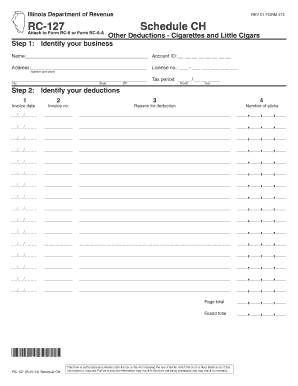

*047301110* Tax Illinois Form

What is the 047301110 Tax Illinois

The 047301110 Tax Illinois form is a specific document used for reporting and paying state taxes in Illinois. This form is essential for individuals and businesses to comply with state tax regulations. It typically includes information about income, deductions, and credits applicable to the taxpayer's situation. Understanding the purpose of this form is crucial for ensuring accurate tax reporting and avoiding potential penalties.

Steps to complete the 047301110 Tax Illinois

Completing the 047301110 Tax Illinois form involves several key steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Fill out personal information, such as name, address, and Social Security number.

- Report all sources of income, including wages, self-employment income, and investment earnings.

- Claim any deductions or credits for which you are eligible, ensuring to follow state guidelines.

- Review the completed form for accuracy before submission.

Required Documents

To complete the 047301110 Tax Illinois form, certain documents are necessary:

- W-2 forms from employers for reported income.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as business expenses or charitable contributions.

- Previous year’s tax return for reference.

Filing Deadlines / Important Dates

Filing the 047301110 Tax Illinois form must adhere to specific deadlines. Typically, the deadline for individual tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to stay informed about any changes in deadlines to avoid late penalties.

Who Issues the Form

The 047301110 Tax Illinois form is issued by the Illinois Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. It provides resources and guidance on how to correctly fill out the form and meet state tax obligations.

Penalties for Non-Compliance

Failing to file the 047301110 Tax Illinois form on time or providing inaccurate information can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. Understanding the consequences of non-compliance is crucial for taxpayers to avoid unnecessary financial burdens.

Quick guide on how to complete 047301110 tax illinois

Effortlessly prepare [SKS] on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without hassle. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The simplest way to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to *047301110* Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the 047301110 tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to *047301110* Tax Illinois?

airSlate SignNow is a digital solution that allows businesses to send and eSign documents efficiently. For those dealing with *047301110* Tax Illinois, it simplifies the process of signing tax documents, ensuring compliance and accuracy in submissions.

-

How can airSlate SignNow help with filing *047301110* Tax Illinois?

Using airSlate SignNow, you can easily prepare and sign your *047301110* Tax Illinois documents online. The platform streamlines the workflow, allowing you to gather signatures quickly and securely, which is essential for timely tax filing.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that can assist with *047301110* Tax Illinois, ensuring you find a cost-effective solution that fits your budget.

-

What features does airSlate SignNow offer for managing *047301110* Tax Illinois documents?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage. These tools are particularly beneficial for managing *047301110* Tax Illinois documents, making the signing process more efficient.

-

Is airSlate SignNow secure for handling sensitive *047301110* Tax Illinois information?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This ensures that your *047301110* Tax Illinois information is protected throughout the signing process.

-

Can I integrate airSlate SignNow with other software for *047301110* Tax Illinois management?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your ability to manage *047301110* Tax Illinois documents seamlessly. This allows for a more streamlined workflow across your business tools.

-

What are the benefits of using airSlate SignNow for *047301110* Tax Illinois?

The primary benefits of using airSlate SignNow for *047301110* Tax Illinois include increased efficiency, reduced paperwork, and improved accuracy. By digitizing the signing process, you can save time and minimize errors in your tax documentation.

Get more for *047301110* Tax Illinois

Find out other *047301110* Tax Illinois

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien