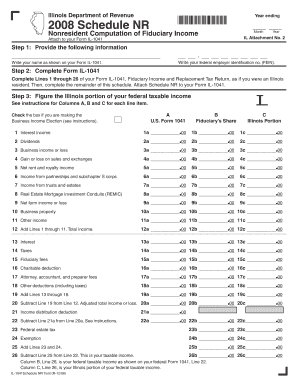

Illinois Department of Revenue *863801110* Schedule NR Nonresident Computation of Fiduciary Income Attach to Your Form IL 1041 Y

Understanding the Illinois Department Of Revenue Schedule NR

The Illinois Department Of Revenue Schedule NR, identified by the number *863801110*, is specifically designed for nonresidents to compute fiduciary income. This form is essential for nonresident estates and trusts that need to report income earned in Illinois. It must be attached to Form IL-1041, which is the state income tax return for estates and trusts. The Schedule NR helps ensure that nonresidents accurately report their Illinois-source income and comply with state tax obligations.

How to Use the Schedule NR

To effectively use the Schedule NR, nonresidents should first gather all relevant financial information regarding the income earned in Illinois. This includes income from real estate, businesses, or other sources within the state. After collecting this information, fill out the form by following the provided instructions carefully, ensuring that all calculations are accurate. Once completed, attach the Schedule NR to your Form IL-1041 before submitting it to the Illinois Department of Revenue.

Steps to Complete the Schedule NR

Completing the Illinois Schedule NR involves several key steps:

- Gather all necessary documentation, including income statements and expense records.

- Fill out the identification section with the estate or trust's details.

- Report the Illinois-source income in the appropriate sections of the form.

- Calculate the total income and any deductions applicable to nonresidents.

- Review the completed form for accuracy before attaching it to Form IL-1041.

Key Elements of the Schedule NR

Important components of the Schedule NR include sections for reporting various types of income, such as dividends, interest, and capital gains. Additionally, the form includes spaces for deductions that may apply to nonresidents, which can help reduce taxable income. Understanding these elements is crucial for accurate reporting and compliance with Illinois tax laws.

Filing Deadlines for the Schedule NR

It is important to adhere to filing deadlines when submitting the Schedule NR. Typically, the due date aligns with the federal tax return deadline, which is usually April 15 for most taxpayers. However, if this date falls on a weekend or holiday, the deadline may be extended. Nonresidents should ensure they file on time to avoid penalties and interest on any unpaid taxes.

Eligibility Criteria for Using Schedule NR

Eligibility to use the Schedule NR is primarily determined by residency status. Nonresidents who have earned income from Illinois sources, such as rental properties or business operations, must file this form. Additionally, estates and trusts that are administered outside of Illinois but have income sourced within the state are also required to complete the Schedule NR.

Quick guide on how to complete illinois department of revenue 863801110 schedule nr nonresident computation of fiduciary income attach to your form il 1041

Complete [SKS] effortlessly on any device

Online document administration has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can locate the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any hold-ups. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign [SKS] without hassle

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact confidential information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign [SKS] and ensure outstanding communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue *863801110* Schedule NR Nonresident Computation Of Fiduciary Income Attach To Your Form IL 1041 Y

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue 863801110 schedule nr nonresident computation of fiduciary income attach to your form il 1041

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue *863801110* Schedule NR Nonresident Computation Of Fiduciary Income?

The Illinois Department Of Revenue *863801110* Schedule NR Nonresident Computation Of Fiduciary Income is a form used to calculate the income tax for nonresident fiduciaries. It is essential for ensuring compliance with Illinois tax regulations when filing Form IL 1041. This schedule helps in accurately reporting income earned by nonresidents in Illinois.

-

How do I attach the Schedule NR to my Form IL 1041?

To attach the Schedule NR to your Form IL 1041, simply include it as an additional document when submitting your tax return. Ensure that all calculations are accurate and that the schedule is completed in accordance with the Illinois Department Of Revenue guidelines. This will help avoid any delays in processing your return.

-

What are the benefits of using airSlate SignNow for submitting my Schedule NR?

Using airSlate SignNow for submitting your Schedule NR offers a streamlined, efficient process for eSigning and sending documents. It ensures that your Illinois Department Of Revenue *863801110* Schedule NR Nonresident Computation Of Fiduciary Income is securely transmitted and easily accessible. Additionally, it saves time and reduces the risk of errors in document handling.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The cost is competitive and provides access to features that simplify the process of managing documents like the Illinois Department Of Revenue *863801110* Schedule NR Nonresident Computation Of Fiduciary Income. You can choose a plan that best fits your requirements.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your workflow. This integration allows you to manage your Illinois Department Of Revenue *863801110* Schedule NR Nonresident Computation Of Fiduciary Income alongside other financial documents, making the process more efficient.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides features such as eSigning, document templates, and secure cloud storage. These tools are designed to help you manage your Illinois Department Of Revenue *863801110* Schedule NR Nonresident Computation Of Fiduciary Income effectively. With these features, you can ensure that your documents are organized and easily retrievable.

-

How secure is my information when using airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and security protocols to protect your sensitive information, including your Illinois Department Of Revenue *863801110* Schedule NR Nonresident Computation Of Fiduciary Income. You can trust that your data is safe while using our services.

Get more for Illinois Department Of Revenue *863801110* Schedule NR Nonresident Computation Of Fiduciary Income Attach To Your Form IL 1041 Y

Find out other Illinois Department Of Revenue *863801110* Schedule NR Nonresident Computation Of Fiduciary Income Attach To Your Form IL 1041 Y

- Sign Alaska Rental property lease agreement Simple

- Help Me With Sign North Carolina Rental lease agreement forms

- Sign Missouri Rental property lease agreement Mobile

- Sign Missouri Rental property lease agreement Safe

- Sign West Virginia Rental lease agreement forms Safe

- Sign Tennessee Rental property lease agreement Free

- Sign West Virginia Rental property lease agreement Computer

- How Can I Sign Montana Rental lease contract

- Can I Sign Montana Rental lease contract

- How To Sign Minnesota Residential lease agreement

- How Can I Sign California Residential lease agreement form

- How To Sign Georgia Residential lease agreement form

- Sign Nebraska Residential lease agreement form Online

- Sign New Hampshire Residential lease agreement form Safe

- Help Me With Sign Tennessee Residential lease agreement

- Sign Vermont Residential lease agreement Safe

- Sign Rhode Island Residential lease agreement form Simple

- Can I Sign Pennsylvania Residential lease agreement form

- Can I Sign Wyoming Residential lease agreement form

- How Can I Sign Wyoming Room lease agreement