IL 2210 Computation of Penalties for Individuals Illinois Form

What is the IL 2210 Computation Of Penalties For Individuals Illinois

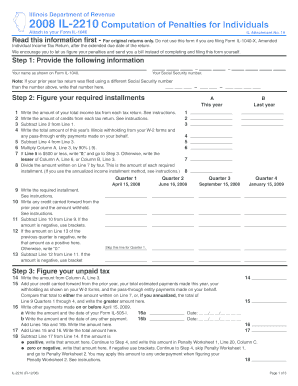

The IL 2210 Computation Of Penalties For Individuals is a form used by taxpayers in Illinois to calculate penalties for underpayment of state income tax. This form is essential for individuals who may not have paid enough tax throughout the year, either through withholding or estimated payments. The penalties are determined based on the amount of tax owed and the duration of the underpayment. Understanding this form helps individuals ensure compliance with state tax regulations and avoid unnecessary penalties.

How to use the IL 2210 Computation Of Penalties For Individuals Illinois

Using the IL 2210 form involves several steps to accurately compute any penalties owed. First, gather your financial records, including total income and tax payments made during the year. Next, determine your total tax liability and compare it to the amount you have already paid. If there is a shortfall, the form provides a structured way to calculate the penalty based on specific guidelines set by the Illinois Department of Revenue. Completing the form accurately ensures that you can address any penalties appropriately.

Steps to complete the IL 2210 Computation Of Penalties For Individuals Illinois

Completing the IL 2210 involves a systematic approach:

- Gather your income documents and tax payment records.

- Calculate your total tax liability for the year.

- Determine the total amount of tax you have paid through withholding and estimated payments.

- Identify any underpayment by subtracting your total payments from your tax liability.

- Follow the instructions on the form to calculate the penalty based on the underpayment amount and the applicable interest rates.

- Review your calculations for accuracy before submission.

Key elements of the IL 2210 Computation Of Penalties For Individuals Illinois

Several key elements are crucial when completing the IL 2210 form:

- Tax Liability: The total amount of tax you owe for the year.

- Payments Made: All payments made towards your tax liability, including withholding and estimated payments.

- Underpayment Amount: The difference between your tax liability and payments made.

- Penalty Calculation: The method used to compute penalties based on the underpayment and time period.

Filing Deadlines / Important Dates

It is important to be aware of key deadlines related to the IL 2210 form. Typically, the form is due on the same date as your state income tax return. For most individuals, this is April 15 of each year. If you are filing for an extension, ensure that you submit the IL 2210 form by the extended deadline to avoid additional penalties. Keeping track of these dates helps in maintaining compliance and avoiding late fees.

Penalties for Non-Compliance

Failure to file the IL 2210 form or pay the required penalties can lead to significant consequences. Non-compliance may result in additional fines, interest on unpaid taxes, and potential legal action by the Illinois Department of Revenue. Understanding the implications of not addressing underpayment penalties is crucial for individuals to manage their tax responsibilities effectively.

Quick guide on how to complete il 2210 computation of penalties for individuals illinois

Complete [SKS] effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IL 2210 Computation Of Penalties For Individuals Illinois

Create this form in 5 minutes!

How to create an eSignature for the il 2210 computation of penalties for individuals illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 2210 Computation Of Penalties For Individuals Illinois?

The IL 2210 Computation Of Penalties For Individuals Illinois is a form used to calculate penalties for underpayment of estimated tax. It helps individuals determine if they owe any penalties and how much they may be. Understanding this computation is crucial for accurate tax filing and avoiding unnecessary penalties.

-

How can airSlate SignNow assist with the IL 2210 Computation Of Penalties For Individuals Illinois?

airSlate SignNow provides a streamlined platform for signing and sending tax documents, including the IL 2210 Computation Of Penalties For Individuals Illinois. Our easy-to-use interface ensures that you can complete and submit your forms quickly, reducing the risk of errors and penalties.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as eSignature, document templates, and secure cloud storage, which are essential for managing tax documents like the IL 2210 Computation Of Penalties For Individuals Illinois. These features enhance efficiency and ensure that your documents are always accessible and compliant.

-

Is airSlate SignNow cost-effective for individuals handling tax documents?

Yes, airSlate SignNow is a cost-effective solution for individuals managing tax documents, including the IL 2210 Computation Of Penalties For Individuals Illinois. Our pricing plans are designed to fit various budgets, making it accessible for anyone needing to eSign and send important documents.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your workflow when dealing with the IL 2210 Computation Of Penalties For Individuals Illinois. This integration allows for easy document sharing and collaboration, streamlining the entire tax filing process.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the IL 2210 Computation Of Penalties For Individuals Illinois, offers numerous benefits such as increased efficiency, reduced paper usage, and enhanced security. Our platform ensures that your documents are signed and stored securely, giving you peace of mind during tax season.

-

How secure is airSlate SignNow for handling sensitive tax information?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax information, including the IL 2210 Computation Of Penalties For Individuals Illinois. You can trust that your documents are safe and secure while using our platform.

Get more for IL 2210 Computation Of Penalties For Individuals Illinois

- Form 7b defence

- Nsw ucpr form 77 notice of change or appointment of solicitor

- Motion for hearing martin county clerk of court form

- Navmc 11654 check in form training command marine corps trngcmd marines

- Copper t iud consent form dhhs 4103 womens health branch www2 columbusco

- Ms1 4 conline booking note form breakbulk

- Trec no 23 14 new home contract incomplete construction trec texas form

- Form 410a instructions

Find out other IL 2210 Computation Of Penalties For Individuals Illinois

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now