Illinois Department of Revenue Schedule INS Year Ending Attach to Your Form IL 1120

Understanding the Illinois Department Of Revenue Schedule INS Year Ending Attach To Your Form IL 1120

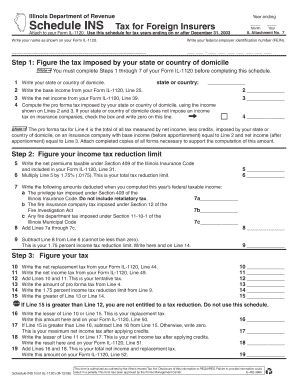

The Illinois Department Of Revenue Schedule INS is a crucial form for corporations filing their annual tax returns using Form IL 1120. This schedule is specifically designed to report income from investments, ensuring that businesses comply with state tax regulations. It is essential for accurately calculating the tax liability based on investment income, which may include dividends, interest, and capital gains. Proper completion of this form is necessary to avoid potential penalties and ensure compliance with Illinois tax laws.

Steps to Complete the Illinois Department Of Revenue Schedule INS Year Ending Attach To Your Form IL 1120

Completing the Schedule INS involves several key steps:

- Gather all relevant financial documents, including income statements and investment records.

- Identify the types of income to report, such as dividends, interest, and capital gains.

- Fill out the required sections of the Schedule INS, ensuring accuracy in reporting figures.

- Attach the completed Schedule INS to your Form IL 1120 before submission.

- Review all entries for completeness and accuracy to prevent errors that could lead to penalties.

Key Elements of the Illinois Department Of Revenue Schedule INS Year Ending Attach To Your Form IL 1120

The Schedule INS includes several critical components that must be accurately reported:

- Investment Income: Report all sources of investment income, including dividends and interest.

- Capital Gains: Include any capital gains realized during the tax year.

- Tax Calculation: Use the provided formulas to calculate the applicable tax based on reported income.

- Signature and Date: Ensure the form is signed and dated by an authorized representative of the corporation.

Filing Deadlines for the Illinois Department Of Revenue Schedule INS Year Ending Attach To Your Form IL 1120

Timely filing is essential to avoid penalties. The due date for submitting Form IL 1120, along with the attached Schedule INS, is typically the 15th day of the month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. If additional time is needed, corporations may request an extension, but it is crucial to comply with all requirements and deadlines to maintain good standing with the Illinois Department of Revenue.

Legal Use of the Illinois Department Of Revenue Schedule INS Year Ending Attach To Your Form IL 1120

The Schedule INS is legally required for corporations that have investment income. Failing to file this schedule or inaccurately reporting income can lead to significant penalties, including fines and interest on unpaid taxes. It is essential for corporations to understand their obligations under Illinois tax law and ensure that the Schedule INS is completed and submitted correctly. Compliance with these regulations not only helps avoid legal issues but also supports the integrity of the tax system.

Obtaining the Illinois Department Of Revenue Schedule INS Year Ending Attach To Your Form IL 1120

The Schedule INS can be obtained directly from the Illinois Department of Revenue's official website or through tax preparation software that supports Illinois tax forms. It is advisable to ensure that you are using the most current version of the form to comply with any recent changes in tax laws or regulations. Businesses should familiarize themselves with the form's requirements and instructions to facilitate accurate and efficient completion.

Quick guide on how to complete illinois department of revenue schedule ins year ending attach to your form il 1120

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow simplifies all your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign [SKS] to ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule ins year ending attach to your form il 1120

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule INS Year Ending Attach To Your Form IL 1120?

The Illinois Department Of Revenue Schedule INS Year Ending Attach To Your Form IL 1120 is a form used by businesses to report income and expenses for the year. It is essential for ensuring compliance with state tax regulations. Properly completing this form can help businesses avoid penalties and ensure accurate tax filings.

-

How can airSlate SignNow help with the Illinois Department Of Revenue Schedule INS Year Ending Attach To Your Form IL 1120?

airSlate SignNow provides an easy-to-use platform for businesses to eSign and send documents, including the Illinois Department Of Revenue Schedule INS Year Ending Attach To Your Form IL 1120. This streamlines the process, making it faster and more efficient to complete and submit necessary tax forms.

-

What are the pricing options for using airSlate SignNow for tax document management?

airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features that facilitate the management of documents like the Illinois Department Of Revenue Schedule INS Year Ending Attach To Your Form IL 1120. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available with airSlate SignNow for tax preparation software?

Yes, airSlate SignNow integrates seamlessly with various tax preparation software, enhancing the workflow for completing the Illinois Department Of Revenue Schedule INS Year Ending Attach To Your Form IL 1120. These integrations allow for easy document sharing and collaboration, ensuring a smooth tax filing process.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as eSigning, document templates, and secure cloud storage, which are essential for managing tax documents like the Illinois Department Of Revenue Schedule INS Year Ending Attach To Your Form IL 1120. These features help ensure that your documents are organized, accessible, and compliant with regulations.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and security protocols to protect sensitive tax documents, including the Illinois Department Of Revenue Schedule INS Year Ending Attach To Your Form IL 1120. This ensures that your information remains confidential and secure throughout the signing process.

-

Can I track the status of my documents with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your documents, including the Illinois Department Of Revenue Schedule INS Year Ending Attach To Your Form IL 1120. You can see when documents are sent, viewed, and signed, giving you peace of mind during the tax filing process.

Get more for Illinois Department Of Revenue Schedule INS Year Ending Attach To Your Form IL 1120

Find out other Illinois Department Of Revenue Schedule INS Year Ending Attach To Your Form IL 1120

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe