Form 944 X Sp Rev February Adjusted Employers ANNUAL Federal Tax Return or Claim for Refund Spanish Version 2024-2026

What is the Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version

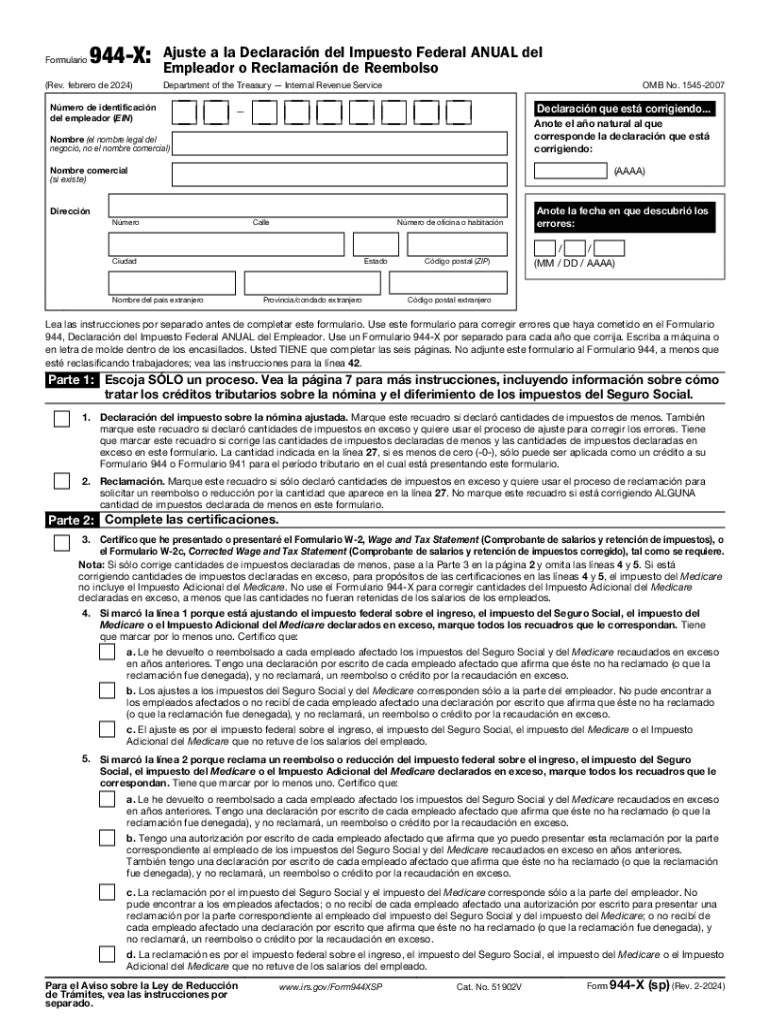

The Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version is a tax form used by employers in the United States to correct errors on their previously filed Form 944. This form allows employers to adjust their annual federal tax return or claim a refund for overpaid taxes. It is specifically designed for Spanish-speaking users, ensuring accessibility and understanding for a broader audience. Employers must accurately report their tax liabilities and any adjustments to avoid penalties and ensure compliance with IRS regulations.

How to use the Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version

Using the Form 944 X sp Rev February involves several steps. First, gather all necessary information related to the original Form 944, including the tax year and the specific errors that need correction. Next, fill out the form by providing accurate details regarding the adjustments. It is important to clearly indicate the changes made, including any corrections to the tax amounts. After completing the form, review it for accuracy before submission. Employers can file the form either electronically or by mail, depending on their preference and IRS guidelines.

Steps to complete the Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version

Completing the Form 944 X sp Rev February requires careful attention to detail. Follow these steps:

- Obtain the correct version of the form from the IRS website or authorized sources.

- Review the original Form 944 to identify the errors that need correction.

- Fill in the form, providing the necessary information, including the employer's name, address, and EIN.

- Clearly specify the adjustments being made, detailing the previous amounts and the corrected figures.

- Sign and date the form to validate the submission.

- Submit the form via the chosen method, ensuring compliance with IRS submission guidelines.

Key elements of the Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version

The key elements of the Form 944 X sp Rev February include the following:

- Employer Identification Number (EIN): Essential for identifying the employer.

- Tax Year: The year for which the corrections are being made.

- Adjustment Details: A clear explanation of the errors and the corrections being requested.

- Signature: Required to validate the form and confirm the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form 944 X sp Rev February are critical for compliance. Generally, employers must submit the form within three years from the date they filed the original Form 944. However, specific deadlines may vary based on the circumstances of the correction. It is advisable to consult IRS guidelines or a tax professional for the most accurate and relevant deadlines applicable to your situation.

Eligibility Criteria

To use the Form 944 X sp Rev February, employers must meet certain eligibility criteria. Primarily, the form is intended for employers who file Form 944, which is designated for those with a lower payroll tax liability. Employers must also have valid reasons for making adjustments, such as correcting underreported wages or overpayments. Ensuring eligibility helps streamline the correction process and avoids complications with the IRS.

Quick guide on how to complete form 944 x sp rev february adjusted employers annual federal tax return or claim for refund spanish version

Complete Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version effortlessly on any device

Web-based document organization has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and safely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without complications. Manage Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version without any hassle

- Obtain Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 944 x sp rev february adjusted employers annual federal tax return or claim for refund spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version?

The Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version is a tax form used by employers to correct errors on their previously filed Form 944. This version is specifically designed for Spanish-speaking users, ensuring accessibility and understanding of tax obligations. It allows employers to claim refunds or make adjustments to their annual federal tax return.

-

How can airSlate SignNow help with the Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version?

airSlate SignNow provides a streamlined platform for electronically signing and sending the Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version. Our solution simplifies the process, making it easy for employers to manage their tax documents efficiently. With our user-friendly interface, you can complete and submit your forms without hassle.

-

Is there a cost associated with using airSlate SignNow for the Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses of all sizes. Our plans are cost-effective, ensuring that you can manage your Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing tax documents like the Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version?

airSlate SignNow offers features such as electronic signatures, document templates, and secure cloud storage, all of which are essential for managing the Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version. These features enhance efficiency and ensure that your documents are handled securely and professionally. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for filing the Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to file the Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version. This seamless integration allows you to streamline your workflow and ensure that all your tax documents are in one place. You can connect with popular platforms to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version?

Using airSlate SignNow for the Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version offers numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform reduces the risk of errors associated with manual processes and ensures that your documents are securely stored and easily accessible. This efficiency allows you to focus on your business rather than paperwork.

-

Is airSlate SignNow user-friendly for those filing the Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate the platform when filing the Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version. Our intuitive interface allows users to quickly learn how to send, sign, and manage their documents. Whether you are tech-savvy or not, you will find our platform accessible and straightforward.

Get more for Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version

- Snhu program modification form

- For use in jamaica by jamaican residents only date dear form

- Aaa hudson valley form

- Exhibition visitor form template

- Audio visual equipment list form

- California form 3502 nonprofit corporation request for pre dissolution tax abatement

- California form 3885 corporation depreciation and amortization

- Shareholding agreement template form

Find out other Form 944 X sp Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form