Int2 Bank Franchise Tax Return Dor Mo Form

What is the Int2 Bank Franchise Tax Return Dor Mo

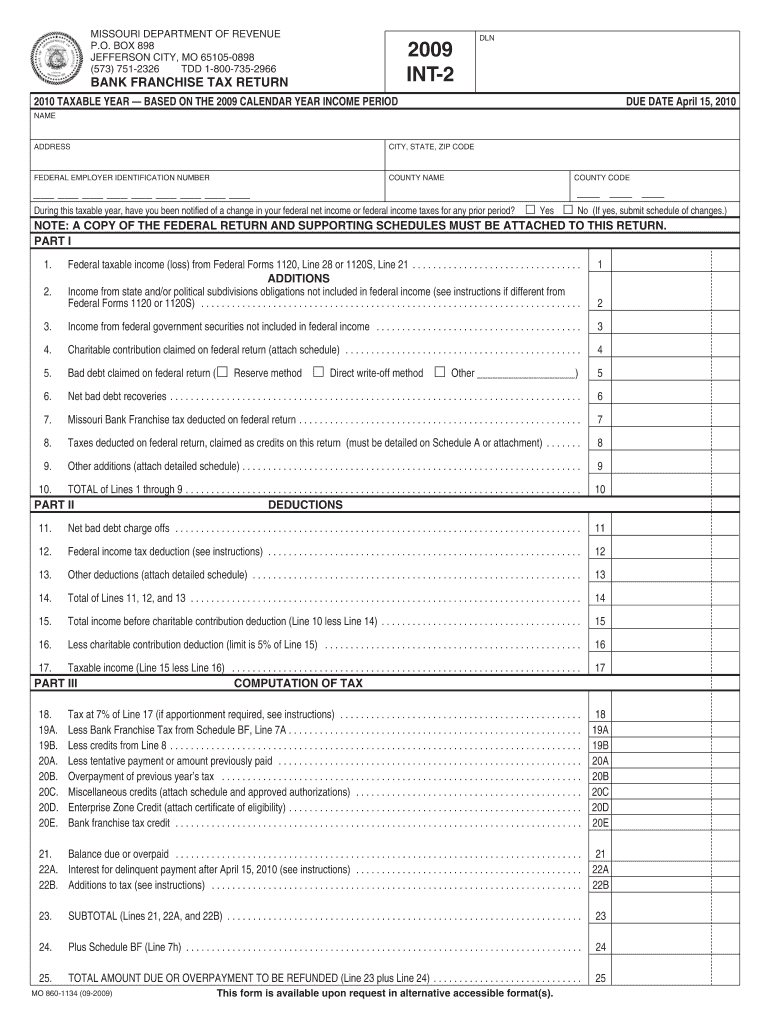

The Int2 Bank Franchise Tax Return Dor Mo is a specific tax form used by financial institutions operating in Missouri. This form is essential for reporting income and calculating franchise taxes owed to the state. It is designed to ensure that banks and other financial entities comply with state tax regulations. The return includes detailed information about the institution's financial performance, including assets, liabilities, and income generated during the tax year.

Steps to complete the Int2 Bank Franchise Tax Return Dor Mo

Completing the Int2 Bank Franchise Tax Return Dor Mo involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Accurately report total assets and liabilities as of the end of the tax year.

- Calculate the franchise tax based on the state's tax rate and the reported financial figures.

- Complete all required sections of the form, ensuring accuracy and compliance with state guidelines.

- Review the form for any errors before submission.

Legal use of the Int2 Bank Franchise Tax Return Dor Mo

The Int2 Bank Franchise Tax Return Dor Mo is legally required for all banks operating in Missouri. Failure to file this return can result in penalties, including fines and interest on unpaid taxes. It is important for financial institutions to understand their legal obligations regarding this form to avoid any compliance issues with the Missouri Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the Int2 Bank Franchise Tax Return Dor Mo typically align with the end of the tax year. Institutions must submit their returns by April fifteenth of the following year. It is crucial for banks to be aware of any changes in deadlines or extensions offered by the state to ensure timely compliance.

Required Documents

To complete the Int2 Bank Franchise Tax Return Dor Mo, several documents are required:

- Financial statements, including balance sheets and income statements.

- Records of all transactions and financial activities for the tax year.

- Documentation supporting any deductions or credits claimed on the return.

Form Submission Methods

The Int2 Bank Franchise Tax Return Dor Mo can be submitted through various methods. Banks may choose to file the form electronically via the Missouri Department of Revenue's online portal, or they can submit a paper version through the mail. Each method has specific guidelines and requirements that must be followed to ensure proper processing of the return.

Quick guide on how to complete int2 bank franchise tax return dor mo

Complete [SKS] effortlessly on any device

Online document organization has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to modify and eSign [SKS] seamlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Int2 Bank Franchise Tax Return Dor Mo

Create this form in 5 minutes!

How to create an eSignature for the int2 bank franchise tax return dor mo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Int2 Bank Franchise Tax Return Dor Mo?

The Int2 Bank Franchise Tax Return Dor Mo is a specific tax form required for businesses operating in Missouri. It helps ensure compliance with state tax regulations. Understanding this form is crucial for accurate tax reporting and avoiding penalties.

-

How can airSlate SignNow assist with the Int2 Bank Franchise Tax Return Dor Mo?

airSlate SignNow simplifies the process of preparing and submitting the Int2 Bank Franchise Tax Return Dor Mo by allowing users to eSign documents securely. Our platform streamlines document management, making it easier to gather necessary signatures and submit forms on time.

-

What are the pricing options for using airSlate SignNow for the Int2 Bank Franchise Tax Return Dor Mo?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling the Int2 Bank Franchise Tax Return Dor Mo. Our cost-effective solutions ensure that you only pay for what you need, making it accessible for businesses of all sizes.

-

What features does airSlate SignNow provide for managing the Int2 Bank Franchise Tax Return Dor Mo?

With airSlate SignNow, you gain access to features like customizable templates, secure eSigning, and document tracking specifically for the Int2 Bank Franchise Tax Return Dor Mo. These tools enhance efficiency and ensure that your tax documents are handled with care.

-

Are there any integrations available with airSlate SignNow for the Int2 Bank Franchise Tax Return Dor Mo?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software to facilitate the preparation of the Int2 Bank Franchise Tax Return Dor Mo. This integration helps streamline your workflow and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for the Int2 Bank Franchise Tax Return Dor Mo?

Using airSlate SignNow for the Int2 Bank Franchise Tax Return Dor Mo offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to manage your tax documents easily, ensuring compliance and timely submissions.

-

Is airSlate SignNow user-friendly for filing the Int2 Bank Franchise Tax Return Dor Mo?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate while preparing the Int2 Bank Franchise Tax Return Dor Mo. Our intuitive interface ensures that you can complete your tasks quickly and efficiently.

Get more for Int2 Bank Franchise Tax Return Dor Mo

Find out other Int2 Bank Franchise Tax Return Dor Mo

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement