IL 2220 Computation of Penalties for Businesses Illinois Form

Understanding the IL 2220 Computation of Penalties for Businesses in Illinois

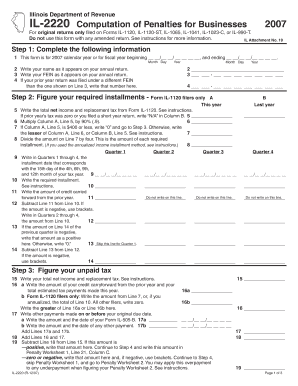

The IL 2220 form is essential for businesses in Illinois to calculate penalties related to underpayment of estimated tax. This form is specifically designed for those who may not have paid enough tax throughout the year, leading to potential penalties. Understanding the purpose of the IL 2220 is crucial for compliance and to avoid unnecessary financial repercussions.

Steps to Complete the IL 2220 Form

Completing the IL 2220 involves several key steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, calculate your total tax liability for the year. This amount will help determine if you have underpaid your estimated taxes. Then, follow the instructions on the form to input your figures accurately. Be sure to double-check your calculations to ensure accuracy, as errors can lead to additional penalties.

Key Elements of the IL 2220 Form

Several critical components make up the IL 2220 form. These include:

- Taxpayer Information: Basic details about the business, including name, address, and identification number.

- Estimated Tax Payments: A section to report the estimated tax payments made throughout the year.

- Penalty Calculation: This part of the form calculates the penalty based on the underpayment of estimated taxes.

- Signature Section: A space for the taxpayer or authorized representative to sign and date the form.

Filing Deadlines for the IL 2220 Form

Timely submission of the IL 2220 is crucial to avoid additional penalties. The form must be filed along with your annual tax return. Typically, this coincides with the federal tax filing deadline, which is usually April fifteenth for most businesses. However, if you are unable to file by this date, it is important to check for any extensions or alternative deadlines that may apply to your specific situation.

Legal Use of the IL 2220 Form

The IL 2220 form is legally required for businesses that meet specific criteria regarding tax payments. It serves as a formal declaration of any penalties owed due to underpayment of estimated taxes. Filing this form accurately and on time is not only a legal obligation but also a critical step in maintaining good standing with the Illinois Department of Revenue.

Obtaining the IL 2220 Form

Businesses can obtain the IL 2220 form through the Illinois Department of Revenue's website or by contacting their office directly. It is available in both digital and paper formats. For convenience, many businesses choose to fill out the form electronically, which can streamline the submission process and reduce the risk of errors.

Quick guide on how to complete il 2220 instructions

Effortlessly prepare il 2220 instructions on any device

Digital document management has gained popularity among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without interruptions. Manage il 2220 instructions on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign il 2220 instructions with ease

- Find il 2220 instructions and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form: via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your selection. Modify and electronically sign il 2220 instructions and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to il 2220 instructions

Create this form in 5 minutes!

How to create an eSignature for the il 2220 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask il 2220 instructions

-

What are the key features of airSlate SignNow related to il 2220 instructions?

airSlate SignNow offers a range of features that simplify the process of managing il 2220 instructions. Users can easily create, send, and eSign documents, ensuring compliance and accuracy. The platform also provides templates specifically designed for tax forms, including the il 2220 instructions, making it easier to complete and submit.

-

How does airSlate SignNow help with the completion of il 2220 instructions?

With airSlate SignNow, users can efficiently fill out and manage their il 2220 instructions. The platform allows for easy collaboration, enabling multiple users to review and sign documents in real-time. This streamlines the process and reduces the chances of errors, ensuring that your il 2220 instructions are completed accurately.

-

Is airSlate SignNow a cost-effective solution for managing il 2220 instructions?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses needing to manage il 2220 instructions. The pricing plans are flexible and cater to various business sizes, ensuring that you only pay for what you need. This affordability, combined with its robust features, makes it an ideal choice for managing tax documents.

-

Can I integrate airSlate SignNow with other software for il 2220 instructions?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow for managing il 2220 instructions. Whether you use CRM systems, cloud storage, or accounting software, you can easily connect them with airSlate SignNow to streamline your document management process.

-

What benefits does airSlate SignNow provide for businesses handling il 2220 instructions?

airSlate SignNow provides numerous benefits for businesses dealing with il 2220 instructions. It enhances efficiency by reducing the time spent on paperwork and minimizes errors through its user-friendly interface. Additionally, the platform ensures that all documents are securely stored and easily accessible, which is crucial for compliance.

-

How secure is airSlate SignNow when handling il 2220 instructions?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like il 2220 instructions. The platform employs advanced encryption and security protocols to protect your data. This ensures that your information remains confidential and secure throughout the signing process.

-

What support options are available for users of airSlate SignNow regarding il 2220 instructions?

airSlate SignNow offers comprehensive support options for users needing assistance with il 2220 instructions. You can access a detailed knowledge base, video tutorials, and customer support via chat or email. This ensures that you have the resources you need to effectively use the platform for your document management.

Get more for il 2220 instructions

- Indiana cfa 1 form 89214948

- Jhsc meeting minutes recording form wsps

- Recertification packet baltimore regional housing partnership form

- Physical demands information form and wsib

- Community hours form grand erie district school board

- Builder eligibility form

- Nnei contract form 10 0003l 4

- 2016 little mr amp miss bapplicationb cherry blossom festival form

Find out other il 2220 instructions

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free