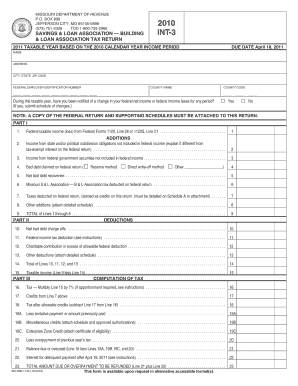

INT 3 Savings & Loan Association Missouri Department of Revenue Dor Mo Form

What is the INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo

The INT 3 Savings & Loan Association form is a document issued by the Missouri Department of Revenue. It is primarily used for reporting and documenting financial transactions related to savings and loan associations operating within Missouri. This form plays a crucial role in ensuring compliance with state regulations and provides necessary information for tax and financial reporting purposes. Understanding the specifics of this form is essential for both individuals and businesses engaged in financial activities within the state.

How to use the INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo

Using the INT 3 Savings & Loan Association form involves several steps to ensure accurate completion and submission. First, gather all relevant financial documents that pertain to your savings and loan transactions. Next, carefully fill out the form, providing all required information such as account details, transaction amounts, and any applicable dates. Once completed, review the form for accuracy before submitting it to the Missouri Department of Revenue through the designated submission method.

Steps to complete the INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo

Completing the INT 3 form requires a systematic approach:

- Gather necessary documentation, including transaction records and financial statements.

- Obtain the latest version of the INT 3 form from the Missouri Department of Revenue.

- Fill out the form with accurate details, ensuring all sections are completed as required.

- Double-check the information for any errors or omissions.

- Submit the form via the appropriate method, whether online, by mail, or in person.

Key elements of the INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo

The INT 3 form includes several key elements that are critical for its proper use. These elements typically encompass:

- Identification information for the savings and loan association.

- Details of financial transactions, including amounts and dates.

- Signature and certification by an authorized representative.

- Any additional information required by the Missouri Department of Revenue.

Eligibility Criteria

To utilize the INT 3 Savings & Loan Association form, individuals or entities must meet specific eligibility criteria. Typically, this includes being a registered savings and loan association within the state of Missouri. Additionally, the form is relevant for those who engage in financial transactions that require reporting to the Missouri Department of Revenue. Understanding these criteria helps ensure compliance and proper form usage.

Form Submission Methods

The INT 3 Savings & Loan Association form can be submitted through various methods, accommodating different preferences and needs. Users may choose to submit the form online via the Missouri Department of Revenue's electronic filing system, or they can opt for traditional methods such as mailing the completed form or delivering it in person to the appropriate office. Each submission method has its own guidelines and timelines, so it is essential to select the one that best fits your situation.

Quick guide on how to complete int 3 savings amp loan association missouri department of revenue dor mo

Effortlessly Prepare INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb environmentally friendly substitute for traditional printed and signed documents, enabling you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to Modify and eSign INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo with Ease

- Locate INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo and guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the int 3 savings amp loan association missouri department of revenue dor mo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo?

The INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo is a financial institution that provides various savings and loan services. It is designed to help customers manage their finances effectively while complying with state regulations. Understanding its offerings can help you make informed financial decisions.

-

How does airSlate SignNow integrate with the INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo?

airSlate SignNow seamlessly integrates with the INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo, allowing users to eSign and send documents directly related to their financial transactions. This integration streamlines the process, making it easier for customers to manage their paperwork efficiently. You can enhance your workflow by utilizing this integration.

-

What are the pricing options for using airSlate SignNow with INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those related to the INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo. You can choose from various subscription tiers that provide access to essential features at competitive rates. This ensures that you only pay for what you need.

-

What features does airSlate SignNow offer for the INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo?

airSlate SignNow provides a range of features tailored for the INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo, including document templates, eSignature capabilities, and secure storage. These features enhance the efficiency of document management and ensure compliance with state regulations. Users can easily create, send, and track documents.

-

What are the benefits of using airSlate SignNow for the INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo?

Using airSlate SignNow for the INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo offers numerous benefits, such as increased efficiency, reduced paperwork, and enhanced security. The platform simplifies the signing process, allowing for faster transactions and improved customer satisfaction. Businesses can save time and resources by adopting this solution.

-

Is airSlate SignNow secure for transactions related to the INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo?

Yes, airSlate SignNow prioritizes security, ensuring that all transactions related to the INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo are protected. The platform employs advanced encryption and compliance with industry standards to safeguard sensitive information. Users can trust that their documents are secure throughout the signing process.

-

Can I customize documents for the INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo using airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize documents specifically for the INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo. You can create templates that meet your unique requirements, ensuring that all necessary information is included. This customization enhances the relevance and effectiveness of your documents.

Get more for INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo

- Basketball hall of fame donation request form

- Contract carriage permit 49817535 form

- Ol 12 dmv form

- Form 888 sample answers 397004972

- Building permit form city of greenville illinois

- 2 any license issued as a result of this applicat form

- Oregon liquor control commission form

- What property tax deduction can you claim for form

Find out other INT 3 Savings & Loan Association Missouri Department Of Revenue Dor Mo

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast