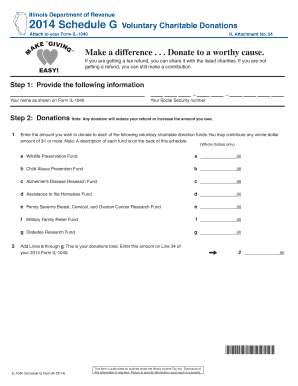

Illinois Department of Revenue Schedule G Voluntary Charitable Donations Attach to Your Form IL 1040 IL Attachment No

Understanding the Illinois Department Of Revenue Schedule G Voluntary Charitable Donations

The Illinois Department Of Revenue Schedule G Voluntary Charitable Donations is a specific form that allows taxpayers to contribute to designated charitable organizations directly through their state income tax return. This form is attached to the Form IL-1040, enabling individuals to specify their voluntary donations to approved charities. By using this form, taxpayers can support various causes while potentially receiving a tax benefit for their contributions.

How to Complete the Schedule G for Charitable Donations

To fill out the Schedule G, start by gathering the necessary information about the charitable organizations you wish to support. Ensure that these organizations are recognized by the state and listed as eligible for contributions. On the form, you will need to provide the name and address of each charity, along with the amount you intend to donate. Carefully follow the instructions provided on the form to ensure accurate reporting of your donations.

Key Elements of the Schedule G Form

Several key elements are crucial when completing the Schedule G. These include:

- Charity Information: Include the name, address, and tax identification number of each charity.

- Donation Amounts: Clearly specify the dollar amount you wish to donate to each organization.

- Signature: Ensure the form is signed and dated to validate your contributions.

Accurate completion of these elements is essential to ensure your donations are processed correctly and can be claimed on your tax return.

Filing Deadlines for the Schedule G

It is important to be aware of the filing deadlines associated with the Schedule G. Typically, this form must be submitted along with your Form IL-1040 by the state income tax filing deadline, which is usually April 15. If you are unable to meet this deadline, consider filing for an extension to avoid penalties.

Eligibility Criteria for Charitable Donations

To qualify for making voluntary charitable donations using Schedule G, you must be a resident of Illinois and file a Form IL-1040. Additionally, the charities you choose to support must be recognized by the Illinois Department of Revenue. It is advisable to verify the eligibility of these organizations to ensure your contributions are valid for tax purposes.

Digital Submission of the Schedule G

Submitting your Schedule G digitally can streamline the process. Many taxpayers choose to e-file their Form IL-1040 along with the Schedule G through approved tax software. This method not only saves time but also reduces the risk of errors that can occur with paper submissions. Ensure that the software you use is compatible with Illinois state forms to facilitate a smooth filing experience.

Quick guide on how to complete illinois department of revenue schedule g voluntary charitable donations attach to your form il 1040 il attachment no

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly and without issues. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to edit and electronically sign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize crucial sections of the documents or obscure sensitive information using tools specially designed by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Verify all details and click the Done button to store your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any preferred device. Modify and electronically sign [SKS] to guarantee outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule G Voluntary Charitable Donations Attach To Your Form IL 1040 IL Attachment No

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule g voluntary charitable donations attach to your form il 1040 il attachment no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule G Voluntary Charitable Donations?

The Illinois Department Of Revenue Schedule G Voluntary Charitable Donations is a form that allows taxpayers to make voluntary contributions to charitable organizations when filing their Form IL 1040. By attaching this schedule, you can support various causes while potentially receiving tax benefits.

-

How do I attach the Illinois Department Of Revenue Schedule G to my Form IL 1040?

To attach the Illinois Department Of Revenue Schedule G Voluntary Charitable Donations to your Form IL 1040, simply complete the schedule and include it with your tax return. Ensure that all required information is filled out accurately to avoid any processing delays.

-

What are the benefits of using the Illinois Department Of Revenue Schedule G?

Using the Illinois Department Of Revenue Schedule G Voluntary Charitable Donations allows you to contribute to charitable organizations while potentially lowering your taxable income. This not only supports your community but also enhances your overall tax strategy.

-

Are there any costs associated with filing the Illinois Department Of Revenue Schedule G?

Filing the Illinois Department Of Revenue Schedule G Voluntary Charitable Donations is typically free if you complete it yourself. However, if you choose to use tax preparation software or hire a professional, there may be associated costs depending on the service you select.

-

Can I use airSlate SignNow to eSign my Illinois Department Of Revenue Schedule G?

Yes, airSlate SignNow provides an easy-to-use platform for eSigning your Illinois Department Of Revenue Schedule G Voluntary Charitable Donations. This ensures that your documents are signed securely and efficiently, streamlining your tax filing process.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as document templates, secure eSigning, and cloud storage, making it easy to manage your Illinois Department Of Revenue Schedule G Voluntary Charitable Donations. These tools help you stay organized and ensure that your tax documents are always accessible.

-

Is airSlate SignNow compatible with other tax software?

Yes, airSlate SignNow integrates seamlessly with various tax software solutions, allowing you to easily manage your Illinois Department Of Revenue Schedule G Voluntary Charitable Donations. This compatibility enhances your workflow and ensures that all your documents are in one place.

Get more for Illinois Department Of Revenue Schedule G Voluntary Charitable Donations Attach To Your Form IL 1040 IL Attachment No

- Legal last will and testament form for single person with adult and minor children vermont

- Legal last will and testament form for single person with adult children vermont

- Legal last will and testament for married person with minor children from prior marriage vermont form

- Vt civil union form

- Legal last will and testament form for married person with adult children from prior marriage vermont

- Legal last will and testament form for divorced person not remarried with adult children vermont

- Vt civil union 497429143 form

- Legal last will and testament form for divorced person not remarried with no children vermont

Find out other Illinois Department Of Revenue Schedule G Voluntary Charitable Donations Attach To Your Form IL 1040 IL Attachment No

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast