Illinois Department of Revenue Income Tax Credits Schedule 1299 D Attach to Your Form IL 1120, IL 1041, or IL 990 T

Understanding the Illinois Department Of Revenue Income Tax Credits Schedule 1299 D

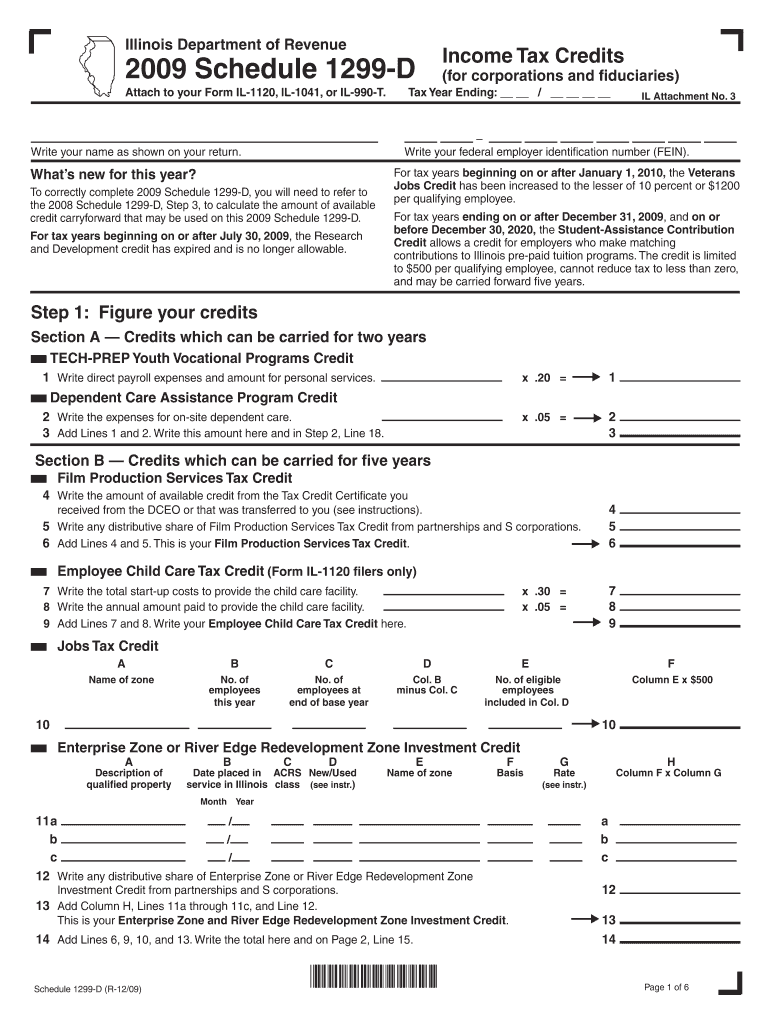

The Illinois Department Of Revenue Income Tax Credits Schedule 1299 D is a crucial form for taxpayers in the state of Illinois. It is specifically designed for individuals and entities filing Form IL-1120, IL-1041, or IL-990 T. This schedule allows taxpayers to claim various income tax credits that can significantly reduce their tax liabilities. Understanding this form is essential for ensuring compliance with state tax regulations and maximizing potential tax savings.

How to Complete the Illinois Department Of Revenue Income Tax Credits Schedule 1299 D

Completing the Schedule 1299 D involves several steps. First, gather all necessary documentation related to the tax credits you intend to claim. This may include receipts, proof of eligibility, and any other relevant information. Next, accurately fill out the schedule, ensuring that all figures are correct and that you have included all applicable credits. After completing the form, it is important to review it for accuracy before attaching it to your primary tax return, whether it be IL-1120, IL-1041, or IL-990 T.

Eligibility Criteria for the Illinois Department Of Revenue Income Tax Credits Schedule 1299 D

To qualify for the credits listed on Schedule 1299 D, taxpayers must meet specific eligibility criteria. These criteria can vary based on the type of credit being claimed. Generally, taxpayers must be residents of Illinois or have a business entity registered in the state. Additionally, certain credits may require proof of investment, job creation, or other economic activities. It is important to review the requirements for each credit to ensure compliance and proper documentation.

Key Elements of the Illinois Department Of Revenue Income Tax Credits Schedule 1299 D

The Schedule 1299 D contains several key elements that taxpayers need to understand. These include the specific tax credits available, the instructions for claiming each credit, and the necessary calculations for determining the amount of credit to claim. Additionally, the schedule provides space for taxpayers to report any carryover credits from previous years, which can further reduce tax liabilities. Familiarity with these elements can help streamline the filing process and ensure accurate submissions.

Filing Deadlines for the Illinois Department Of Revenue Income Tax Credits Schedule 1299 D

Timely filing of the Schedule 1299 D is essential to avoid penalties and ensure that you receive the credits you are entitled to. The deadlines for submitting this form typically align with the deadlines for the associated tax returns, such as IL-1120, IL-1041, or IL-990 T. Taxpayers should be aware of these deadlines and plan accordingly to ensure that all forms are submitted on time. Late submissions may result in the loss of tax credits and potential penalties.

Form Submission Methods for the Illinois Department Of Revenue Income Tax Credits Schedule 1299 D

Taxpayers have several options for submitting the Schedule 1299 D. The form can be filed electronically alongside your primary tax return through approved e-filing services. Alternatively, you may choose to print the completed schedule and submit it by mail. For those who prefer in-person submissions, visiting a local Illinois Department of Revenue office is also an option. Each method has its own advantages, and taxpayers should choose the one that best fits their needs.

Quick guide on how to complete illinois department of revenue income tax credits schedule 1299 d attach to your form il 1120 il 1041 or il 990 t 10998597

Complete [SKS] effortlessly on any device

Managing documents online has gained signNow traction among organizations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Handle [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based task today.

The easiest method to alter and electronically sign [SKS] hassle-free

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight essential sections of the documents or obscure sensitive data with the tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal standing as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about missing or misplaced documents, tedious form searching, or mistakes that necessitate printing fresh document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign [SKS] and ensure excellent communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Income Tax Credits Schedule 1299 D Attach To Your Form IL 1120, IL 1041, Or IL 990 T

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue income tax credits schedule 1299 d attach to your form il 1120 il 1041 or il 990 t 10998597

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Income Tax Credits Schedule 1299 D?

The Illinois Department Of Revenue Income Tax Credits Schedule 1299 D is a form used to claim various income tax credits available to businesses in Illinois. This schedule must be attached to your Form IL 1120, IL 1041, or IL 990 T when filing your taxes. Understanding this form is crucial for maximizing your tax benefits.

-

How do I complete the Schedule 1299 D for my business?

To complete the Schedule 1299 D, you need to gather all relevant financial information and documentation related to the tax credits you are claiming. Ensure that you accurately fill out the form and attach it to your Form IL 1120, IL 1041, or IL 990 T. Utilizing tools like airSlate SignNow can streamline this process by allowing you to eSign and send documents efficiently.

-

What types of tax credits can I claim using Schedule 1299 D?

Schedule 1299 D allows you to claim various tax credits, including those for investment, research and development, and job creation. Each credit has specific eligibility requirements, so it's essential to review these before filing. Properly claiming these credits can signNowly reduce your tax liability.

-

Is there a cost associated with using airSlate SignNow for tax document management?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. These plans provide access to features that simplify the process of managing tax documents, including the Illinois Department Of Revenue Income Tax Credits Schedule 1299 D. Investing in this solution can save you time and enhance your document workflow.

-

Can airSlate SignNow integrate with my existing accounting software?

Absolutely! airSlate SignNow integrates seamlessly with many popular accounting software solutions. This integration allows you to manage your tax documents, including the Illinois Department Of Revenue Income Tax Credits Schedule 1299 D, directly within your existing systems, enhancing efficiency and accuracy.

-

What are the benefits of using airSlate SignNow for tax document signing?

Using airSlate SignNow for tax document signing offers numerous benefits, including ease of use, cost-effectiveness, and enhanced security. You can quickly eSign and send the Illinois Department Of Revenue Income Tax Credits Schedule 1299 D, ensuring timely submission and compliance with tax regulations. This solution helps streamline your workflow and reduces the risk of errors.

-

How can I ensure my Schedule 1299 D is filed correctly?

To ensure your Schedule 1299 D is filed correctly, double-check all entries for accuracy and completeness. Consider using airSlate SignNow to manage your documents, as it provides tools for tracking and verifying your submissions. Additionally, consulting with a tax professional can help clarify any uncertainties regarding the form.

Get more for Illinois Department Of Revenue Income Tax Credits Schedule 1299 D Attach To Your Form IL 1120, IL 1041, Or IL 990 T

- Program resources consignment order form 2015 unitedmethodistwomen

- Vendor bapplicationb gaston county schools form

- Required acceptance tests form

- 309i form

- Contractor registration the city of mandeville form

- Indiana immediate possession form

- Rpa experience requirement bomi canada form

- Certificate of medical necessity omnipod form

Find out other Illinois Department Of Revenue Income Tax Credits Schedule 1299 D Attach To Your Form IL 1120, IL 1041, Or IL 990 T

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple