FY IL 2210 Illinois Department of Revenue Form

What is the FY IL 2210 Illinois Department Of Revenue

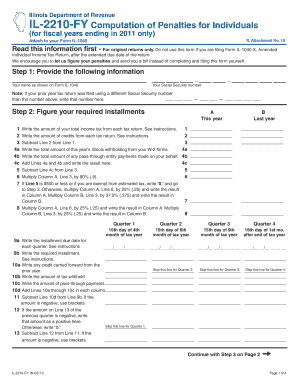

The FY IL 2210 is a form issued by the Illinois Department of Revenue that is used to calculate underpayment penalties for individual income tax. This form is essential for taxpayers who may not have met their estimated tax payment requirements throughout the year. By using this form, individuals can determine if they owe a penalty for underpayment and how much that penalty will be.

How to use the FY IL 2210 Illinois Department Of Revenue

To effectively use the FY IL 2210, taxpayers should first gather their income information and any estimated tax payments made during the year. The form guides users through a series of calculations to determine if their payments were sufficient. It is important to follow the instructions carefully to ensure accurate reporting and avoid potential penalties.

Steps to complete the FY IL 2210 Illinois Department Of Revenue

Completing the FY IL 2210 involves several key steps:

- Gather all relevant financial documents, including income statements and records of estimated tax payments.

- Fill out the personal information section at the top of the form.

- Calculate your total tax liability for the year.

- Determine the total amount of estimated tax payments made.

- Follow the form's instructions to calculate any potential penalties for underpayment.

- Review the completed form for accuracy before submission.

Key elements of the FY IL 2210 Illinois Department Of Revenue

Key elements of the FY IL 2210 include:

- Taxpayer identification information, such as name and Social Security number.

- Calculation of total tax liability.

- Documentation of estimated tax payments made throughout the year.

- Instructions for determining if a penalty applies.

- Signature and date section for verification.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the FY IL 2210. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for individual taxpayers. If you file for an extension, ensure that you also extend the filing of the FY IL 2210 accordingly to avoid penalties.

Penalties for Non-Compliance

Failure to file the FY IL 2210 when required can result in penalties. The Illinois Department of Revenue may impose a penalty based on the amount of underpayment calculated. This can lead to additional financial burdens, making it important for taxpayers to file accurately and on time.

Quick guide on how to complete fy il 2210 illinois department of revenue

Prepare [SKS] effortlessly on any gadget

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can easily access the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any gadget with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The simplest way to modify and eSign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight signNow sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you want to share your form, whether via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Edit and eSign [SKS] and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to FY IL 2210 Illinois Department Of Revenue

Create this form in 5 minutes!

How to create an eSignature for the fy il 2210 illinois department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FY IL 2210 form and why is it important?

The FY IL 2210 form is a document required by the Illinois Department of Revenue for taxpayers who may owe a penalty for underpayment of estimated tax. Understanding this form is crucial for compliance and avoiding penalties. By using airSlate SignNow, you can easily eSign and submit your FY IL 2210 form, ensuring timely and accurate filing.

-

How can airSlate SignNow help with the FY IL 2210 filing process?

airSlate SignNow streamlines the FY IL 2210 filing process by allowing users to electronically sign and send documents securely. This eliminates the need for printing and mailing, saving time and reducing errors. With our platform, you can manage your tax documents efficiently and stay compliant with the Illinois Department of Revenue.

-

What are the pricing options for using airSlate SignNow for FY IL 2210?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including options for individuals and enterprises. Our cost-effective solution ensures that you can manage your FY IL 2210 filings without breaking the bank. Visit our pricing page for detailed information on plans that suit your requirements.

-

Are there any integrations available for airSlate SignNow that assist with FY IL 2210?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your FY IL 2210 filings. These integrations help streamline your workflow, allowing for automatic data transfer and reducing the risk of errors. Check our integrations page to see all compatible applications.

-

What features does airSlate SignNow offer for managing tax documents like FY IL 2210?

airSlate SignNow provides a range of features designed for efficient document management, including templates, reminders, and secure storage. These tools help you keep track of your FY IL 2210 submissions and ensure that you meet all deadlines set by the Illinois Department of Revenue. Our user-friendly interface makes it easy to navigate and utilize these features.

-

Can I access my FY IL 2210 documents from anywhere using airSlate SignNow?

Absolutely! airSlate SignNow is a cloud-based solution, allowing you to access your FY IL 2210 documents from any device with internet connectivity. This flexibility ensures that you can manage your tax filings on the go, making it easier to stay organized and compliant with the Illinois Department of Revenue.

-

Is airSlate SignNow secure for handling sensitive documents like FY IL 2210?

Yes, security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your sensitive documents, including the FY IL 2210 form. You can trust that your information is safe while using our platform to eSign and manage your tax documents.

Get more for FY IL 2210 Illinois Department Of Revenue

Find out other FY IL 2210 Illinois Department Of Revenue

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe