Cert 115 2005-2026

What is the Cert 115

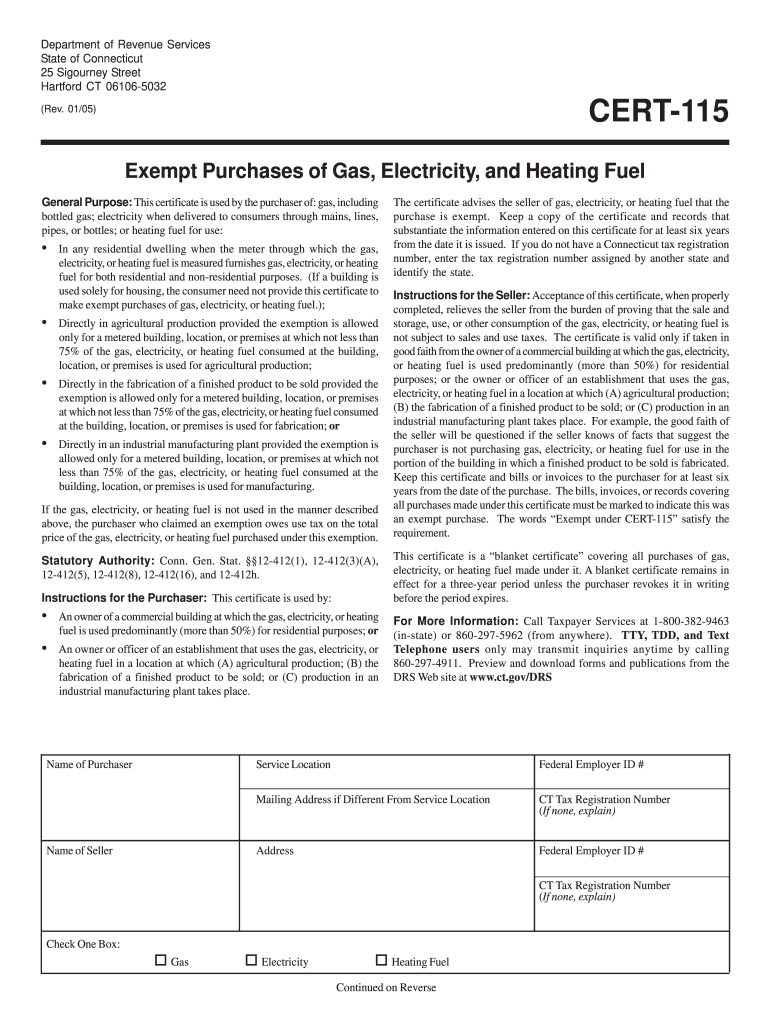

The Cert 115, also known as the Connecticut Sales and Use Tax Exemption Certificate, is a critical document used by businesses and individuals in Connecticut to claim exemption from sales tax on qualifying purchases. This form is particularly relevant for entities that purchase goods or services that are exempt from sales tax under state law. The Cert 115 allows eligible purchasers to avoid paying sales tax at the point of sale, facilitating smoother transactions and compliance with tax regulations.

How to use the Cert 115

To effectively use the Cert 115, purchasers must complete the form accurately, providing necessary details such as the buyer's name, address, and the nature of the exemption. After filling out the form, it should be presented to the seller at the time of purchase. It is essential for sellers to retain a copy of the completed Cert 115 for their records, as this serves as proof of the tax-exempt status of the transaction. The form can be used for various purchases, including equipment, supplies, and other goods that qualify for exemption.

Steps to complete the Cert 115

Completing the Cert 115 involves several straightforward steps:

- Download the Cert 115 form from a reliable source or obtain a physical copy.

- Fill in your name and address in the designated fields.

- Specify the type of exemption you are claiming and the reason for the exemption.

- Sign and date the form to certify its accuracy.

- Present the completed form to the seller when making a purchase.

Legal use of the Cert 115

The Cert 115 is legally binding when completed and signed by the purchaser. It is crucial that the form is used in accordance with Connecticut tax laws to avoid potential legal issues. Misuse of the form, such as claiming exemptions for ineligible purchases, can result in penalties or fines. Therefore, it is advisable for users to familiarize themselves with the specific exemptions allowed under state law before utilizing the Cert 115.

Eligibility Criteria

To be eligible to use the Cert 115, purchasers must meet certain criteria established by Connecticut tax regulations. Generally, the following entities can qualify for exemption:

- Non-profit organizations

- Government agencies

- Businesses purchasing goods for resale

- Entities engaged in manufacturing or certain types of production

It is important for users to confirm their eligibility and the specific exemptions applicable to their situation before submitting the form.

IRS Guidelines

The IRS provides guidelines concerning the use of exemption certificates like the Cert 115, particularly in relation to sales tax. While the Cert 115 is a state-specific form, understanding IRS regulations can help ensure compliance with federal tax laws. Users should be aware that the IRS may require documentation to support claims of tax-exempt purchases, and maintaining accurate records is essential for audit purposes.

Quick guide on how to complete cert 115 form

Your assistance manual on how to prepare your Cert 115

If you’re curious about how to generate and submit your Cert 115, here are some brief instructions on making tax processing easier.

To begin, all you need is to set up your airSlate SignNow profile to transform how you manage documents online. airSlate SignNow is an extremely intuitive and powerful document solution that enables you to modify, create, and finalize your tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and revert to modify responses as necessary. Streamline your tax management with advanced PDF editing, eSigning, and straightforward sharing.

Follow the steps below to complete your Cert 115 in just a few minutes:

- Establish your account and start handling PDFs in no time.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Get form to access your Cert 115 in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Review your document and rectify any mistakes.

- Save updates, print your version, send it to your recipient, and download it to your device.

Use this manual to submit your taxes electronically with airSlate SignNow. Please keep in mind that filing on paper can lead to increased return mistakes and delayed refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cert 115 form

How to make an electronic signature for the Cert 115 Form in the online mode

How to generate an electronic signature for your Cert 115 Form in Google Chrome

How to generate an electronic signature for putting it on the Cert 115 Form in Gmail

How to create an eSignature for the Cert 115 Form right from your mobile device

How to make an electronic signature for the Cert 115 Form on iOS devices

How to generate an electronic signature for the Cert 115 Form on Android devices

People also ask

-

What is Cert 115 in the context of airSlate SignNow?

Cert 115 refers to the standard compliance certification that airSlate SignNow meets to ensure secure and reliable electronic signature solutions. By utilizing Cert 115, businesses can trust that their document signing processes are compliant with industry regulations, enhancing security and credibility.

-

How does airSlate SignNow support the Cert 115 certification?

airSlate SignNow actively maintains its Cert 115 certification by adhering to strict security protocols and regular audits. This commitment ensures that all electronic signatures and document transactions are handled with the utmost security, allowing businesses to operate confidently.

-

What are the pricing options for airSlate SignNow with Cert 115 compliance?

airSlate SignNow offers competitive pricing plans that accommodate various business sizes and needs, all while ensuring compliance with Cert 115 standards. Whether you are a small startup or a large enterprise, you can find a plan that fits your budget while benefiting from secure eSigning capabilities.

-

What features does airSlate SignNow provide under Cert 115 compliance?

With Cert 115 compliance, airSlate SignNow provides features such as advanced security measures, audit trails, and customizable workflows. These features not only enhance the signing experience but also ensure that all documents are handled in compliance with regulatory standards.

-

How can businesses benefit from using airSlate SignNow's Cert 115 compliant solution?

Businesses can benefit from using airSlate SignNow's Cert 115 compliant solution by ensuring that their electronic signatures are legally binding and secure. This not only streamlines the signing process but also builds trust with clients and partners, knowing that their data is protected.

-

Does airSlate SignNow integrate with other tools while maintaining Cert 115 compliance?

Yes, airSlate SignNow seamlessly integrates with various third-party applications such as CRM systems and cloud storage solutions while maintaining Cert 115 compliance. This allows businesses to enhance their workflows without compromising on security and compliance standards.

-

What industries can benefit from airSlate SignNow's Cert 115 compliant services?

Various industries, including healthcare, finance, and real estate, can benefit from airSlate SignNow's Cert 115 compliant services. These sectors often deal with sensitive information and require secure, compliant solutions for electronic signatures and document management.

Get more for Cert 115

- Bulletin for post level 1 2018 form

- Studying pedigrees form

- Leslie mccleary lcsw psychotherapist fertile ground integrated form

- Home depot salinas form

- Schedule of real estate owned spreadsheet form

- Consent to treat columbia rheumatology columbiarheumatology form

- Od 922 761 tickets label templates ioofnj form

- The evil swirling darkness quiz bscholasticb form

Find out other Cert 115

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement