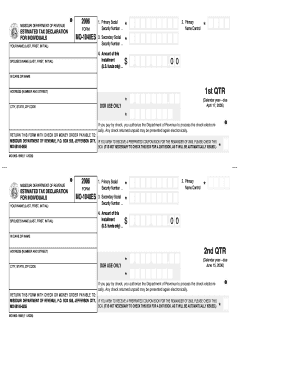

MO 1040ES, Estimated Tax Declaration for Individuals Dor Mo Form

What is the MO 1040ES, Estimated Tax Declaration For Individuals Dor Mo

The MO 1040ES is a form used by individuals in Missouri to report and pay estimated income taxes. This form is essential for taxpayers who expect to owe tax of $500 or more when filing their annual return. The MO 1040ES allows individuals to make quarterly payments to avoid penalties and interest that may arise from underpayment of taxes. It is specifically designed for those who do not have taxes withheld from their income, such as self-employed individuals, freelancers, or those with significant investment income.

How to use the MO 1040ES, Estimated Tax Declaration For Individuals Dor Mo

Using the MO 1040ES involves several key steps. First, taxpayers must determine their expected income for the year and calculate the estimated tax liability. This involves assessing all sources of income, including wages, self-employment earnings, and investment returns. Once the estimated tax amount is calculated, individuals can fill out the MO 1040ES form, providing necessary details such as their name, address, and Social Security number. Payments can be made electronically or by mail, depending on the taxpayer's preference.

Steps to complete the MO 1040ES, Estimated Tax Declaration For Individuals Dor Mo

Completing the MO 1040ES requires careful attention to detail. The steps include:

- Gathering income information for the current year.

- Calculating total expected tax liability using the appropriate tax rates.

- Filling out the MO 1040ES form with personal and financial information.

- Determining the payment schedule, typically quarterly.

- Submitting the form and making the estimated tax payment by the due date.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the MO 1040ES to avoid penalties. Estimated tax payments are typically due on the 15th of April, June, September, and January of the following year. If these dates fall on a weekend or holiday, the due date is extended to the next business day. Taxpayers should mark their calendars to ensure timely submissions and avoid unnecessary fees.

Required Documents

To complete the MO 1040ES, individuals need specific documents, including:

- Previous year’s tax return for reference.

- Records of income from all sources, such as W-2 forms and 1099s.

- Documentation of any deductions or credits that may apply.

- Bank account information if opting for electronic payments.

Penalties for Non-Compliance

Failing to file the MO 1040ES or making insufficient payments can lead to penalties. The Missouri Department of Revenue may impose interest on unpaid taxes and additional penalties for late submissions. It is important for taxpayers to stay compliant with estimated tax requirements to avoid these financial repercussions.

Quick guide on how to complete mo 1040es estimated tax declaration for individuals dor mo

Complete MO 1040ES, Estimated Tax Declaration For Individuals Dor Mo smoothly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Manage MO 1040ES, Estimated Tax Declaration For Individuals Dor Mo on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to modify and eSign MO 1040ES, Estimated Tax Declaration For Individuals Dor Mo effortlessly

- Obtain MO 1040ES, Estimated Tax Declaration For Individuals Dor Mo and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize signNow sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors requiring new document prints. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign MO 1040ES, Estimated Tax Declaration For Individuals Dor Mo and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mo 1040es estimated tax declaration for individuals dor mo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MO 1040ES, Estimated Tax Declaration For Individuals Dor Mo?

The MO 1040ES, Estimated Tax Declaration For Individuals Dor Mo, is a form used by individuals in Missouri to report and pay estimated taxes. It is essential for those who expect to owe tax of $500 or more when filing their annual return. Understanding this form helps ensure compliance with state tax regulations.

-

How can airSlate SignNow assist with the MO 1040ES, Estimated Tax Declaration For Individuals Dor Mo?

airSlate SignNow simplifies the process of completing and submitting the MO 1040ES, Estimated Tax Declaration For Individuals Dor Mo by providing an easy-to-use platform for eSigning and document management. Users can quickly fill out the form, sign it electronically, and send it directly to the appropriate tax authorities, saving time and reducing errors.

-

What are the pricing options for using airSlate SignNow for the MO 1040ES, Estimated Tax Declaration For Individuals Dor Mo?

airSlate SignNow offers various pricing plans to accommodate different needs, starting with a free trial for new users. The subscription plans provide access to advanced features that can streamline the completion of the MO 1040ES, Estimated Tax Declaration For Individuals Dor Mo, making it a cost-effective solution for individuals and businesses alike.

-

Are there any features specifically designed for the MO 1040ES, Estimated Tax Declaration For Individuals Dor Mo?

Yes, airSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage that are particularly beneficial for managing the MO 1040ES, Estimated Tax Declaration For Individuals Dor Mo. These features enhance efficiency and ensure that users can easily track their tax documents.

-

What are the benefits of using airSlate SignNow for tax declarations?

Using airSlate SignNow for tax declarations like the MO 1040ES, Estimated Tax Declaration For Individuals Dor Mo, offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows users to manage their documents from anywhere, ensuring they can meet deadlines without hassle.

-

Can airSlate SignNow integrate with other accounting software for tax purposes?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your financial documents, including the MO 1040ES, Estimated Tax Declaration For Individuals Dor Mo. This integration helps streamline workflows and ensures that all your tax-related documents are in one place.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that all documents, including the MO 1040ES, Estimated Tax Declaration For Individuals Dor Mo, are protected with advanced encryption and secure storage. Users can confidently manage their sensitive tax information without worrying about data bsignNowes.

Get more for MO 1040ES, Estimated Tax Declaration For Individuals Dor Mo

Find out other MO 1040ES, Estimated Tax Declaration For Individuals Dor Mo

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement