Estate Tax Forms Nd

Understanding Estate Tax Forms in North Dakota

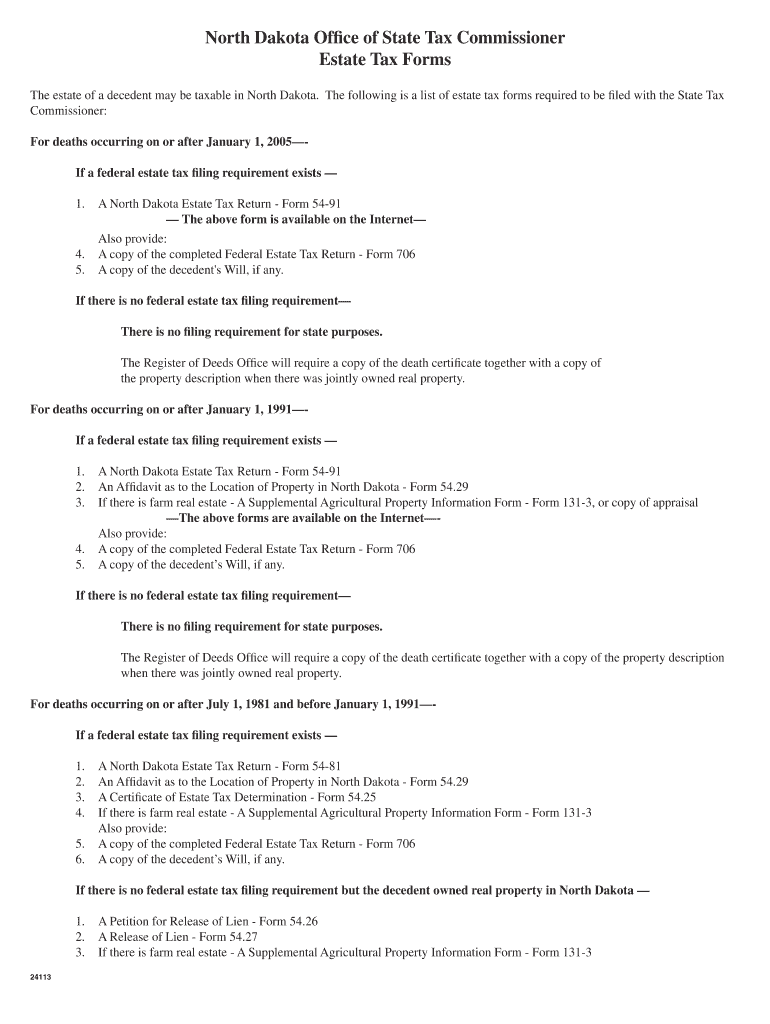

Estate tax forms in North Dakota are essential documents used to report the value of an estate for tax purposes after an individual's death. These forms help determine the estate tax liability, which is based on the total value of the deceased's assets. In North Dakota, the estate tax applies to estates exceeding a certain threshold, and understanding these forms is crucial for executors and beneficiaries alike.

How to Use Estate Tax Forms in North Dakota

Using estate tax forms involves several steps, starting with gathering all necessary financial information about the deceased's assets. This includes real estate, bank accounts, investments, and personal property. Once the information is compiled, the appropriate estate tax form must be filled out accurately, reflecting the total value of the estate. It is advisable to consult with a tax professional to ensure compliance with state regulations and to avoid potential errors that could lead to penalties.

Steps to Complete Estate Tax Forms in North Dakota

Completing estate tax forms requires a systematic approach:

- Collect all relevant financial documents, including wills, property deeds, and bank statements.

- Determine the total value of the estate by appraising assets and liabilities.

- Fill out the estate tax form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline, either online or via mail.

Legal Use of Estate Tax Forms in North Dakota

Estate tax forms serve a legal purpose, as they are required by the state to assess the estate's tax obligations. Executors are legally responsible for filing these forms on behalf of the estate. Failure to file or inaccuracies in the forms can result in legal consequences, including fines or penalties. It is important to ensure that all information is disclosed truthfully and completely to comply with state laws.

Required Documents for Estate Tax Forms in North Dakota

When preparing to complete estate tax forms, several documents are required:

- The deceased's will, if available.

- Death certificate to verify the date of death.

- Asset documentation, such as property deeds and bank statements.

- Liability documentation, including outstanding debts and obligations.

- Any prior tax returns that may be relevant to the estate.

Filing Deadlines for Estate Tax Forms in North Dakota

Filing deadlines for estate tax forms in North Dakota are crucial to avoid penalties. Typically, the estate tax return must be filed within nine months of the date of death. Executors should be aware of this timeline and plan accordingly to ensure all forms are submitted on time. Extensions may be available in certain circumstances, but they must be requested properly.

Quick guide on how to complete estate tax forms nd

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents promptly without any delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The easiest way to modify and eSign [SKS] with minimal effort

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Craft your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information carefully and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Estate Tax Forms Nd

Create this form in 5 minutes!

How to create an eSignature for the estate tax forms nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Estate Tax Forms Nd and why are they important?

Estate Tax Forms Nd are essential documents required for reporting estate taxes in North Dakota. They help ensure compliance with state tax laws and facilitate the proper distribution of an estate's assets. Understanding these forms is crucial for executors and beneficiaries to avoid penalties and ensure a smooth estate settlement.

-

How can airSlate SignNow help with Estate Tax Forms Nd?

airSlate SignNow provides a user-friendly platform for electronically signing and sending Estate Tax Forms Nd. Our solution simplifies the process, allowing users to complete and submit these forms quickly and securely. With airSlate SignNow, you can manage your estate documents efficiently, ensuring compliance and peace of mind.

-

What features does airSlate SignNow offer for managing Estate Tax Forms Nd?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for Estate Tax Forms Nd. These tools streamline the process, making it easier to fill out, sign, and send your forms. Additionally, our platform ensures that all documents are stored securely and are easily accessible.

-

Is airSlate SignNow cost-effective for handling Estate Tax Forms Nd?

Yes, airSlate SignNow is a cost-effective solution for managing Estate Tax Forms Nd. Our pricing plans are designed to accommodate various business needs, ensuring that you get the best value for your investment. By reducing the time and resources spent on paperwork, you can save money while ensuring compliance.

-

Can I integrate airSlate SignNow with other software for Estate Tax Forms Nd?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, making it easy to manage Estate Tax Forms Nd alongside your existing tools. Whether you use accounting software or document management systems, our platform can enhance your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for Estate Tax Forms Nd?

Using airSlate SignNow for Estate Tax Forms Nd provides numerous benefits, including increased efficiency, enhanced security, and improved compliance. Our platform allows you to complete and sign forms quickly, reducing the risk of errors. Additionally, the secure storage of documents ensures that your sensitive information is protected.

-

How does airSlate SignNow ensure the security of Estate Tax Forms Nd?

airSlate SignNow prioritizes the security of your Estate Tax Forms Nd by employing advanced encryption and secure access protocols. Our platform complies with industry standards to protect your data from unauthorized access. You can trust that your sensitive estate documents are safe and secure with us.

Get more for Estate Tax Forms Nd

Find out other Estate Tax Forms Nd

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later