Illinois Department of Revenue Schedule J Attach to Your Form IL 1120

What is the Illinois Department Of Revenue Schedule J Attach To Your Form IL 1120

The Illinois Department Of Revenue Schedule J is a supplemental form that must be attached to Form IL-1120, which is the Illinois Corporation Income and Replacement Tax Return. This schedule is specifically designed for corporations that are claiming a net loss carryforward or a net operating loss deduction. By completing Schedule J, businesses can accurately report their income and deductions, ensuring compliance with state tax regulations.

How to use the Illinois Department Of Revenue Schedule J Attach To Your Form IL 1120

To effectively use Schedule J, begin by gathering all necessary financial documents, including prior year tax returns and any records related to net operating losses. Complete the form by entering the relevant figures from your financial statements, ensuring that all calculations align with the guidelines provided by the Illinois Department of Revenue. Once completed, attach Schedule J to your Form IL-1120 before submitting your tax return.

Steps to complete the Illinois Department Of Revenue Schedule J Attach To Your Form IL 1120

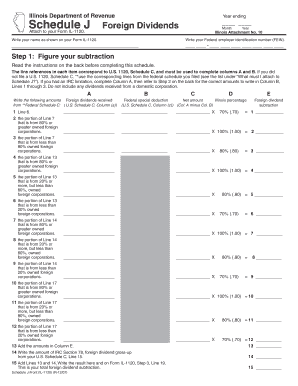

Completing Schedule J involves several key steps:

- Gather financial documents, including income statements and prior tax returns.

- Fill out the identification section, including your business name and federal employer identification number.

- Report the current year’s income and any applicable deductions.

- Calculate the net loss carryforward or net operating loss deduction, if applicable.

- Review all entries for accuracy before attaching Schedule J to your Form IL-1120.

Key elements of the Illinois Department Of Revenue Schedule J Attach To Your Form IL 1120

Key elements of Schedule J include sections for reporting income, deductions, and any net operating loss carryforwards. The form requires specific financial data, such as total income, total deductions, and the amount of any losses being carried forward. Accurate reporting of these elements is crucial for determining your corporation's tax liability and ensuring compliance with state tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Illinois Department Of Revenue Schedule J coincide with the due date for Form IL-1120. Typically, this is the 15th day of the month following the end of your corporation's tax year. For corporations operating on a calendar year, the deadline is usually March 15. It is essential to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

Penalties for Non-Compliance

Failure to file Schedule J or inaccuracies in the information reported can result in penalties imposed by the Illinois Department of Revenue. These penalties may include fines and interest on any unpaid tax amounts. Additionally, non-compliance can lead to audits and further scrutiny of your corporation’s financial records, making it critical to ensure accuracy and timeliness in your filings.

Quick guide on how to complete illinois department of revenue schedule j attach to your form il 1120

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents promptly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign [SKS] without hassle

- Locate [SKS] and click Get Form to begin.

- Utilize our tools to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing additional copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule J Attach To Your Form IL 1120

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule j attach to your form il 1120

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule J and why do I need to attach it to my Form IL 1120?

The Illinois Department Of Revenue Schedule J is a form used to calculate the income tax liability for corporations in Illinois. Attaching it to your Form IL 1120 is essential for accurately reporting your income and ensuring compliance with state tax regulations. This helps avoid potential penalties and ensures that your tax filings are complete.

-

How can airSlate SignNow help me with the Illinois Department Of Revenue Schedule J?

airSlate SignNow provides an efficient platform to prepare, send, and eSign your Illinois Department Of Revenue Schedule J. With our user-friendly interface, you can easily attach this form to your Form IL 1120, streamlining your tax filing process. This saves you time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for my Illinois Department Of Revenue Schedule J?

Yes, airSlate SignNow offers various pricing plans tailored to meet your business needs. Our cost-effective solutions ensure that you can efficiently manage your Illinois Department Of Revenue Schedule J and other documents without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Illinois Department Of Revenue Schedule J?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These tools make it easy to manage your Illinois Department Of Revenue Schedule J and ensure that all necessary documents are properly completed and stored. Our platform enhances your overall document workflow.

-

Can I integrate airSlate SignNow with other software for my tax filings?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing you to streamline your workflow. This means you can easily attach your Illinois Department Of Revenue Schedule J to your Form IL 1120 without switching between multiple applications, enhancing efficiency.

-

How secure is my information when using airSlate SignNow for the Illinois Department Of Revenue Schedule J?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your sensitive information, including your Illinois Department Of Revenue Schedule J. You can trust that your data is safe while you eSign and manage your documents.

-

What are the benefits of using airSlate SignNow for my Illinois Department Of Revenue Schedule J?

Using airSlate SignNow for your Illinois Department Of Revenue Schedule J offers numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. Our platform simplifies the eSigning process, allowing you to focus on your business while ensuring compliance with tax regulations.

Get more for Illinois Department Of Revenue Schedule J Attach To Your Form IL 1120

Find out other Illinois Department Of Revenue Schedule J Attach To Your Form IL 1120

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online