Illinois Department of Revenue Year Ending Tax Special Depreciation IL 4562 for Tax Years Ending on or After September 11, Form

What is the Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562 For Tax Years Ending On Or After September 11

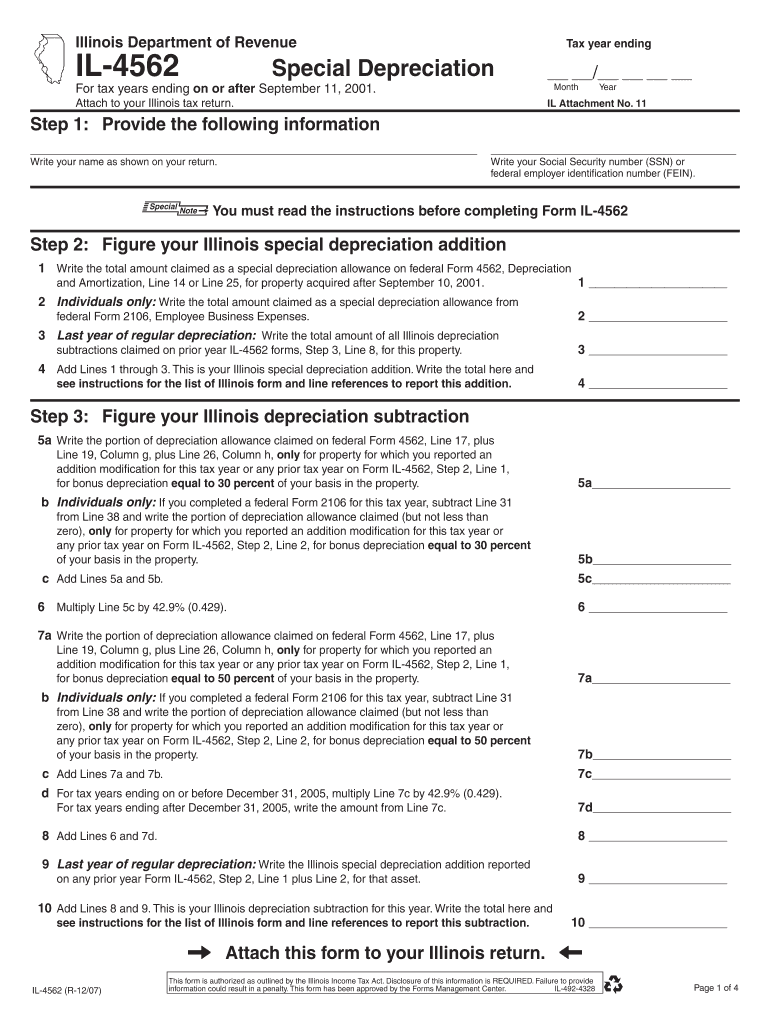

The Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562 is a tax form specifically designed for businesses and individuals who wish to claim special depreciation on qualified property. This form is applicable for tax years ending on or after September 11 and allows taxpayers to report depreciation deductions for assets that have been acquired or improved. Special depreciation can significantly reduce taxable income, thus providing financial relief for taxpayers investing in new equipment or property.

How to use the Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562 For Tax Years Ending On Or After September 11

To utilize the Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562, taxpayers must first determine their eligibility for special depreciation based on the type of property they own. Once eligibility is confirmed, the form must be filled out accurately, detailing the assets for which depreciation is being claimed. It is important to follow the specific instructions provided with the form to ensure compliance with state regulations. After completion, the form should be submitted alongside the taxpayer's annual tax return.

Steps to complete the Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562 For Tax Years Ending On Or After September 11

Completing the Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562 involves several key steps:

- Gather all relevant financial records and documentation related to the assets being depreciated.

- Review the eligibility criteria for special depreciation to ensure compliance.

- Fill out the form, providing detailed information about each asset, including acquisition dates and costs.

- Calculate the depreciation amount according to the guidelines provided by the Illinois Department of Revenue.

- Review the completed form for accuracy before submitting it with your tax return.

Legal use of the Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562 For Tax Years Ending On Or After September 11

The legal use of the Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562 is governed by state tax laws. Taxpayers must ensure that they are using the form in accordance with the regulations set forth by the Illinois Department of Revenue. Misuse or incorrect filing can lead to penalties or audits. It is advisable to consult with a tax professional if there are uncertainties regarding the legal implications of claiming special depreciation.

Filing Deadlines / Important Dates

Filing deadlines for the Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562 align with the general tax filing deadlines for the state. Typically, taxpayers must submit their forms by the due date of their annual tax return, which is usually April 15 for most individuals and March 15 for corporations. It is important to stay informed about any changes to these dates, as well as any extensions that may apply.

Required Documents

To complete the Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562, taxpayers need to gather several key documents:

- Purchase invoices or receipts for the assets being depreciated.

- Previous tax returns that may provide context for claimed depreciation.

- Any additional documentation that supports the eligibility for special depreciation.

Quick guide on how to complete illinois department of revenue year ending tax special depreciation il 4562 for tax years ending on or after september 11

Complete [SKS] effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and without delays. Handle [SKS] on any platform with the airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The simplest method to alter and eSign [SKS] without breaking a sweat

- Obtain [SKS] and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to store your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562 For Tax Years Ending On Or After September 11,

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue year ending tax special depreciation il 4562 for tax years ending on or after september 11

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562?

The Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562 is a form used to claim special depreciation for assets placed in service during the tax year. This form is essential for businesses looking to maximize their tax benefits under Illinois tax law. Understanding how to properly fill out this form can signNowly impact your tax liabilities.

-

How can airSlate SignNow help with the Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562?

airSlate SignNow provides an easy-to-use platform for businesses to prepare and eSign the Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562. With our solution, you can streamline the document management process, ensuring that your forms are completed accurately and submitted on time. This efficiency can save you both time and money.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing the Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562. These features ensure that your documents are not only compliant but also easily accessible. Additionally, our platform allows for collaboration among team members, enhancing productivity.

-

Is airSlate SignNow cost-effective for small businesses handling tax forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing tax forms like the Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562. Our pricing plans are flexible and cater to various business sizes, ensuring that you only pay for what you need. This affordability allows small businesses to access essential tools without breaking the bank.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage the Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562 alongside your other financial documents. This integration helps streamline your workflow, allowing for better data management and reducing the risk of errors. You can connect with popular platforms to enhance your overall efficiency.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562, offers numerous benefits. You gain access to a secure, user-friendly platform that simplifies the eSigning process and document management. Additionally, our solution enhances compliance and reduces the time spent on paperwork, allowing you to focus on your core business activities.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority at airSlate SignNow, especially when handling sensitive tax documents like the Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562. Our platform employs advanced encryption and security protocols to protect your data. You can trust that your information is safe while using our services, ensuring peace of mind as you manage your tax filings.

Get more for Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562 For Tax Years Ending On Or After September 11,

Find out other Illinois Department Of Revenue Year Ending Tax Special Depreciation IL 4562 For Tax Years Ending On Or After September 11,

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure