MISSOURI DEPARTMENT of REVENUE FORM MO 1040P SPOUSE'S SOCIAL SECURITY NUMBER MISSOURI INDIVIDUAL INCOME TAX RETURN and PROP

Understanding the Missouri Department of Revenue Form MO 1040P

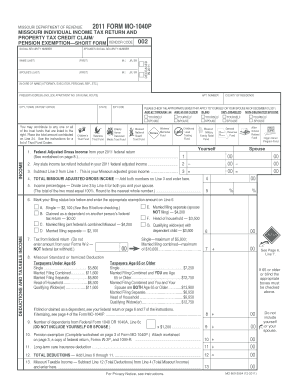

The Missouri Department of Revenue Form MO 1040P is designed for individuals filing their Missouri Individual Income Tax Return while also claiming a property tax credit. This form is particularly relevant for those who are eligible for the pension exemption. It requires specific information, including the taxpayer's and spouse's Social Security numbers, to ensure accurate processing and compliance with state tax regulations.

Steps to Complete the Missouri Department of Revenue Form MO 1040P

Completing the Form MO 1040P involves several key steps:

- Gather necessary documents, including your Social Security number, your spouse's Social Security number, and any relevant financial statements.

- Fill out the personal information section, ensuring accuracy in names and Social Security numbers.

- Provide details regarding your income and any deductions you are claiming.

- Complete the property tax credit section, if applicable, by providing the required information about your property taxes.

- Review the form for completeness and accuracy before submission.

Eligibility Criteria for Using Form MO 1040P

To qualify for using the Missouri Department of Revenue Form MO 1040P, taxpayers must meet specific eligibility requirements. Generally, this form is intended for individuals who are:

- Residents of Missouri.

- Claiming a property tax credit.

- Receiving pension income that may be exempt from state taxes.

Required Documents for Form MO 1040P

When preparing to file Form MO 1040P, it is essential to have the following documents on hand:

- Your Social Security number and your spouse's Social Security number.

- Documentation of income, including W-2s or 1099 forms.

- Records of property taxes paid, which are necessary for claiming the property tax credit.

Submission Methods for Form MO 1040P

Taxpayers can submit Form MO 1040P through various methods, ensuring flexibility and convenience:

- Online submission through the Missouri Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if preferred.

Penalties for Non-Compliance with Form MO 1040P

Failure to comply with the requirements of Form MO 1040P can result in penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on any unpaid taxes.

- Potential audits by the Missouri Department of Revenue.

Quick guide on how to complete missouri department of revenue form mo 1040p spouses social security number missouri individual income tax return and property

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal sustainable substitute for conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, and mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign [SKS] while ensuring outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the missouri department of revenue form mo 1040p spouses social security number missouri individual income tax return and property

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MISSOURI DEPARTMENT OF REVENUE FORM MO 1040P?

The MISSOURI DEPARTMENT OF REVENUE FORM MO 1040P is a tax form used for filing the Missouri Individual Income Tax Return and Property Tax Credit Claim. It includes essential information such as the spouse's Social Security number and is designed to help taxpayers claim pension exemptions. Understanding this form is crucial for accurate tax filing in Missouri.

-

How do I fill out the MISSOURI DEPARTMENT OF REVENUE FORM MO 1040P?

Filling out the MISSOURI DEPARTMENT OF REVENUE FORM MO 1040P involves providing personal information, including the spouse's Social Security number and income details. It's important to follow the instructions carefully to ensure all necessary sections are completed. Utilizing tools like airSlate SignNow can simplify this process by allowing you to eSign and manage documents efficiently.

-

What are the benefits of using airSlate SignNow for the MISSOURI DEPARTMENT OF REVENUE FORM MO 1040P?

Using airSlate SignNow for the MISSOURI DEPARTMENT OF REVENUE FORM MO 1040P streamlines the document signing process, making it faster and more efficient. You can easily send, receive, and eSign documents securely, ensuring compliance with tax regulations. This cost-effective solution enhances productivity and reduces the hassle of paper-based processes.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and reflects the value of features such as unlimited document signing and secure storage. Investing in airSlate SignNow can save you time and resources when managing the MISSOURI DEPARTMENT OF REVENUE FORM MO 1040P and other tax documents.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software and business applications. This integration allows you to manage the MISSOURI DEPARTMENT OF REVENUE FORM MO 1040P alongside your existing tools, enhancing workflow efficiency and ensuring all necessary information is readily available.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for document management, including eSigning, document templates, and secure cloud storage. These features are particularly useful for handling the MISSOURI DEPARTMENT OF REVENUE FORM MO 1040P, as they simplify the process of collecting signatures and organizing tax documents. The platform is designed to enhance user experience and ensure compliance.

-

How secure is airSlate SignNow for handling sensitive tax information?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and security protocols to protect sensitive information, including the MISSOURI DEPARTMENT OF REVENUE FORM MO 1040P and associated Social Security numbers. Users can trust that their data is safe while using airSlate SignNow for their tax-related documents.

Get more for MISSOURI DEPARTMENT OF REVENUE FORM MO 1040P SPOUSE'S SOCIAL SECURITY NUMBER MISSOURI INDIVIDUAL INCOME TAX RETURN AND PROP

Find out other MISSOURI DEPARTMENT OF REVENUE FORM MO 1040P SPOUSE'S SOCIAL SECURITY NUMBER MISSOURI INDIVIDUAL INCOME TAX RETURN AND PROP

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document