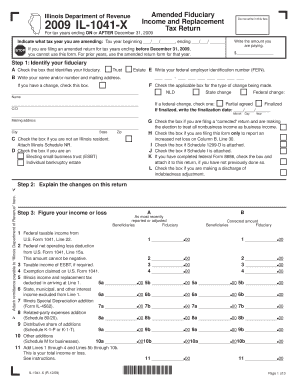

Illinois Department of Revenue IL 1041 X for Tax Years Ending on or AFTER December 31, Amended Fiduciary Income and Replacement Form

Understanding the Illinois Department Of Revenue IL 1041 X

The Illinois Department Of Revenue IL 1041 X is specifically designed for tax years ending on or after December 31. This form serves as an amended fiduciary income and replacement tax return. It is crucial for fiduciaries to accurately report any changes or corrections to previously filed returns. The form helps ensure compliance with state tax regulations, allowing fiduciaries to rectify any discrepancies in their tax filings.

Steps to Complete the IL 1041 X Form

Completing the IL 1041 X involves several key steps to ensure accuracy and compliance:

- Gather all relevant financial documents, including the original IL 1041 and any supporting documentation for the amendments.

- Carefully review the original return to identify the specific areas that require changes.

- Fill out the IL 1041 X form, ensuring that all fields are completed accurately.

- Attach any necessary schedules or documentation that support the changes made.

- Review the completed form for errors before submission.

Obtaining the IL 1041 X Form

The IL 1041 X form can be obtained directly from the Illinois Department of Revenue's official website. It is available for download in PDF format, allowing for easy printing and completion. Additionally, fiduciaries may also request a physical copy from local tax offices if needed.

Legal Use of the IL 1041 X

The legal use of the IL 1041 X is essential for fiduciaries who need to amend their income tax returns. Filing this form correctly ensures compliance with Illinois tax laws and helps avoid potential penalties. It is important for fiduciaries to understand the legal implications of submitting an amended return, including the necessity of accurate reporting and timely submission.

Filing Deadlines for the IL 1041 X

Filing deadlines for the IL 1041 X are critical for fiduciaries to adhere to. Typically, the amended return must be filed within a specific timeframe following the original return's due date. It is advisable to check the Illinois Department of Revenue's guidelines for the exact deadlines relevant to the tax year in question.

Required Documents for Submission

When submitting the IL 1041 X, certain documents are required to support the amendments. These may include:

- The original IL 1041 return.

- Any schedules or attachments that were part of the original filing.

- Documentation that justifies the changes made, such as corrected income statements or receipts.

Penalties for Non-Compliance

Failing to file the IL 1041 X or submitting incorrect information can result in penalties imposed by the Illinois Department of Revenue. These penalties may include fines or interest on unpaid taxes. It is important for fiduciaries to ensure their amended returns are accurate and submitted on time to avoid these consequences.

Quick guide on how to complete illinois department of revenue il 1041 x for tax years ending on or after december 31 amended fiduciary income and replacement

Complete [SKS] effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to produce, modify, and eSign your documents quickly without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to adjust and eSign [SKS] smoothly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using the tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue IL 1041 X For Tax Years Ending ON Or AFTER December 31, Amended Fiduciary Income And Replacement

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue il 1041 x for tax years ending on or after december 31 amended fiduciary income and replacement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue IL 1041 X For Tax Years Ending ON Or AFTER December 31, Amended Fiduciary Income And Replacement Tax Return?

The Illinois Department Of Revenue IL 1041 X For Tax Years Ending ON Or AFTER December 31, Amended Fiduciary Income And Replacement Tax Return is a form used to amend previously filed fiduciary income tax returns in Illinois. This form allows taxpayers to correct errors or make changes to their tax filings for specific tax years. It's essential for ensuring compliance and accuracy in tax reporting.

-

How can airSlate SignNow help with the Illinois Department Of Revenue IL 1041 X?

airSlate SignNow provides a streamlined solution for sending and eSigning the Illinois Department Of Revenue IL 1041 X For Tax Years Ending ON Or AFTER December 31, Amended Fiduciary Income And Replacement Tax Return. Our platform simplifies the document management process, making it easy to prepare, sign, and submit your amended returns efficiently.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective while providing access to essential features for managing documents, including the Illinois Department Of Revenue IL 1041 X For Tax Years Ending ON Or AFTER December 31, Amended Fiduciary Income And Replacement Tax Return. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, document tracking, and integration with popular applications. These features enhance the efficiency of managing documents like the Illinois Department Of Revenue IL 1041 X For Tax Years Ending ON Or AFTER December 31, Amended Fiduciary Income And Replacement Tax Return. Our platform is designed to simplify the entire process.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your sensitive documents, including the Illinois Department Of Revenue IL 1041 X For Tax Years Ending ON Or AFTER December 31, Amended Fiduciary Income And Replacement Tax Return, are protected. We utilize advanced encryption and security protocols to safeguard your information throughout the document management process.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow efficiency. This includes compatibility with accounting and tax software, making it easier to manage forms like the Illinois Department Of Revenue IL 1041 X For Tax Years Ending ON Or AFTER December 31, Amended Fiduciary Income And Replacement Tax Return seamlessly within your existing systems.

-

What are the benefits of using airSlate SignNow for tax returns?

Using airSlate SignNow for tax returns, including the Illinois Department Of Revenue IL 1041 X For Tax Years Ending ON Or AFTER December 31, Amended Fiduciary Income And Replacement Tax Return, offers numerous benefits. These include faster processing times, reduced paperwork, and improved accuracy in submissions. Our platform helps you stay organized and compliant with tax regulations.

Get more for Illinois Department Of Revenue IL 1041 X For Tax Years Ending ON Or AFTER December 31, Amended Fiduciary Income And Replacement

Find out other Illinois Department Of Revenue IL 1041 X For Tax Years Ending ON Or AFTER December 31, Amended Fiduciary Income And Replacement

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter