Illinois Department of Revenue Schedule M Attach to Your Form IL 1120, IL 1120 ST, IL 1065, or IL 1041 Other Additions and Subtr

Understanding the Illinois Department Of Revenue Schedule M

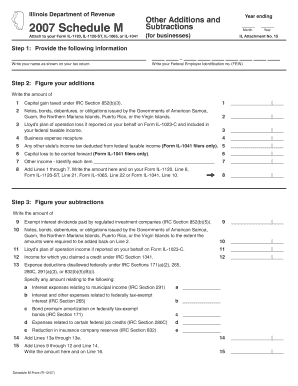

The Illinois Department Of Revenue Schedule M is a crucial attachment for businesses filing Form IL 1120, IL 1120 ST, IL 1065, or IL 1041. This form is specifically designed to report other additions and subtractions that affect the income of a business for the tax year. It helps ensure that all relevant financial information is accurately reflected in the business’s tax filings, allowing for proper calculation of taxable income.

Steps to Complete the Illinois Department Of Revenue Schedule M

Completing the Schedule M involves several important steps:

- Gather Financial Statements: Collect all necessary financial documents, including income statements and balance sheets, to provide accurate data.

- Identify Additions and Subtractions: Review your financial records to determine which items qualify as additions or subtractions to your income.

- Fill Out the Form: Enter the identified amounts in the appropriate sections of Schedule M, ensuring accuracy in calculations.

- Attach to Main Form: Once completed, attach Schedule M to your primary tax form (IL 1120, IL 1120 ST, IL 1065, or IL 1041) when submitting your tax return.

- Review for Accuracy: Double-check all entries for accuracy and completeness before submission to avoid potential issues with the Illinois Department of Revenue.

Key Elements of the Illinois Department Of Revenue Schedule M

Several key elements must be included when completing Schedule M:

- Business Information: Include the business name, address, and identification number at the top of the form.

- Income Additions: Clearly list all items that increase your taxable income, such as federal income tax refunds and non-deductible expenses.

- Income Subtractions: Document any deductions that reduce your taxable income, like certain business expenses and losses.

- Calculation Section: Ensure that all additions and subtractions are accurately calculated to determine the final taxable income.

Obtaining the Illinois Department Of Revenue Schedule M

The Schedule M can be obtained through various means:

- Online: Visit the Illinois Department of Revenue website to download the form directly.

- By Mail: Request a physical copy of the form by contacting the Illinois Department of Revenue.

- Tax Preparation Software: Many tax preparation software programs include Schedule M as part of their offerings, allowing for easy digital completion.

Legal Use of the Illinois Department Of Revenue Schedule M

Using Schedule M correctly is essential for compliance with Illinois tax laws. The form must be filled out accurately and submitted alongside the appropriate tax return to avoid penalties. Businesses should ensure they understand the legal implications of the information reported, as incorrect filings can lead to audits or fines.

Filing Deadlines for Illinois Department Of Revenue Schedule M

Filing deadlines for Schedule M coincide with the deadlines for the primary tax forms it accompanies. Generally, these forms are due on the fifteenth day of the fourth month following the end of the business's fiscal year. It is important to stay informed about any changes to deadlines or requirements to ensure timely and compliant submissions.

Quick guide on how to complete illinois department of revenue schedule m attach to your form il 1120 il 1120 st il 1065 or il 1041 other additions and

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you prefer to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document management requirements in just a few clicks from your chosen device. Modify and electronically sign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule M Attach To Your Form IL 1120, IL 1120 ST, IL 1065, Or IL 1041 Other Additions And Subtr

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule m attach to your form il 1120 il 1120 st il 1065 or il 1041 other additions and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule M?

The Illinois Department Of Revenue Schedule M is a form that businesses must attach to their Form IL 1120, IL 1120 ST, IL 1065, or IL 1041 to report other additions and subtractions. This form helps ensure accurate tax reporting for businesses operating in Illinois. By using this schedule, you can clarify any adjustments to your income that may affect your tax liability.

-

How do I complete the Illinois Department Of Revenue Schedule M?

To complete the Illinois Department Of Revenue Schedule M, you need to gather all relevant financial information regarding your business's income and deductions. Follow the instructions provided with the form to accurately report any additions and subtractions. Ensure that you attach this schedule to your Form IL 1120, IL 1120 ST, IL 1065, or IL 1041 for proper filing.

-

What are the benefits of using airSlate SignNow for submitting the Schedule M?

Using airSlate SignNow to submit the Illinois Department Of Revenue Schedule M streamlines the eSigning process, making it quick and efficient. Our platform allows you to easily send, sign, and manage documents securely. This not only saves time but also reduces the risk of errors in your tax submissions.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses. Our cost-effective solutions provide access to essential features for managing and eSigning documents, including the Illinois Department Of Revenue Schedule M. You can choose a plan that best fits your business requirements.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This allows you to easily manage your documents, including the Illinois Department Of Revenue Schedule M, alongside your existing tools, enhancing your workflow and efficiency.

-

What types of businesses need to file the Illinois Department Of Revenue Schedule M?

Any business entity that files Form IL 1120, IL 1120 ST, IL 1065, or IL 1041 in Illinois must complete and attach the Illinois Department Of Revenue Schedule M. This includes corporations, partnerships, and trusts that need to report additional income or deductions. Ensuring compliance with this requirement is crucial for accurate tax reporting.

-

How can I ensure my Schedule M is filed correctly?

To ensure your Illinois Department Of Revenue Schedule M is filed correctly, double-check all entries for accuracy and completeness. Utilize airSlate SignNow's features to review and eSign your documents securely. Additionally, consider consulting with a tax professional to verify that all necessary information is included before submission.

Get more for Illinois Department Of Revenue Schedule M Attach To Your Form IL 1120, IL 1120 ST, IL 1065, Or IL 1041 Other Additions And Subtr

- Rental agreement multifamily nw form

- Temporary electrical power letter fort worth texas fortworthtexas form

- Pennsylvania application record 2015 form

- English student 6 form

- Kalahari apply online form

- Ss 182a application for a permit to install or modify an onsite sewage disposal system form

- Trec 39 8 form

- Sfccn medical authorization request form sfchp

Find out other Illinois Department Of Revenue Schedule M Attach To Your Form IL 1120, IL 1120 ST, IL 1065, Or IL 1041 Other Additions And Subtr

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form