Illinois Department of Revenue IL 2210 Computation of Penalties for Individuals Attach to Your Form IL 1040 IL Attachment No

Understanding the Illinois Department Of Revenue IL 2210 Computation Of Penalties For Individuals

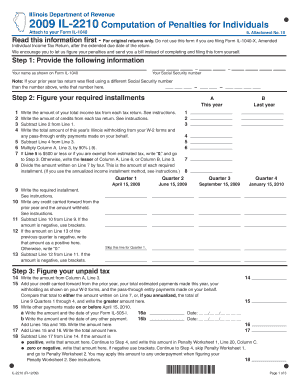

The Illinois Department Of Revenue IL 2210 is a form specifically designed for individuals who may face penalties due to underpayment of their state income tax. This form calculates the penalties owed based on the individual's tax liability and payment history. It is essential for taxpayers to understand this form, as it provides a structured method to determine any penalties incurred and ensures compliance with state tax regulations.

Steps to Complete the Illinois Department Of Revenue IL 2210

Completing the IL 2210 involves several key steps:

- Gather your financial documents, including your Form IL 1040 and any relevant income statements.

- Calculate your total tax liability for the year to determine if you underpaid your taxes.

- Follow the instructions on the IL 2210 to compute any penalties based on your underpayment.

- Attach the completed IL 2210 to your Form IL 1040 when filing your taxes.

Legal Use of the Illinois Department Of Revenue IL 2210

The IL 2210 serves a legal purpose in tax compliance. It is used by the Illinois Department of Revenue to assess penalties for individuals who do not meet their tax obligations. Proper completion and submission of this form can help avoid further legal issues related to tax compliance and ensure that taxpayers fulfill their responsibilities under Illinois tax law.

Key Elements of the Illinois Department Of Revenue IL 2210

Important components of the IL 2210 include:

- Taxpayer identification information, including name and Social Security number.

- Calculation of total tax liability and payments made throughout the year.

- Details on the penalties incurred due to underpayment, including specific calculations.

- Signature and date to validate the submission of the form.

Filing Deadlines for the Illinois Department Of Revenue IL 2210

It is crucial to be aware of the filing deadlines associated with the IL 2210. Typically, this form must be submitted alongside your Form IL 1040 by the state tax deadline, which is usually April fifteenth. If you miss this deadline, you may incur additional penalties or interest on the amount owed.

Examples of Using the Illinois Department Of Revenue IL 2210

Consider a scenario where an individual has a total tax liability of five thousand dollars but only paid three thousand dollars throughout the year. In this case, the IL 2210 would be necessary to calculate the penalties for the two thousand dollars underpaid. This form allows the individual to accurately report and address any penalties owed, ensuring compliance with state tax laws.

Quick guide on how to complete illinois department of revenue il 2210 computation of penalties for individuals attach to your form il 1040 il attachment no

Complete [SKS] seamlessly on any device

Web-based document management has become favored among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow supplies all the tools you need to create, edit, and eSign your documents promptly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important parts of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the anxiety of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue IL 2210 Computation Of Penalties For Individuals Attach To Your Form IL 1040 IL Attachment No

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue il 2210 computation of penalties for individuals attach to your form il 1040 il attachment no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue IL 2210 Computation Of Penalties For Individuals?

The Illinois Department Of Revenue IL 2210 Computation Of Penalties For Individuals is a form used to calculate penalties for individuals who underpay their Illinois state taxes. This form must be attached to your Form IL 1040 IL Attachment No. to ensure compliance with state tax regulations.

-

How can airSlate SignNow help with the Illinois Department Of Revenue IL 2210?

airSlate SignNow provides an efficient platform for electronically signing and sending documents, including the Illinois Department Of Revenue IL 2210 Computation Of Penalties For Individuals. This streamlines the process of submitting your Form IL 1040 IL Attachment No., making it easier to manage your tax obligations.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as eSignature capabilities, document templates, and secure cloud storage. These features are particularly useful for managing tax documents like the Illinois Department Of Revenue IL 2210 Computation Of Penalties For Individuals Attach To Your Form IL 1040 IL Attachment No.

-

Is airSlate SignNow cost-effective for individuals filing taxes?

Yes, airSlate SignNow is designed to be a cost-effective solution for individuals and businesses alike. By simplifying the process of signing and sending documents, including the Illinois Department Of Revenue IL 2210 Computation Of Penalties For Individuals, users can save both time and money.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your workflow. This allows you to easily attach the Illinois Department Of Revenue IL 2210 Computation Of Penalties For Individuals to your Form IL 1040 IL Attachment No. without any hassle.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including increased efficiency, enhanced security, and ease of use. Specifically, it simplifies the process of completing the Illinois Department Of Revenue IL 2210 Computation Of Penalties For Individuals Attach To Your Form IL 1040 IL Attachment No.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents. This ensures that your Illinois Department Of Revenue IL 2210 Computation Of Penalties For Individuals Attach To Your Form IL 1040 IL Attachment No. remains confidential and secure.

Get more for Illinois Department Of Revenue IL 2210 Computation Of Penalties For Individuals Attach To Your Form IL 1040 IL Attachment No

Find out other Illinois Department Of Revenue IL 2210 Computation Of Penalties For Individuals Attach To Your Form IL 1040 IL Attachment No

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now