Illinois Department of Revenue Schedule K 1 T 1 Check the Appropriate Box to Be Completed by Trusts or Estates Filing Form IL 10

Understanding the Illinois Department Of Revenue Schedule K-1 T

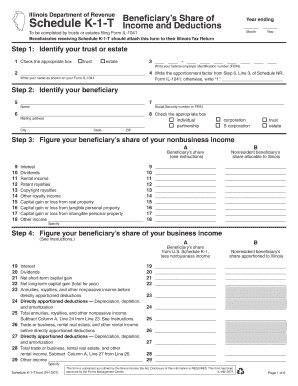

The Illinois Department Of Revenue Schedule K-1 T is a crucial form for trusts or estates filing Form IL-1041. This form is specifically designed for beneficiaries who receive a Schedule K-1 T. It serves as a declaration of the income, deductions, and credits that beneficiaries must report on their Illinois tax returns. Proper completion of this form ensures that beneficiaries accurately reflect their share of the trust or estate's income on their individual tax filings.

Steps to Complete the Schedule K-1 T

Completing the Schedule K-1 T involves several key steps to ensure accuracy. First, beneficiaries should gather all relevant financial documents related to the trust or estate. Next, they must carefully fill out the form, checking the appropriate boxes that apply to their situation. It's important to report all income, deductions, and credits as outlined on the form. Once completed, the Schedule K-1 T must be attached to the beneficiary's Illinois tax return, ensuring compliance with state tax regulations.

Obtaining the Schedule K-1 T

Beneficiaries can obtain the Illinois Department Of Revenue Schedule K-1 T from the Illinois Department of Revenue's official website or by contacting their local tax office. The form is typically available for download in a PDF format, which can be printed and filled out manually. For those who prefer digital options, many tax preparation software programs also include the Schedule K-1 T, making it easier to complete and file.

Legal Use of the Schedule K-1 T

The Schedule K-1 T has specific legal implications for beneficiaries. It is essential for accurately reporting income received from trusts or estates, as it helps ensure compliance with Illinois tax laws. Failure to properly report the information from the Schedule K-1 T may result in penalties or additional taxes owed. Therefore, beneficiaries should treat this form with the utmost importance and ensure its accuracy when filing their tax returns.

Key Elements of the Schedule K-1 T

Several key elements must be included when filling out the Schedule K-1 T. These include the name and identification number of the trust or estate, the beneficiary's details, and a breakdown of the income, deductions, and credits allocated to the beneficiary. It is crucial to ensure that all figures are accurate and reflect the actual amounts received, as discrepancies can lead to tax issues.

Filing Deadlines for the Schedule K-1 T

Beneficiaries should be aware of the filing deadlines associated with the Schedule K-1 T. Typically, the form must be submitted along with the Illinois tax return by the due date, which is generally April 15 for most taxpayers. However, if an extension is filed for the tax return, the Schedule K-1 T must also be submitted by the extended deadline. Staying informed about these deadlines helps prevent late filing penalties.

Quick guide on how to complete illinois department of revenue schedule k 1 t 1 check the appropriate box to be completed by trusts or estates filing form il

Complete [SKS] with ease on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without any holdups. Handle [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign [SKS] without stress

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then hit the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule K 1 T 1 Check The Appropriate Box To Be Completed By Trusts Or Estates Filing Form IL 10

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule k 1 t 1 check the appropriate box to be completed by trusts or estates filing form il

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule K 1 T 1?

The Illinois Department Of Revenue Schedule K 1 T 1 is a form that beneficiaries must complete when filing Form IL 1041. It is specifically designed for trusts or estates, ensuring that beneficiaries receiving Schedule K 1 T understand their tax obligations. This form must be attached to the Illinois tax return of the beneficiary.

-

How do I complete the Illinois Department Of Revenue Schedule K 1 T 1?

To complete the Illinois Department Of Revenue Schedule K 1 T 1, beneficiaries should carefully read the instructions provided with Form IL 1041. They need to check the appropriate boxes and provide accurate information regarding their share of income, deductions, and credits. Proper completion is crucial for compliance with Illinois tax regulations.

-

What are the benefits of using airSlate SignNow for filing tax forms?

Using airSlate SignNow for filing tax forms like the Illinois Department Of Revenue Schedule K 1 T 1 streamlines the process of document signing and submission. It offers an easy-to-use interface, ensuring that all necessary forms are completed accurately and efficiently. This can save time and reduce the risk of errors in tax filings.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to manage their document signing needs. With flexible pricing plans, it allows businesses to choose a package that fits their budget while still providing essential features for handling forms like the Illinois Department Of Revenue Schedule K 1 T 1.

-

Can airSlate SignNow integrate with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various tax preparation software, making it easier to manage documents like the Illinois Department Of Revenue Schedule K 1 T 1. This seamless integration helps ensure that all necessary forms are readily available and can be signed electronically, enhancing workflow efficiency.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for document management, including electronic signatures, templates, and secure storage. These features are particularly useful for managing tax forms such as the Illinois Department Of Revenue Schedule K 1 T 1, ensuring that all documents are organized and easily accessible.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents. When handling forms like the Illinois Department Of Revenue Schedule K 1 T 1, users can trust that their information is secure and that their electronic signatures are legally binding.

Get more for Illinois Department Of Revenue Schedule K 1 T 1 Check The Appropriate Box To Be Completed By Trusts Or Estates Filing Form IL 10

- Subcontractors package virginia form

- Virginia minors form

- Virginia identity form

- Virginia deceased form

- Identity theft by known imposter package virginia form

- Your personal assets 497428485 form

- Essential documents for the organized traveler package virginia form

- Essential documents for the organized traveler package with personal organizer virginia form

Find out other Illinois Department Of Revenue Schedule K 1 T 1 Check The Appropriate Box To Be Completed By Trusts Or Estates Filing Form IL 10

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe