For Tax Years Ending on or AFTER December 31, Write the Amount You Are Paying Form

Understanding the Form for Tax Years Ending ON Or AFTER December 31

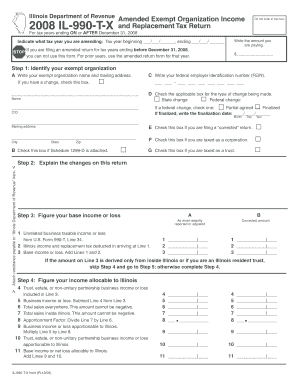

The form titled "For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying" is a crucial document for taxpayers in the United States. It is typically used to report the amount of tax owed for specific tax years that conclude on or after December 31. This form is essential for ensuring compliance with federal tax obligations and helps taxpayers accurately report their financial responsibilities to the Internal Revenue Service (IRS).

Steps to Complete the Form

Completing the form involves several key steps to ensure accuracy and compliance. First, gather all relevant financial documents, including income statements and previous tax returns. Next, carefully fill in the required fields, paying close attention to the amounts owed for each applicable tax year. It is important to double-check all entries for accuracy before submission. Finally, sign and date the form, ensuring that all necessary information is included to avoid delays in processing.

Legal Use of the Form

This form serves a legal purpose by documenting the taxpayer's obligations to the IRS. It is essential for maintaining accurate tax records and can be used as evidence in case of an audit. Proper completion and submission of this form also help avoid potential penalties associated with underreporting or failing to report taxes owed. Understanding the legal implications of this form can aid taxpayers in fulfilling their responsibilities and protecting their rights.

Filing Deadlines and Important Dates

Timely submission of the form is crucial to avoid penalties and interest on unpaid taxes. The IRS typically sets specific deadlines for tax filings, which may vary based on the type of taxpayer and the tax year in question. It is advisable to stay informed about these deadlines and plan accordingly to ensure that the form is submitted on time. Marking these important dates on a calendar can help taxpayers manage their filing responsibilities effectively.

Required Documents for Submission

To complete the form, taxpayers must gather several key documents. These may include W-2 forms, 1099 forms, and any other relevant financial statements that detail income and deductions. Having these documents readily available can streamline the completion process and ensure that all necessary information is accurately reported. It is beneficial to organize these documents ahead of time to avoid last-minute complications.

IRS Guidelines for Completing the Form

The IRS provides specific guidelines for completing the form accurately. These guidelines outline the information required, the format for reporting amounts, and any additional documentation that may be necessary. Familiarizing oneself with these guidelines can help taxpayers avoid common mistakes and ensure that their submissions meet IRS standards. Consulting the IRS website or official publications can provide valuable insights into the requirements for this form.

Examples of Using the Form

Understanding practical examples of how to use the form can enhance clarity. For instance, a self-employed individual may need to report income from various sources, while a retired person might report pension income. Each scenario may involve different amounts and tax considerations, highlighting the importance of accurately reflecting the financial situation on the form. These examples can serve as a guide for taxpayers to ensure they are completing the form correctly based on their unique circumstances.

Quick guide on how to complete for tax years ending on or after december 31 write the amount you are paying

Complete [SKS] effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents promptly without any holdups. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying

Create this form in 5 minutes!

How to create an eSignature for the for tax years ending on or after december 31 write the amount you are paying

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of 'For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying'?

This phrase is crucial for tax reporting as it indicates the specific amounts that need to be reported for tax years ending on or after December 31. Accurately documenting these amounts ensures compliance with tax regulations and helps avoid potential penalties.

-

How does airSlate SignNow help with tax document management?

airSlate SignNow streamlines the process of managing tax documents by allowing users to easily send, sign, and store important files. This efficiency is particularly beneficial for ensuring that all documents related to 'For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying' are organized and accessible.

-

What features does airSlate SignNow offer for eSigning tax documents?

airSlate SignNow provides a user-friendly interface for eSigning tax documents, ensuring that users can quickly and securely sign documents related to 'For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying'. Features include customizable templates, audit trails, and mobile access.

-

Is airSlate SignNow cost-effective for small businesses handling tax documents?

Yes, airSlate SignNow offers competitive pricing plans that cater to small businesses, making it a cost-effective solution for managing tax documents. By using airSlate SignNow, businesses can efficiently handle their tax-related paperwork, including 'For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying'.

-

Can airSlate SignNow integrate with accounting software for tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing users to manage their tax documents and financial records in one place. This integration is particularly useful for ensuring that all amounts related to 'For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying' are accurately reflected in financial reports.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including enhanced security, reduced processing time, and improved compliance. By ensuring that all documents related to 'For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying' are handled efficiently, businesses can focus on their core operations.

-

How secure is airSlate SignNow for handling sensitive tax information?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax information. This ensures that all documents related to 'For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying' are kept confidential and secure from unauthorized access.

Get more for For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying

Find out other For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying

- How Can I Electronic signature Tennessee Sublease Agreement Template

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast