MI 4797, Michigan Adjustments of Gains and Losses from Sales of Business Property MI 4797, Michigan Adjustments of Gains and Los Form

Understanding the MI 4797, Michigan Adjustments Of Gains And Losses From Sales Of Business Property

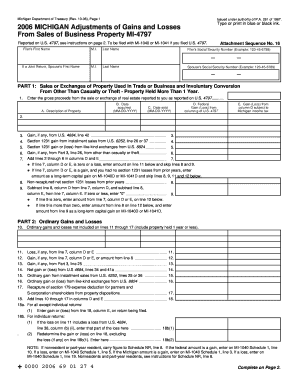

The MI 4797 form is a crucial document for businesses in Michigan that need to report adjustments of gains and losses from the sale of business property. This form helps taxpayers calculate the correct amount of gain or loss that should be reported on their state tax returns. It is essential for ensuring compliance with Michigan tax laws and for accurately reflecting the financial outcomes of property transactions.

How to Use the MI 4797 Form

Using the MI 4797 form involves several steps to ensure accurate reporting. First, gather all relevant financial records related to the sale of business property. This includes purchase prices, sale prices, and any improvements made to the property. Next, fill out the form by entering the necessary details, such as the property description and the calculated gains or losses. Finally, submit the completed form along with your state tax return to the Michigan Department of Treasury.

Key Elements of the MI 4797 Form

Several key elements are included in the MI 4797 form that taxpayers should be aware of. These elements include:

- Property Description: A detailed description of the business property sold.

- Sale Information: The sale price and date of the transaction.

- Cost Basis: The original purchase price and any adjustments made over time.

- Gain or Loss Calculation: The formula used to determine the gain or loss from the sale.

Steps to Complete the MI 4797 Form

Completing the MI 4797 form involves a systematic approach:

- Gather all documentation related to the sale of business property.

- Fill out the property description and sale information sections accurately.

- Calculate the cost basis and determine the gain or loss.

- Review the form for accuracy before submission.

- Submit the form with your state tax return by the appropriate deadline.

Filing Deadlines for the MI 4797 Form

It is important to be aware of the filing deadlines associated with the MI 4797 form. Generally, this form should be submitted along with your annual Michigan tax return. The deadline for filing is typically April 15, unless it falls on a weekend or holiday, in which case the deadline may be extended. Taxpayers should ensure they are aware of any changes to deadlines or extensions that may apply.

Eligibility Criteria for Using the MI 4797 Form

To use the MI 4797 form, taxpayers must meet specific eligibility criteria. This form is intended for individuals or businesses that have sold business property and need to report gains or losses for tax purposes. It is applicable to various business entities, including sole proprietorships, partnerships, and corporations. Ensuring eligibility before filing can help avoid complications during the tax process.

Quick guide on how to complete mi 4797 michigan adjustments of gains and losses from sales of business property mi 4797 michigan adjustments of gains and

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed papers, as you can locate the appropriate template and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and advance any document-based procedure today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it onto your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes requiring the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MI 4797, Michigan Adjustments Of Gains And Losses From Sales Of Business Property MI 4797, Michigan Adjustments Of Gains And Los

Create this form in 5 minutes!

How to create an eSignature for the mi 4797 michigan adjustments of gains and losses from sales of business property mi 4797 michigan adjustments of gains and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MI 4797, Michigan Adjustments Of Gains And Losses From Sales Of Business Property?

The MI 4797, Michigan Adjustments Of Gains And Losses From Sales Of Business Property is a tax form used to report gains and losses from the sale of business property in Michigan. This form helps taxpayers adjust their income for state tax purposes, ensuring compliance with Michigan tax laws.

-

How can airSlate SignNow assist with the MI 4797 form?

airSlate SignNow provides an easy-to-use platform for businesses to send and eSign documents, including the MI 4797, Michigan Adjustments Of Gains And Losses From Sales Of Business Property. Our solution streamlines the process, making it simple to complete and submit your tax forms securely.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can manage documents like the MI 4797, Michigan Adjustments Of Gains And Losses From Sales Of Business Property without breaking the bank.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSigning, document templates, and secure storage. These tools are designed to simplify the management of important documents, including the MI 4797, Michigan Adjustments Of Gains And Losses From Sales Of Business Property, enhancing your workflow efficiency.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers integrations with various software applications, allowing for seamless document management. This means you can easily incorporate the MI 4797, Michigan Adjustments Of Gains And Losses From Sales Of Business Property into your existing systems for a more streamlined process.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like the MI 4797, Michigan Adjustments Of Gains And Losses From Sales Of Business Property provides numerous benefits, including time savings and improved accuracy. Our platform ensures that your documents are completed correctly and submitted on time.

-

Is airSlate SignNow secure for handling sensitive tax information?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your sensitive tax information, including the MI 4797, Michigan Adjustments Of Gains And Losses From Sales Of Business Property, is protected. We utilize advanced encryption and security protocols to safeguard your data.

Get more for MI 4797, Michigan Adjustments Of Gains And Losses From Sales Of Business Property MI 4797, Michigan Adjustments Of Gains And Los

Find out other MI 4797, Michigan Adjustments Of Gains And Losses From Sales Of Business Property MI 4797, Michigan Adjustments Of Gains And Los

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe