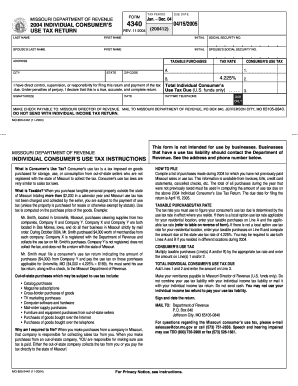

INDIVIDUAL CONSUMER'S USE TAX RETURN Dor Mo Form

What is the INDIVIDUAL CONSUMER'S USE TAX RETURN Dor Mo

The INDIVIDUAL CONSUMER'S USE TAX RETURN Dor Mo is a tax form used by residents of Missouri to report and pay use tax on items purchased for personal use that were not taxed at the time of purchase. This form is essential for ensuring compliance with state tax laws, particularly for individuals who acquire goods from out-of-state vendors or online retailers. Use tax is similar to sales tax and is meant to level the playing field for local businesses by taxing purchases made outside the state.

Steps to complete the INDIVIDUAL CONSUMER'S USE TAX RETURN Dor Mo

Completing the INDIVIDUAL CONSUMER'S USE TAX RETURN involves several key steps. First, gather all relevant information regarding purchases made during the tax period, including dates, descriptions, and amounts. Next, accurately fill out the form by entering your personal information, detailing the purchases, and calculating the total use tax owed. Review the completed form for accuracy before submitting it. Finally, ensure that you keep a copy of the form and any supporting documents for your records.

How to obtain the INDIVIDUAL CONSUMER'S USE TAX RETURN Dor Mo

The INDIVIDUAL CONSUMER'S USE TAX RETURN can be obtained from the Missouri Department of Revenue's website or through local tax offices. The form is typically available in both digital and printable formats, allowing individuals to choose their preferred method for completion. It is advisable to check for the most current version of the form to ensure compliance with any recent changes in tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the INDIVIDUAL CONSUMER'S USE TAX RETURN Dor Mo are generally aligned with the state income tax deadlines. Typically, the form must be submitted by April 15 for the previous tax year. It is important to stay informed about any changes to these deadlines, as late submissions may incur penalties or interest on unpaid taxes.

Required Documents

To complete the INDIVIDUAL CONSUMER'S USE TAX RETURN, individuals should gather several key documents. This includes receipts or invoices for all taxable purchases, proof of payment, and any previous tax returns that may provide relevant information. Having these documents on hand will facilitate accurate reporting and help ensure compliance with state tax laws.

Penalties for Non-Compliance

Failure to file the INDIVIDUAL CONSUMER'S USE TAX RETURN or pay the associated taxes can result in penalties imposed by the state of Missouri. These penalties may include fines, interest on unpaid taxes, and potential legal action. It is crucial for individuals to understand their obligations and ensure timely filing to avoid these consequences.

Eligibility Criteria

Eligibility to file the INDIVIDUAL CONSUMER'S USE TAX RETURN Dor Mo generally applies to all Missouri residents who make purchases subject to use tax. This includes individuals who buy goods from out-of-state vendors or online retailers that do not charge sales tax. Understanding the eligibility criteria helps ensure that individuals fulfill their tax responsibilities accurately.

Quick guide on how to complete individual consumers use tax return dor mo

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign [SKS] Without Any Hassle

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes just seconds and has the same legal standing as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you'd like to send your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your requirements in document management with just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to INDIVIDUAL CONSUMER'S USE TAX RETURN Dor Mo

Create this form in 5 minutes!

How to create an eSignature for the individual consumers use tax return dor mo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the INDIVIDUAL CONSUMER'S USE TAX RETURN Dor Mo?

The INDIVIDUAL CONSUMER'S USE TAX RETURN Dor Mo is a tax form used by individuals in Missouri to report and pay use tax on items purchased for personal use. This form is essential for ensuring compliance with state tax laws and helps individuals accurately report their taxable purchases.

-

How can airSlate SignNow help with the INDIVIDUAL CONSUMER'S USE TAX RETURN Dor Mo?

airSlate SignNow simplifies the process of completing and submitting the INDIVIDUAL CONSUMER'S USE TAX RETURN Dor Mo by allowing users to fill out, sign, and send the form electronically. This streamlines the tax filing process, making it more efficient and less time-consuming.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, electronic signatures, and secure document storage, which are particularly useful for managing the INDIVIDUAL CONSUMER'S USE TAX RETURN Dor Mo. These features ensure that your tax documents are organized and easily accessible when needed.

-

Is there a cost associated with using airSlate SignNow for tax returns?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals filing the INDIVIDUAL CONSUMER'S USE TAX RETURN Dor Mo. The cost is competitive and provides excellent value for the features and convenience offered.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow can be integrated with various accounting and tax preparation software, enhancing your ability to manage the INDIVIDUAL CONSUMER'S USE TAX RETURN Dor Mo. This integration allows for seamless data transfer and improved workflow efficiency.

-

What are the benefits of using airSlate SignNow for my tax returns?

Using airSlate SignNow for your INDIVIDUAL CONSUMER'S USE TAX RETURN Dor Mo offers numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform ensures that your documents are signed and submitted quickly, helping you avoid potential penalties.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive information related to the INDIVIDUAL CONSUMER'S USE TAX RETURN Dor Mo. The platform employs advanced encryption and security measures to protect your data.

Get more for INDIVIDUAL CONSUMER'S USE TAX RETURN Dor Mo

- Csa planning course michael fields agricultural institute michaelfields form

- However you may print copies b and c of this form to provide a written acknowledgment to the donor ngap

- Advances in operations research an open access journal form

- Estimated tax payment 2011 voucher 1 1 important information mass

- Csi veteransamp39 preference form vp 1 employment csi

- Form ste application for sales tax exemption for calendar year 2011 or taxable year beginning and ending 2011 massachusetts

- Motion and declaration for default forms

- Finance report military order of the purple heart purpleheart form

Find out other INDIVIDUAL CONSUMER'S USE TAX RETURN Dor Mo

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself