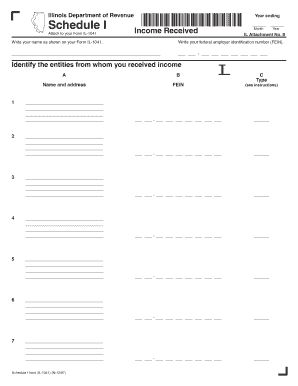

Illinois Department of Revenue *IL07640111332* Income Received Schedule I Attach to Your Form IL 1041 Year Ending Month Year IL

Understanding the Illinois Department Of Revenue IL07640111332 Income Received Schedule I

The Illinois Department Of Revenue IL07640111332 Income Received Schedule I is a crucial document for taxpayers who need to report income received by estates or trusts. This form is attached to Form IL-1041, which is the Illinois Income Tax Return for Estates and Trusts. It specifies the types of income that must be reported, including interest, dividends, and other sources of income. Completing this schedule accurately is essential for compliance with Illinois tax laws.

Steps to Complete the Illinois Department Of Revenue IL07640111332 Income Received Schedule I

Completing the IL07640111332 Income Received Schedule I involves several steps:

- Gather all relevant financial documents, including bank statements and investment records.

- Identify the types of income received during the tax year that need to be reported.

- Fill out the schedule by entering the income amounts in the appropriate sections.

- Ensure that all calculations are accurate and double-check for any errors.

- Attach the completed schedule to your Form IL-1041 before submission.

Key Elements of the Illinois Department Of Revenue IL07640111332 Income Received Schedule I

The key elements of the IL07640111332 include:

- Income Categories: The schedule lists specific categories of income, such as interest, dividends, and rental income.

- Reporting Requirements: Taxpayers must report all income accurately, as failure to do so can lead to penalties.

- Signature and Date: The form must be signed and dated by the responsible party, typically the executor or trustee.

Legal Use of the Illinois Department Of Revenue IL07640111332 Income Received Schedule I

This schedule is legally required for estates and trusts that have received income during the tax year. It ensures that the income is reported correctly to the state of Illinois, which is essential for compliance with state tax regulations. Failure to file this schedule can result in penalties and interest on unpaid taxes.

Filing Deadlines for the Illinois Department Of Revenue IL07640111332 Income Received Schedule I

Taxpayers must adhere to specific filing deadlines for the IL07640111332. Generally, the deadline for submitting Form IL-1041, along with the attached schedule, is the fifteenth day of the fourth month following the end of the tax year. For most taxpayers, this means the deadline falls on April 15. However, if the estate or trust operates on a fiscal year, the deadline will vary accordingly.

Obtaining the Illinois Department Of Revenue IL07640111332 Income Received Schedule I

The IL07640111332 Income Received Schedule I can be obtained directly from the Illinois Department of Revenue's website or through tax preparation software that supports Illinois tax forms. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Quick guide on how to complete illinois department of revenue il07640111332 income received schedule i attach to your form il 1041 year ending month year il

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to generate, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

The easiest way to edit and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive data with the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to share your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors requiring new document prints. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue *IL07640111332* Income Received Schedule I Attach To Your Form IL 1041 Year Ending Month Year IL

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue il07640111332 income received schedule i attach to your form il 1041 year ending month year il

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue *IL07640111332* Income Received Schedule I?

The Illinois Department Of Revenue *IL07640111332* Income Received Schedule I is a form that taxpayers must attach to their Form IL 1041 to report income received during the tax year. This schedule helps ensure accurate reporting of income for estates and trusts, making it essential for compliance with state tax regulations.

-

How can airSlate SignNow help with the Illinois Department Of Revenue *IL07640111332* Income Received Schedule I?

airSlate SignNow provides a streamlined solution for electronically signing and sending the Illinois Department Of Revenue *IL07640111332* Income Received Schedule I. With our platform, you can easily prepare, sign, and submit your documents, ensuring a hassle-free experience during tax season.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to suit different business needs, including a free trial for new users. Our plans are designed to be cost-effective, allowing you to manage your documents, including the Illinois Department Of Revenue *IL07640111332* Income Received Schedule I, without breaking the bank.

-

Is airSlate SignNow compliant with Illinois tax regulations?

Yes, airSlate SignNow is compliant with Illinois tax regulations, ensuring that your documents, such as the Illinois Department Of Revenue *IL07640111332* Income Received Schedule I, are handled securely and in accordance with state laws. Our platform prioritizes data security and compliance to give you peace of mind.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow efficiency. You can easily connect our platform with accounting software to manage your Illinois Department Of Revenue *IL07640111332* Income Received Schedule I and other tax documents seamlessly.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSigning, document templates, and real-time tracking, making it easy to manage your documents. These features are particularly useful for handling the Illinois Department Of Revenue *IL07640111332* Income Received Schedule I, ensuring that you can complete your tax filings efficiently.

-

How does airSlate SignNow ensure document security?

We take document security seriously at airSlate SignNow. Our platform uses advanced encryption and secure cloud storage to protect your sensitive information, including the Illinois Department Of Revenue *IL07640111332* Income Received Schedule I, ensuring that your data remains confidential and secure.

Get more for Illinois Department Of Revenue *IL07640111332* Income Received Schedule I Attach To Your Form IL 1041 Year Ending Month Year IL

Find out other Illinois Department Of Revenue *IL07640111332* Income Received Schedule I Attach To Your Form IL 1041 Year Ending Month Year IL

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template