Form 40 Corporation Income Tax Return State of North Dakota Nd

What is the Form 40 Corporation Income Tax Return State Of North Dakota Nd

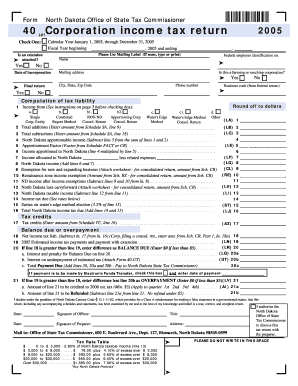

The Form 40 Corporation Income Tax Return is a crucial document for corporations operating in North Dakota. This form is used to report the income, deductions, and tax liability of corporations doing business in the state. It is essential for ensuring compliance with North Dakota tax laws and regulations. Corporations must accurately complete this form to determine their tax obligations and avoid penalties.

How to use the Form 40 Corporation Income Tax Return State Of North Dakota Nd

Using the Form 40 involves several steps to ensure accurate reporting of financial information. Corporations should first gather all necessary financial documents, including income statements and expense records. Next, fill out the form by providing details such as total income, deductions, and credits. It is important to follow the instructions carefully to ensure all required information is included. Once completed, the form must be submitted to the appropriate state tax authority.

Steps to complete the Form 40 Corporation Income Tax Return State Of North Dakota Nd

Completing the Form 40 requires a systematic approach. Here are the steps to follow:

- Gather financial records, including income statements and balance sheets.

- Fill out the corporation's identifying information at the top of the form.

- Report total income and allowable deductions in the designated sections.

- Calculate the taxable income and determine the tax owed.

- Review the form for accuracy and completeness.

- Submit the completed form by the filing deadline.

Key elements of the Form 40 Corporation Income Tax Return State Of North Dakota Nd

The Form 40 includes several key elements that are vital for accurate tax reporting. These elements consist of:

- Identification section for the corporation, including name and address.

- Income reporting section detailing total revenue and other income sources.

- Deductions section where corporations can list allowable expenses.

- Tax calculation section that determines the total tax liability based on taxable income.

- Signature section for an authorized representative to certify the accuracy of the information.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the Form 40. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. It is crucial for corporations to mark their calendars and ensure timely submission to avoid late fees and penalties. Extensions may be available, but they must be requested in advance.

Form Submission Methods (Online / Mail / In-Person)

The Form 40 can be submitted through various methods. Corporations have the option to file electronically through the North Dakota Department of Revenue's online portal. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each submission method has its own guidelines, so corporations should choose the one that best fits their needs and ensure compliance with all requirements.

Quick guide on how to complete form 40 corporation income tax return state of north dakota nd

Effortlessly Complete [SKS] on Any Device

Digital document management has gained traction among businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] across any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign [SKS] Easily

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and press the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] and guarantee smooth communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 40 corporation income tax return state of north dakota nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 40 Corporation Income Tax Return State Of North Dakota Nd?

The Form 40 Corporation Income Tax Return State Of North Dakota Nd is a tax form that corporations must file to report their income, deductions, and tax liability to the state of North Dakota. This form is essential for compliance with state tax laws and helps ensure that corporations pay the correct amount of taxes based on their earnings.

-

How can airSlate SignNow help with the Form 40 Corporation Income Tax Return State Of North Dakota Nd?

airSlate SignNow provides an efficient platform for businesses to prepare, sign, and submit the Form 40 Corporation Income Tax Return State Of North Dakota Nd. With its user-friendly interface, you can easily manage your tax documents and ensure that they are filed accurately and on time.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and larger corporations. Each plan provides access to features that streamline the process of completing the Form 40 Corporation Income Tax Return State Of North Dakota Nd, making it a cost-effective solution for tax management.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as eSignature capabilities, document templates, and secure cloud storage, which are all beneficial for managing the Form 40 Corporation Income Tax Return State Of North Dakota Nd. These features help simplify the filing process and ensure that your documents are organized and easily accessible.

-

Is airSlate SignNow compliant with North Dakota tax regulations?

Yes, airSlate SignNow is designed to comply with North Dakota tax regulations, including those related to the Form 40 Corporation Income Tax Return State Of North Dakota Nd. This compliance ensures that your tax documents meet state requirements, reducing the risk of errors and penalties.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers integrations with various accounting and financial software, making it easier to manage your Form 40 Corporation Income Tax Return State Of North Dakota Nd alongside your other financial documents. This integration streamlines your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for tax filing, including the Form 40 Corporation Income Tax Return State Of North Dakota Nd, offers numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and document sharing, making the tax filing process smoother and more reliable.

Get more for Form 40 Corporation Income Tax Return State Of North Dakota Nd

- Instructions for completing form dea 252

- Carnival cruise line is committed to offering a quality cruise experience to all guests form

- Common supplier registration form

- Relevant identified uses of the substance or mixture form

- Gold card purchase amp renewal application 2018 form

- Information collection consent form dfpcomau

- Please read this appplication completely before proceeding scouting form

- Save this file to your computer and reopen it with adobe acrobat reader to fill out the application correctly form

Find out other Form 40 Corporation Income Tax Return State Of North Dakota Nd

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile