Form 38 ES Estimated Income Tax Estates and Trusts Form 38 ES Estimated Income Tax Estates and Trusts

Understanding the Form 38 ES Estimated Income Tax for Estates and Trusts

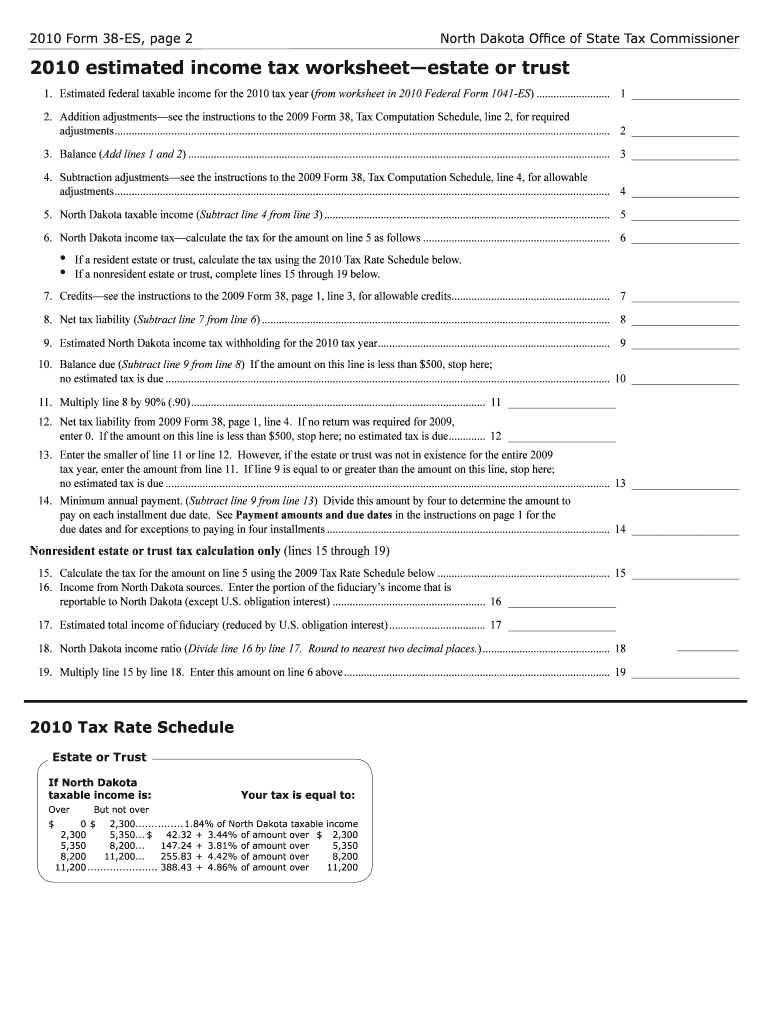

The Form 38 ES is designed specifically for estates and trusts to estimate their income tax liabilities. This form allows fiduciaries to calculate the estimated tax payments required for the current tax year. It's crucial for ensuring compliance with federal tax obligations and helps in managing cash flow for the estate or trust. By submitting this form, fiduciaries can avoid penalties associated with underpayment of taxes.

Steps to Complete the Form 38 ES

Completing the Form 38 ES involves several key steps:

- Gather all necessary financial documents related to the estate or trust.

- Calculate the expected income for the year, including interest, dividends, and any other income sources.

- Determine the applicable tax rate based on the current tax laws.

- Fill out the form accurately, ensuring all calculations are correct.

- Review the form for completeness before submission.

How to Obtain the Form 38 ES

The Form 38 ES can be obtained through the official state tax authority's website or by contacting their office directly. It is also available at various tax preparation offices. Ensuring you have the most current version of the form is essential, as tax laws and forms may change annually.

Key Elements of the Form 38 ES

Important components of the Form 38 ES include:

- Identification of the estate or trust, including name and tax identification number.

- Estimated income calculations for the current tax year.

- Applicable deductions and credits that may reduce the tax liability.

- Payment schedules for estimated tax payments.

Filing Deadlines for the Form 38 ES

Filing deadlines for the Form 38 ES are typically aligned with federal tax deadlines. Estates and trusts must submit their estimated tax payments by the 15th day of the fourth, sixth, ninth, and twelfth months of the tax year. It is vital to adhere to these deadlines to avoid penalties and interest on late payments.

Legal Use of the Form 38 ES

The Form 38 ES is legally required for estates and trusts that anticipate owing tax. Proper use of this form ensures compliance with tax regulations and helps in avoiding unnecessary legal complications. Fiduciaries are responsible for understanding the legal obligations associated with the form and ensuring accurate submissions.

Quick guide on how to complete form 38 es estimated income tax estates and trusts form 38 es estimated income tax estates and trusts

Effortlessly Prepare Form 38 ES Estimated Income Tax Estates And Trusts Form 38 ES Estimated Income Tax Estates And Trusts on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the needed form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, edit, and electronically sign your documents swiftly without delays. Manage Form 38 ES Estimated Income Tax Estates And Trusts Form 38 ES Estimated Income Tax Estates And Trusts on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related tasks today.

How to Edit and Electronically Sign Form 38 ES Estimated Income Tax Estates And Trusts Form 38 ES Estimated Income Tax Estates And Trusts with Ease

- Obtain Form 38 ES Estimated Income Tax Estates And Trusts Form 38 ES Estimated Income Tax Estates And Trusts and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools specially designed by airSlate SignNow.

- Create your electronic signature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form – via email, SMS, or a shareable link, or download it to your computer.

Eliminate concerns over lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device you choose. Edit and electronically sign Form 38 ES Estimated Income Tax Estates And Trusts Form 38 ES Estimated Income Tax Estates And Trusts and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 38 es estimated income tax estates and trusts form 38 es estimated income tax estates and trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 38 ES Estimated Income Tax Estates And Trusts?

The Form 38 ES Estimated Income Tax Estates And Trusts is a tax form used by estates and trusts to report estimated income tax payments. This form helps ensure that the correct amount of tax is paid throughout the year, avoiding penalties. Understanding this form is crucial for effective tax planning and compliance.

-

How can airSlate SignNow assist with the Form 38 ES Estimated Income Tax Estates And Trusts?

airSlate SignNow provides a streamlined solution for completing and eSigning the Form 38 ES Estimated Income Tax Estates And Trusts. Our platform simplifies the document management process, allowing users to fill out, sign, and send the form securely. This efficiency saves time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for the Form 38 ES Estimated Income Tax Estates And Trusts?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of individuals and businesses. Our plans provide access to features that facilitate the completion of the Form 38 ES Estimated Income Tax Estates And Trusts at competitive rates. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Form 38 ES Estimated Income Tax Estates And Trusts?

Our platform includes features such as customizable templates, secure eSigning, and document tracking specifically for the Form 38 ES Estimated Income Tax Estates And Trusts. These tools enhance user experience and ensure that all necessary information is accurately captured. Additionally, users can collaborate in real-time, making the process more efficient.

-

Are there any benefits to using airSlate SignNow for the Form 38 ES Estimated Income Tax Estates And Trusts?

Using airSlate SignNow for the Form 38 ES Estimated Income Tax Estates And Trusts offers numerous benefits, including increased efficiency and reduced paperwork. Our solution allows for quick access to documents and easy sharing with stakeholders. This not only saves time but also enhances compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for the Form 38 ES Estimated Income Tax Estates And Trusts?

Yes, airSlate SignNow supports integrations with various software applications to facilitate the management of the Form 38 ES Estimated Income Tax Estates And Trusts. This allows users to connect their existing tools and streamline workflows. Integrations enhance productivity by ensuring that all necessary data is synchronized across platforms.

-

Is airSlate SignNow secure for handling the Form 38 ES Estimated Income Tax Estates And Trusts?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive information related to the Form 38 ES Estimated Income Tax Estates And Trusts. Our platform is designed to ensure that your documents are safe and secure throughout the signing process.

Get more for Form 38 ES Estimated Income Tax Estates And Trusts Form 38 ES Estimated Income Tax Estates And Trusts

- Army e4 evaluation form pdf

- Employee statement and security guard application form

- Vanderbilt medical center financial assistance form

- Massachusetts department of revenue schedule 2k 1 form

- Nonrefundable individual tax credits and recapture arizona form

- Massachusetts department of revenue form 3k 1

- Massachusetts department of revenue form m 8736 fi

- Child support modification agreement template form

Find out other Form 38 ES Estimated Income Tax Estates And Trusts Form 38 ES Estimated Income Tax Estates And Trusts

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile