penalties for Non-Compliance

Failure to file the Schedule CR Income Tax Individual or inaccuracies in reporting can result in penalties. States may impose fines for late submissions, underreporting income, or failing to pay the correct amount of tax owed. These penalties can vary by state, so it is crucial for taxpayers to ensure compliance to avoid unnecessary financial repercussions.

Quick guide on how to complete schedule cr income tax individual 10998441

Accomplish [SKS] seamlessly on any device

Digital document management has become favored by companies and individuals alike. It offers an ideal environmentally-friendly substitute to conventional printed and signed documents, as you can access the appropriate form and safely keep it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you wish to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign [SKS] and ensure outstanding communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule CR Income Tax Individual

Create this form in 5 minutes!

How to create an eSignature for the schedule cr income tax individual 10998441

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule CR Income Tax Individual?

Schedule CR Income Tax Individual is a form used by taxpayers to claim credits against their income tax liability. It helps individuals reduce the amount of tax they owe by providing a structured way to report eligible credits. Understanding this form is crucial for maximizing your tax benefits.

-

How can airSlate SignNow assist with Schedule CR Income Tax Individual?

airSlate SignNow simplifies the process of preparing and submitting your Schedule CR Income Tax Individual by allowing you to eSign and send documents securely. Our platform ensures that your tax documents are handled efficiently, reducing the risk of errors and delays. With our user-friendly interface, managing your tax forms becomes hassle-free.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans to accommodate various needs, including options for individuals and businesses. Our plans are designed to be cost-effective, ensuring you get the best value while managing your Schedule CR Income Tax Individual and other documents. You can choose a plan that fits your budget and requirements.

-

Are there any features specifically for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, such as templates for Schedule CR Income Tax Individual and automated reminders for deadlines. These features help streamline the process, ensuring you never miss an important date. Additionally, our platform allows for easy collaboration with tax professionals.

-

What benefits does airSlate SignNow provide for filing Schedule CR Income Tax Individual?

Using airSlate SignNow for filing your Schedule CR Income Tax Individual offers numerous benefits, including enhanced security, ease of use, and quick turnaround times. Our platform ensures that your documents are encrypted and stored securely, giving you peace of mind. Plus, the ability to eSign documents from anywhere saves you time and effort.

-

Can I integrate airSlate SignNow with other tax software?

Absolutely! airSlate SignNow can be integrated with various tax software solutions, making it easier to manage your Schedule CR Income Tax Individual alongside other tax-related tasks. This integration allows for seamless data transfer and enhances your overall workflow. Check our integration options to find the best fit for your needs.

-

Is there customer support available for using airSlate SignNow?

Yes, airSlate SignNow provides comprehensive customer support to assist you with any questions regarding your Schedule CR Income Tax Individual or other features. Our support team is available through multiple channels, ensuring you receive timely assistance. Whether you need help with setup or troubleshooting, we're here to help.

Get more for Schedule CR Income Tax Individual

- Behavioral health clinician statement garnett powers amp associates form

- Sample insurance appeal letter form

- Sketching and interpreting graphs worksheet form

- Deliberate practice growth target citrus grove middle school citrusgrovems form

- Standing order request form for appointments logisticare

- The hollingsworth mccaleb quarterly form

- Vestibular physical therapy nyu langone medical center form

- Request for medical center authorization form nyu langone

Find out other Schedule CR Income Tax Individual

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast