Missouri Schedule MM BROWNFIELD REDEVELOPMENT PROGRAM APPLICATION for CLAIMING BROWNFIELD TAX BENEFITS APPORTIONMENT of MISSOURI Form

Understanding the Missouri Schedule MM Brownfield Redevelopment Program Application

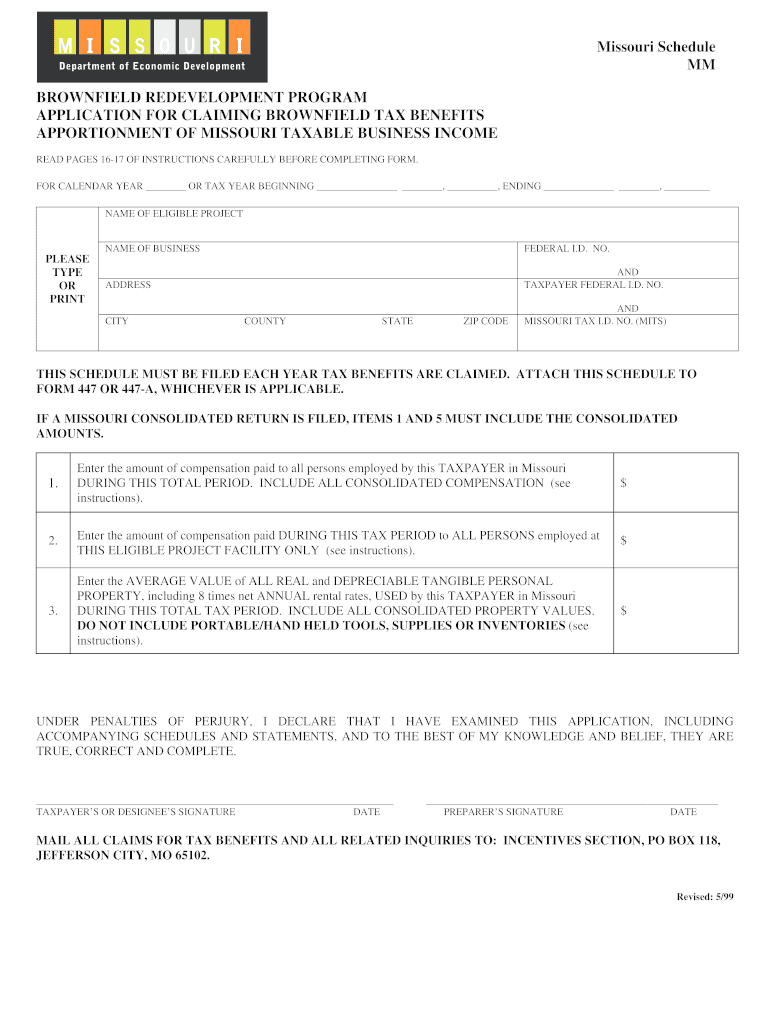

The Missouri Schedule MM Brownfield Redevelopment Program Application is designed for businesses seeking to claim tax benefits related to brownfield redevelopment. This application focuses on the apportionment of Missouri taxable business income. It is essential to read pages sixteen and seventeen of the accompanying instructions carefully to ensure accurate completion of the form.

Steps to Complete the Missouri Schedule MM Application

Completing the Missouri Schedule MM application involves several key steps:

- Gather all necessary documentation, including financial statements and tax records.

- Review the specific eligibility criteria outlined in the instructions.

- Fill out the application form accurately, ensuring all sections are completed.

- Double-check the calculations for apportionment of taxable business income.

- Submit the completed form by the specified deadline to avoid penalties.

Eligibility Criteria for the Brownfield Redevelopment Program

To qualify for the Missouri Brownfield Redevelopment Program, applicants must meet specific eligibility criteria. This includes being a registered business entity in Missouri and engaging in redevelopment activities on designated brownfield sites. Additionally, applicants must demonstrate that the redevelopment will lead to economic benefits, such as job creation or increased tax revenue.

Required Documents for Submission

When submitting the Missouri Schedule MM application, certain documents are required to support the claims made. These documents typically include:

- Proof of business registration in Missouri.

- Financial statements from the previous year.

- Documentation detailing the redevelopment project.

- Any prior tax filings relevant to the brownfield redevelopment.

Form Submission Methods

The Missouri Schedule MM application can be submitted through various methods. Businesses can choose to file the form online, by mail, or in person at designated state offices. Each method has its own guidelines, so it is important to follow the instructions carefully to ensure proper processing of the application.

Potential Penalties for Non-Compliance

Failing to comply with the requirements of the Missouri Schedule MM application can result in penalties. This may include fines or disqualification from receiving tax benefits. It is crucial for applicants to adhere to all guidelines and deadlines to avoid these consequences.

Quick guide on how to complete missouri schedule mm brownfield redevelopment program application for claiming brownfield tax benefits apportionment of

Complete [SKS] effortlessly on any device

Digital document management has gained increased popularity among enterprises and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to alter and eSign [SKS] with ease

- Retrieve [SKS] and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your paperwork.

- Emphasize pertinent sections of the documents or redact sensitive details using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which only takes seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you'd like to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about missing or lost documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Missouri Schedule MM BROWNFIELD REDEVELOPMENT PROGRAM APPLICATION FOR CLAIMING BROWNFIELD TAX BENEFITS APPORTIONMENT OF MISSOURI

Create this form in 5 minutes!

How to create an eSignature for the missouri schedule mm brownfield redevelopment program application for claiming brownfield tax benefits apportionment of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Missouri Schedule MM BROWNFIELD REDEVELOPMENT PROGRAM APPLICATION?

The Missouri Schedule MM BROWNFIELD REDEVELOPMENT PROGRAM APPLICATION is a form used to claim brownfield tax benefits in Missouri. It allows businesses to apportion their taxable income related to brownfield redevelopment projects. It's essential to read pages 16 and 17 of the instructions carefully before completing the form to ensure compliance.

-

How can I benefit from the Missouri Schedule MM BROWNFIELD REDEVELOPMENT PROGRAM?

By utilizing the Missouri Schedule MM BROWNFIELD REDEVELOPMENT PROGRAM APPLICATION, businesses can signNowly reduce their tax liabilities associated with brownfield redevelopment. This program incentivizes the cleanup and redevelopment of contaminated properties, ultimately fostering economic growth. Ensure you follow the instructions on pages 16 and 17 for accurate completion.

-

What are the eligibility requirements for the Missouri Schedule MM application?

To be eligible for the Missouri Schedule MM BROWNFIELD REDEVELOPMENT PROGRAM APPLICATION, businesses must engage in redevelopment activities on designated brownfield sites. Additionally, they must meet specific criteria outlined in the program guidelines. It's crucial to review the instructions on pages 16 and 17 to confirm eligibility.

-

Is there a fee associated with submitting the Missouri Schedule MM application?

There is no direct fee for submitting the Missouri Schedule MM BROWNFIELD REDEVELOPMENT PROGRAM APPLICATION. However, businesses should consider potential costs related to the redevelopment process itself. Always refer to the instructions on pages 16 and 17 for any additional requirements.

-

How does the Missouri Schedule MM affect my business's tax filings?

The Missouri Schedule MM BROWNFIELD REDEVELOPMENT PROGRAM APPLICATION allows businesses to apportion their taxable income, which can lead to signNow tax savings. Properly completing this form can optimize your tax filings and ensure compliance with state regulations. Be sure to read pages 16 and 17 of the instructions for detailed guidance.

-

Can I integrate the Missouri Schedule MM application with other tax software?

Yes, many tax software solutions allow for the integration of the Missouri Schedule MM BROWNFIELD REDEVELOPMENT PROGRAM APPLICATION. This can streamline the process of filing and ensure accuracy in your submissions. Check with your software provider for specific integration capabilities.

-

What documents do I need to complete the Missouri Schedule MM application?

To complete the Missouri Schedule MM BROWNFIELD REDEVELOPMENT PROGRAM APPLICATION, you will need documentation related to your brownfield redevelopment activities, including financial records and project details. It's important to gather all necessary documents before starting the application process. Refer to pages 16 and 17 of the instructions for a comprehensive list.

Get more for Missouri Schedule MM BROWNFIELD REDEVELOPMENT PROGRAM APPLICATION FOR CLAIMING BROWNFIELD TAX BENEFITS APPORTIONMENT OF MISSOURI

Find out other Missouri Schedule MM BROWNFIELD REDEVELOPMENT PROGRAM APPLICATION FOR CLAIMING BROWNFIELD TAX BENEFITS APPORTIONMENT OF MISSOURI

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure