Illinois Department of Revenue IL 2220 Computation of Penalties for Businesses IL Attachment No Form

What is the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No

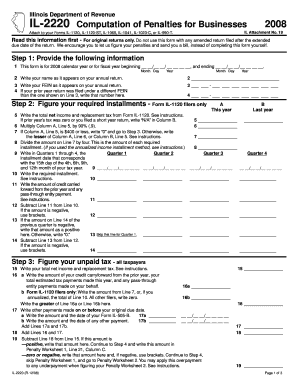

The Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No is a specific form used by businesses in Illinois to calculate penalties related to tax compliance. This form is essential for businesses that may have incurred penalties due to late payments or other compliance issues. It provides a structured method for determining the exact amount owed, ensuring that businesses can accurately report and remit any penalties to the state. Understanding this form is crucial for maintaining compliance and avoiding further penalties.

How to use the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No

Using the Illinois Department Of Revenue IL 2220 involves a few straightforward steps. First, gather all relevant tax documentation, including previous returns and payment records. Next, fill out the form by entering the required financial information, such as the total tax due and any previous payments made. The form will guide you through the calculation process, helping you determine the penalties incurred. Once completed, review the information for accuracy before submission to ensure compliance with state regulations.

Steps to complete the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No

Completing the IL 2220 form requires careful attention to detail. Follow these steps:

- Collect necessary documents, including tax returns and payment history.

- Access the IL 2220 form from the Illinois Department of Revenue website or through your tax professional.

- Fill in your business information, including name, address, and taxpayer identification number.

- Input the total tax amount due and any payments already made.

- Calculate the penalties as directed on the form, using the provided guidelines.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate state department, either electronically or by mail.

Key elements of the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No

The key elements of the IL 2220 form include sections for entering business details, tax amounts, and penalty calculations. It typically requires the following information:

- Business name and contact information.

- Taxpayer identification number.

- Total tax liability.

- Amount of tax paid.

- Calculation of penalties based on late payment or filing.

These elements are crucial for ensuring that the penalties are calculated accurately and that the business remains compliant with Illinois tax laws.

Penalties for Non-Compliance

Failure to accurately complete and submit the Illinois Department Of Revenue IL 2220 can result in significant penalties for businesses. Non-compliance may lead to additional fines, interest on unpaid taxes, and potential legal action from the state. It is essential for businesses to stay informed about their tax obligations and to utilize the IL 2220 form to avoid these consequences. Understanding the implications of non-compliance can help businesses take proactive measures to ensure timely and accurate submissions.

Quick guide on how to complete illinois department of revenue il 2220 computation of penalties for businesses il attachment no

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the appropriate template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to Modify and Electronically Sign [SKS] Effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or mask sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you would like to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue il 2220 computation of penalties for businesses il attachment no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No.?

The Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No. is a form used by businesses to calculate penalties for late tax payments. It helps ensure compliance with state tax regulations and provides a clear breakdown of any penalties incurred.

-

How can airSlate SignNow assist with the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No.?

airSlate SignNow streamlines the process of completing and submitting the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No. by allowing users to eSign and send documents securely. This ensures that your submissions are timely and compliant with state requirements.

-

What are the pricing options for using airSlate SignNow for the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No.?

airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that simplify the completion of the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No., ensuring you get the best value for your investment.

-

What features does airSlate SignNow provide for managing the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No.?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools make it easier to manage the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No. efficiently and effectively.

-

Are there any benefits to using airSlate SignNow for the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No.?

Using airSlate SignNow for the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No. offers numerous benefits, including time savings, reduced paperwork, and enhanced compliance. This solution helps businesses focus on their core operations while ensuring tax documents are handled correctly.

-

Can airSlate SignNow integrate with other software for the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No.?

Yes, airSlate SignNow integrates seamlessly with various accounting and business management software. This integration allows for a smoother workflow when dealing with the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No., making it easier to manage your financial documents.

-

Is airSlate SignNow secure for handling the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No.?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including encryption and secure cloud storage. This ensures that your Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No. is handled safely and confidentially.

Get more for Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No

Find out other Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses IL Attachment No

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer