Illinois Department of Revenue IL 2220 Computation of Penalties for Businesses Attach to Your Forms IL 1120, IL 1120 ST, IL 1065

Understanding the Illinois Department Of Revenue IL 2220

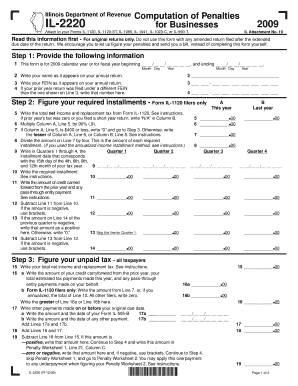

The Illinois Department Of Revenue IL 2220 is a crucial form for businesses that need to compute penalties related to various tax filings. This form is specifically designed to accompany other forms such as IL 1120, IL 1120 ST, IL 1065, IL 1041, IL 1023 C, or IL 990 T. It provides a structured way for businesses to calculate any penalties incurred due to late submissions or other compliance issues. Understanding the details of this form is essential for accurate tax reporting and compliance with state regulations.

Steps to Complete the IL 2220 Form

Completing the IL 2220 form involves several key steps that ensure accurate penalty calculations. First, gather all necessary documentation related to your tax filings, including the forms to which the IL 2220 will be attached. Next, review the specific penalties outlined for late payments or filings as per the Illinois Department of Revenue guidelines. Fill out the form by entering the required information, including the dates of the original filings and any amounts due. Finally, ensure that the completed form is attached to your other tax documents before submission.

Key Elements of the IL 2220 Form

The IL 2220 form includes several important elements that businesses must be aware of. This includes the calculation of penalties based on the number of days a payment is overdue, as well as the total amount due. Additionally, the form requires businesses to provide specific details about their tax filings, such as the type of form being submitted and the corresponding tax year. Understanding these elements is vital for accurate completion and compliance.

Legal Use of the IL 2220 Form

The IL 2220 form serves a legal purpose in the realm of tax compliance for businesses in Illinois. It is essential for documenting any penalties that may arise from non-compliance with tax filing deadlines. By accurately completing and submitting this form, businesses can protect themselves from potential legal repercussions associated with late payments or filings. It is advisable to keep a copy of the submitted form for your records, as it may be needed for future reference or audits.

Filing Deadlines for the IL 2220 Form

Filing deadlines for the IL 2220 form align with the deadlines for the associated tax forms, such as IL 1120 and IL 1065. Businesses must ensure that they submit the IL 2220 along with their primary tax filings to avoid additional penalties. It is important to stay informed about any changes to deadlines announced by the Illinois Department of Revenue, as these can impact your compliance status and potential penalties.

Examples of Using the IL 2220 Form

Using the IL 2220 form can vary depending on the specific circumstances of a business. For instance, a corporation that files its IL 1120 late may need to calculate penalties using the IL 2220 to determine the total amount owed. Similarly, partnerships filing IL 1065 can utilize this form to assess penalties for late submissions. Each scenario will require careful consideration of the filing dates and amounts due to ensure accurate penalty calculations.

Quick guide on how to complete illinois department of revenue il 2220 computation of penalties for businesses attach to your forms il 1120 il 1120 st il 1065

Complete [SKS] seamlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly and without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign [SKS] easily

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using the tools specifically provided by airSlate SignNow.

- Generate your signature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require you to print new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses Attach To Your Forms IL 1120, IL 1120 ST, IL 1065

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue il 2220 computation of penalties for businesses attach to your forms il 1120 il 1120 st il 1065

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue IL 2220 Computation Of Penalties for Businesses?

The Illinois Department Of Revenue IL 2220 Computation Of Penalties for Businesses is a guideline that outlines how penalties are calculated for late or incorrect filings of various tax forms, including IL 1120, IL 1120 ST, IL 1065, IL 1041, IL 1023 C, or IL 990 T. Understanding this computation is crucial for businesses to avoid unnecessary penalties and ensure compliance with state tax regulations.

-

How can airSlate SignNow help with the Illinois Department Of Revenue IL 2220 requirements?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign documents related to the Illinois Department Of Revenue IL 2220 Computation Of Penalties. By streamlining the document management process, businesses can ensure timely submissions of forms IL 1120, IL 1120 ST, IL 1065, IL 1041, IL 1023 C, or IL 990 T, thus minimizing the risk of penalties.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflows that simplify the management of tax documents. These features are particularly beneficial for businesses dealing with the Illinois Department Of Revenue IL 2220 Computation Of Penalties, ensuring that all necessary forms are completed accurately and submitted on time.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. By utilizing our platform, businesses can save on printing and mailing costs while ensuring compliance with the Illinois Department Of Revenue IL 2220 Computation Of Penalties for various tax forms.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing businesses to manage their tax documents efficiently. This integration is particularly useful for those needing to comply with the Illinois Department Of Revenue IL 2220 Computation Of Penalties, as it streamlines the process of preparing and submitting forms IL 1120, IL 1120 ST, IL 1065, IL 1041, IL 1023 C, or IL 990 T.

-

What are the benefits of using airSlate SignNow for tax filings?

Using airSlate SignNow for tax filings offers numerous benefits, including enhanced security, faster processing times, and reduced risk of errors. These advantages are essential for businesses looking to comply with the Illinois Department Of Revenue IL 2220 Computation Of Penalties and ensure timely submission of their tax forms.

-

How does airSlate SignNow ensure document security?

airSlate SignNow prioritizes document security by employing advanced encryption and secure cloud storage. This ensures that all documents related to the Illinois Department Of Revenue IL 2220 Computation Of Penalties are protected, giving businesses peace of mind when submitting forms IL 1120, IL 1120 ST, IL 1065, IL 1041, IL 1023 C, or IL 990 T.

Get more for Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses Attach To Your Forms IL 1120, IL 1120 ST, IL 1065

Find out other Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses Attach To Your Forms IL 1120, IL 1120 ST, IL 1065

- Electronic signature New York Internship Contract Myself

- How Can I Electronic signature New York Internship Contract

- Electronic signature Oklahoma Attendance Contract Online

- Electronic signature Oklahoma Attendance Contract Computer

- Can I Electronic signature New York Internship Contract

- Electronic signature New York Internship Contract Free

- Electronic signature Oklahoma Attendance Contract Mobile

- Electronic signature Oklahoma Attendance Contract Now

- Electronic signature Oklahoma Attendance Contract Later

- Electronic signature Oklahoma Attendance Contract Myself

- Electronic signature New York Internship Contract Secure

- Electronic signature Oklahoma Attendance Contract Free

- Electronic signature Oklahoma Attendance Contract Secure

- Electronic signature Oklahoma Attendance Contract Fast

- Electronic signature New York Internship Contract Fast

- Electronic signature Oklahoma Attendance Contract Simple

- Electronic signature Oklahoma Attendance Contract Easy

- How To Electronic signature Rhode Island Safety Contract

- Electronic signature Oklahoma Attendance Contract Safe

- How Do I Electronic signature Rhode Island Safety Contract