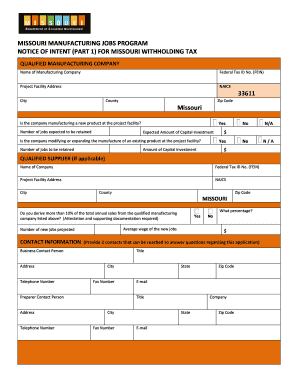

A State Income Tax Credit May Be Provided to a Business Based on Ded Mo Form

What is the A State Income Tax Credit May Be Provided To A Business Based On Ded Mo

The A State Income Tax Credit May Be Provided To A Business Based On Ded Mo is a financial incentive designed to support businesses operating within specific states. This credit allows eligible businesses to reduce their state income tax liability based on certain criteria, which may include the number of employees, the amount of investment in the state, or the industry sector. Understanding the specific provisions of this tax credit can help businesses effectively leverage it to improve their financial standing.

Eligibility Criteria for the A State Income Tax Credit May Be Provided To A Business Based On Ded Mo

To qualify for the A State Income Tax Credit May Be Provided To A Business Based On Ded Mo, businesses must meet specific eligibility requirements. These often include being a registered business entity in the state, having a certain number of employees, and demonstrating a commitment to economic development within the state. Additionally, the business may need to provide documentation that supports its claims for the tax credit, such as payroll records and investment statements.

Steps to Complete the A State Income Tax Credit May Be Provided To A Business Based On Ded Mo

Completing the A State Income Tax Credit May Be Provided To A Business Based On Ded Mo involves several key steps:

- Gather necessary documentation, including financial records and proof of eligibility.

- Complete the required forms accurately, ensuring all information is current and correct.

- Submit the completed forms along with any supporting documentation to the appropriate state tax authority.

- Keep copies of all submitted materials for your records and future reference.

How to Obtain the A State Income Tax Credit May Be Provided To A Business Based On Ded Mo

Obtaining the A State Income Tax Credit May Be Provided To A Business Based On Ded Mo typically involves a straightforward application process. Businesses should start by checking the specific requirements set forth by their state’s tax authority. This may include filling out an application form, providing supporting documents, and possibly attending a meeting or consultation with a tax advisor. Once the application is submitted, businesses should monitor their application status and be prepared to respond to any inquiries from the tax authority.

Required Documents for the A State Income Tax Credit May Be Provided To A Business Based On Ded Mo

When applying for the A State Income Tax Credit May Be Provided To A Business Based On Ded Mo, businesses will need to prepare several key documents, including:

- Proof of business registration in the state.

- Financial statements demonstrating revenue and expenses.

- Payroll records that confirm employee numbers and wages.

- Any additional documentation required by the state tax authority.

State-Specific Rules for the A State Income Tax Credit May Be Provided To A Business Based On Ded Mo

Each state has its own rules and regulations governing the A State Income Tax Credit May Be Provided To A Business Based On Ded Mo. These rules can vary significantly, affecting eligibility, application processes, and the amount of credit available. It is essential for businesses to familiarize themselves with their state’s specific guidelines to ensure compliance and maximize their benefits. Consulting with a tax professional who understands state-specific regulations can also be beneficial.

Quick guide on how to complete a state income tax credit may be provided to a business based on ded mo

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents promptly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Modify and Electronically Sign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign [SKS] and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to A State Income Tax Credit May Be Provided To A Business Based On Ded Mo

Create this form in 5 minutes!

How to create an eSignature for the a state income tax credit may be provided to a business based on ded mo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of a State Income Tax Credit for businesses?

A State Income Tax Credit May Be Provided To A Business Based On Ded Mo, which can signNowly reduce tax liabilities. This credit incentivizes businesses to invest in their operations and workforce, ultimately fostering economic growth. Understanding how these credits work can help businesses maximize their financial benefits.

-

How can airSlate SignNow help businesses qualify for state income tax credits?

By using airSlate SignNow, businesses can streamline their document management processes, ensuring that all necessary paperwork for claiming a State Income Tax Credit May Be Provided To A Business Based On Ded Mo is completed accurately. Our platform simplifies eSigning and document sharing, making it easier to meet compliance requirements. This efficiency can enhance your chances of qualifying for available credits.

-

What features does airSlate SignNow offer that support tax credit applications?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax credit applications. These tools ensure that all documents are properly executed and submitted on time. Utilizing these features can help businesses effectively navigate the process of claiming a State Income Tax Credit May Be Provided To A Business Based On Ded Mo.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. With flexible pricing plans, companies can choose a package that fits their budget while still accessing essential features. This affordability can be particularly beneficial for businesses looking to leverage a State Income Tax Credit May Be Provided To A Business Based On Ded Mo.

-

What integrations does airSlate SignNow offer?

airSlate SignNow integrates seamlessly with various business applications, including CRM systems and cloud storage services. These integrations enhance workflow efficiency and ensure that all documents related to a State Income Tax Credit May Be Provided To A Business Based On Ded Mo are easily accessible. This connectivity allows businesses to manage their operations more effectively.

-

How does airSlate SignNow ensure document security?

Security is a top priority for airSlate SignNow, which employs advanced encryption and compliance measures to protect sensitive documents. This is crucial when dealing with financial documents related to a State Income Tax Credit May Be Provided To A Business Based On Ded Mo. Businesses can trust that their information is secure while using our platform.

-

Can airSlate SignNow assist with remote work?

Absolutely! airSlate SignNow is designed for remote work, allowing teams to collaborate and sign documents from anywhere. This flexibility is particularly useful for businesses looking to claim a State Income Tax Credit May Be Provided To A Business Based On Ded Mo, as it enables timely document submission regardless of location.

Get more for A State Income Tax Credit May Be Provided To A Business Based On Ded Mo

- Peace corps works a cross sectional analysis of 21 host country form

- Package mice cran fhcrc form

- 31 july 2001 memorandum foia foia navy form

- May be available through the community fema form

- A printable version cordell hull birthplace and museum form

- Mid atlantic usatf member club dear prospective member the long ampamp form

- Boumediene et al form

- U s bank application no referencelayout 1 qxd form

Find out other A State Income Tax Credit May Be Provided To A Business Based On Ded Mo

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors